In the grand theater of the crypto markets, where fortunes rise and fall with the capricious whims of the invisible hand, Chainlink has found itself in a most lamentable predicament. Lo, in the span of but a single day, its price hath plummeted below the sacred threshold of $17, a level once held as inviolable. The market, ever fickle, hath retreated by 5.65%, and volumes have swelled as if the very heavens wept in unison. Verily, the cause of this calamity is twofold: the heavy hand of institutional selling and a doubling of volume that hath swept away critical technical levels like chaff before the wind. 🌪️

Yet, amidst this gloom, there glimmers a faint ray of hope. Virtune, in its wisdom, hath embraced Chainlink’s Proof of Reserve, and ONDO hath anointed LINK as the oracle for its tokenized securities. Alas, the path ahead is fraught with volatility, and the fate of this beleaguered asset hangs in the balance. Will it rise like a phoenix from the ashes, or shall it be consigned to the annals of forgotten tokens? Only time, that implacable arbiter, shall tell. ⏳

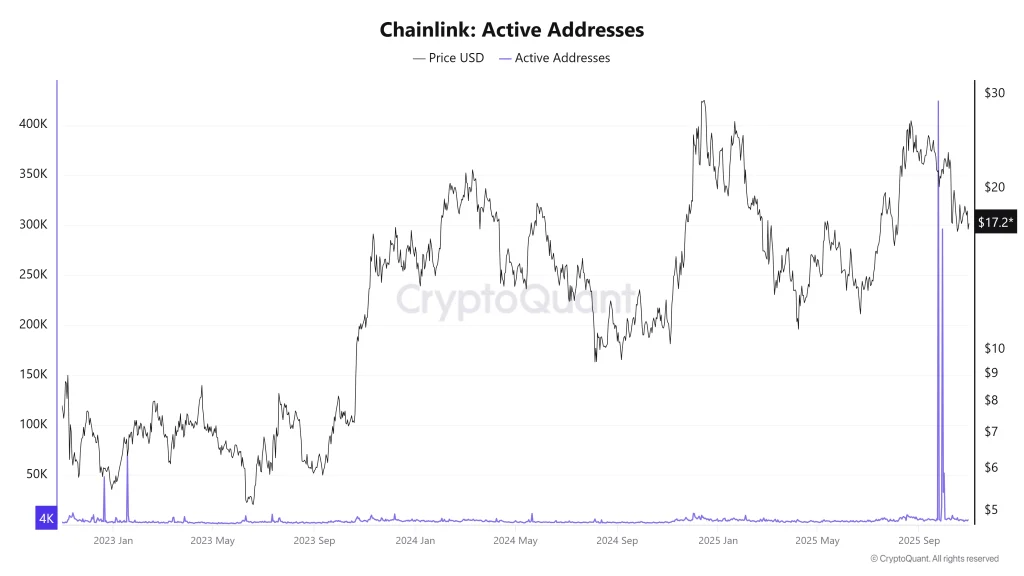

Chainlink Active Addresses

In recent sessions, as the sages at CryptoQuant have observed, the number of active addresses for Chainlink hath surged with a fervor akin to a mob at a bread riot. Though the price hath tumbled like a drunken courtier, this spike in addresses oft portends increased on-chain activity, a harbinger of volatility to come. 🧙♂️

It is a truth universally acknowledged that great leaps in active addresses may presage either a triumphant recovery or a descent into further despair, as traders, ever restless, reposition themselves for the next act in this grand drama. This latest surge, occurring amidst a deluge of selling, suggests that market participants are bracing for further tumult. 🌋

LINK Price Analysis

The near-term prospects for Chainlink’s price are as clear as mud, guided by technical signals and levels of support and resistance that shift like the sands of the desert. At present, LINK trades at $17.19, a decline of 5.62% on the day and 2.81% over the week. It hath breached both a multi-week descending trendline and the hallowed 50% Fibonacci zone near $16.92, causing traders to flee their positions like rats from a sinking ship. 🐀

Delving into the technicals, the RSI at 38.99 confirms the bearish momentum, though LINK hath not yet reached the depths of oversold territory. Immediate support lies at $16.50, and should the selling persist, the next floor awaits at $15.33. Resistance, now firmly established at $17.20, stands as a new pivot point following the breakdown. 🧱

FAQs

What caused Chainlink’s recent price drop?

Chainlink’s price fell due to heavy institutional selling, the loss of key technical support, and an overall risk-off sentiment driven by Bitcoin’s correction. A perfect storm of woe, if you will. 🌩️

Where is the next key support and resistance for LINK?

Current support levels are at $16.50 and $15.33, while resistance stands at $17.20. Mark these well, for they may determine the fate of many a trader. 📉

Does higher active addresses mean a reversal is likely?

Spikes in active addresses signal rising on-chain activity and volatility, which could precede either a rebound or a deeper decline, depending on the whims of the market. A true coin toss, with neither heads nor tails in sight. 🤷♂️

Read More

- How to Unlock the Mines in Cookie Run: Kingdom

- Gold Rate Forecast

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- Gears of War: E-Day Returning Weapon Wish List

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

- The Saddest Deaths In Demon Slayer

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- All Pistols in Battlefield 6

2025-10-31 11:38