So, Alchemy Pay and Gate Research dropped this report on Halloween, because nothing says “spooky” like stablecoins, right? 🎃 They’re calling it an “infrastructure competition” phase. Sounds like a boring board game, but with billions on the line. 🤷♂️

Apparently, the market hit $280 billion by August 2025. Big whoop. But now it’s all about “compliance.” Because nothing screams innovation like more rules. 📏✨

Turns out, it’s not about whose token is the biggest anymore-it’s about controlling payment networks. Because who doesn’t love a good monopoly? 🎲💸

Gate Research says the market grew 660-fold since 2019. Impressive, but can it do my taxes? 🧮

Thanks to the GENIUS Act, MiCA, and Hong Kong’s Stablecoin Ordinance, we’re officially in the “Age of Compliance.” Party hats not included. 🎉🚫

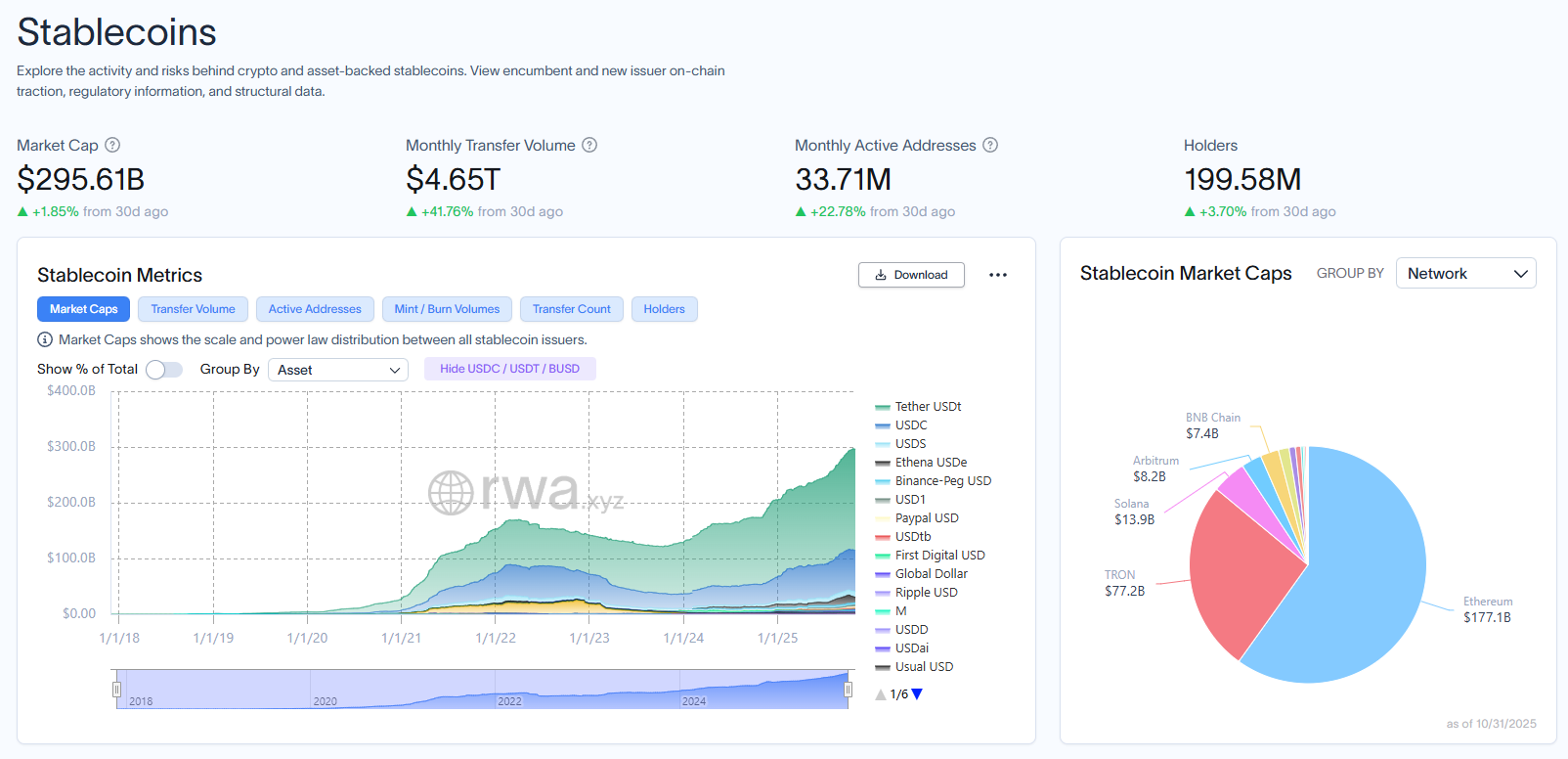

By October 31, the market hit $295.61 billion. And 33.71 million active addresses. That’s a lot of people who still believe in crypto. 🤯

Stablecoin dashboard on rwa.xyz. Because who doesn’t love a good graph? 📈

Traditional Finance Jumps on the Bandwagon 🚀

PayPal, Visa, and Mastercard are now stablecoin BFFs. Because if you can’t beat ‘em, join ‘em. 🤝

PayPal and Ernst & Young settled corporate payroll with PYUSD. Because nothing says “trust” like a stablecoin. 💼💸

Visa’s Global Stablecoin Settlement service lets banks settle USDC payments on blockchains. Finally, something banks can get behind. 🏦⛓️

Even Western Union’s USDPT is in the game. Legacy finance and crypto: sitting in a tree, K-I-S-S-I-N-G. 💏

Infrastructure: The New Arms Race 💪

Tether’s building Plasma and Stable. Circle’s got Arc. Stripe bought Bridge and is working on Tempo. Everyone’s got a blockchain now. It’s like the Wild West, but with more code. 🤠💻

Alchemy Pay launched Alchemy Chain. Because one blockchain is never enough. 🌉

USDT’s got 60.66% market share. USDC’s at 24.64%. But USDC’s got more on-chain action. It’s like the popular kid vs. the smart kid. 🤓🕺

Compliance is the new black. Circle’s warning about EU rules? Sounds like a sitcom plot. 🗣️🇪🇺

Non-USD stablecoins are coming for that 15-20% market share. Euro, yen, won-everyone wants a piece of the pie. 🥧🌍

MiCA’s pushing euro stablecoins. Japan’s got yen coins. Korea’s KRWQ is on Base. It’s a multipolar world, folks. 🌐

So, stablecoins are moving from “explosive growth” to “compliance establishment.” And from dollar dominance to a multipolar landscape. Because nothing stays fun forever. 🎢😢

Read More

- The Winter Floating Festival Event Puzzles In DDV

- Sword Slasher Loot Codes for Roblox

- One Piece: Oda Confirms The Next Strongest Pirate In History After Joy Boy And Davy Jones

- Jujutsu Kaisen: Yuta and Maki’s Ending, Explained

- Japan’s 10 Best Manga Series of 2025, Ranked

- Jujutsu Kaisen: Why Megumi Might Be The Strongest Modern Sorcerer After Gojo

- Faith Incremental Roblox Codes

- ETH PREDICTION. ETH cryptocurrency

- Non-RPG Open-World Games That Feel Like RPGs

- Toby Fox Comments on Deltarune Chapter 5 Release Date

2025-10-31 23:57