The dawn of November arrives not with a roar, but with the uneasy hum of digital fortunes teetering on the edge. Bitcoin, that eternal enigma, clings to $110,513, a slight smirk on its face after October’s bruising. Ethereum, the younger sibling, stumbles in its attempt to breach the $4,000 fortress. And XRP? Ah, XRP, the eternal optimist, begins the month at $2.51, still clinging to the remnants of its summer glory.

As traditional equities yawn and stretch after their earnings feasts, the crypto realm seizes the moment to chart its own course. Macroeconomic concerns? Shelved for now. The Federal Reserve takes a breather, inflation data remains dormant until mid-month, leaving the market to trade on positioning, not the cacophony of headlines. 🚀

TL;DR:

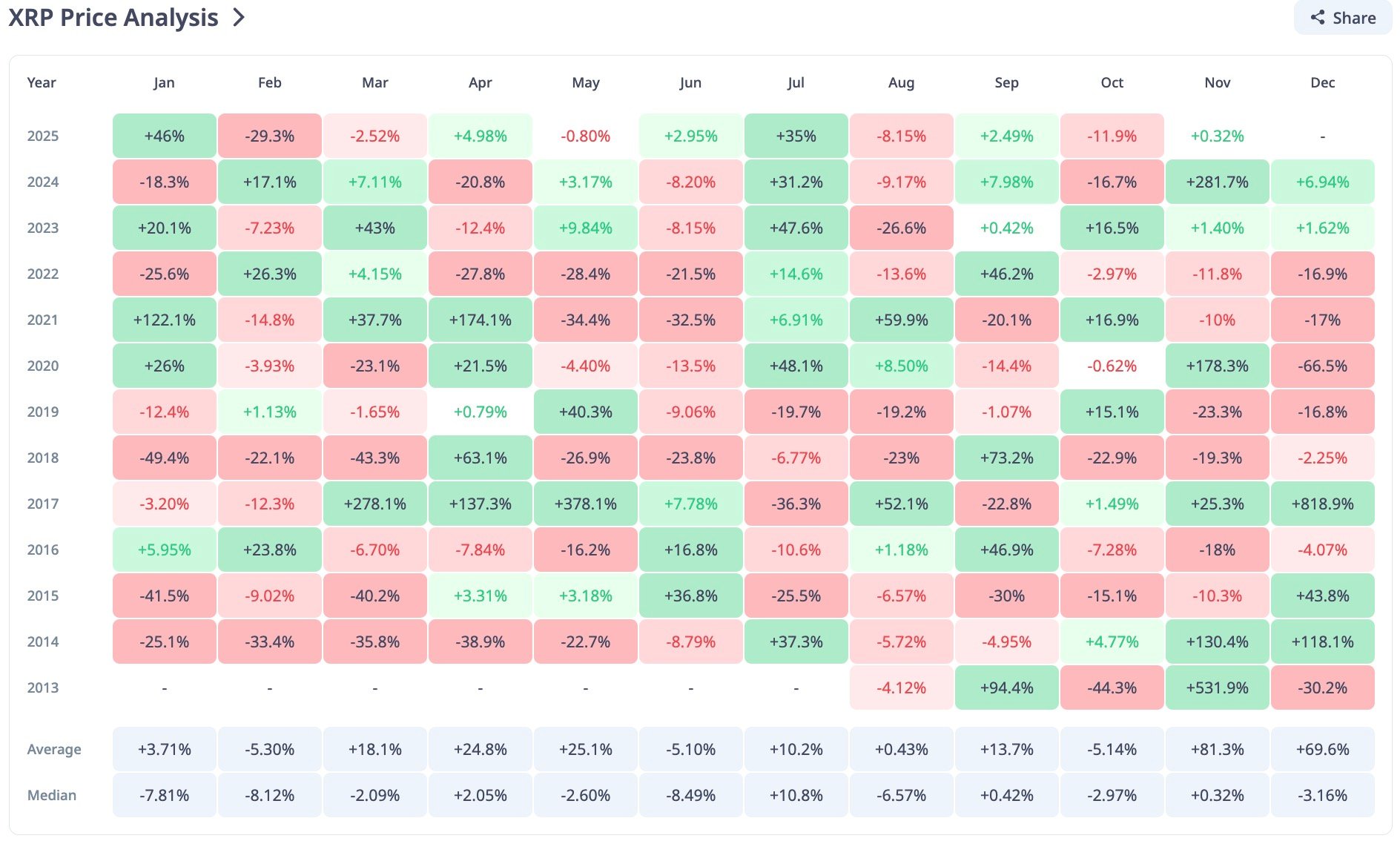

- XRP enters November with a historical advantage: an 81% average gain.

- Coinbase wraps October with $1.8 billion in revenue and a flurry of product launches.

- DonAlt, the trader who called Bitcoin’s rise, signals caution for the first time since $88,000.

XRP’s November Romance: A Historical Affair

XRP’s love affair with November is no mere superstition-it’s etched in the cold, hard data. CryptoRank’s numbers reveal a tantalizing truth: November has delivered an average 81% gain for XRP over the past decade. The median may be neutral, but the outliers are jaw-dropping: 281% in 2024, 818% in 2017, and 130% in 2014. Who needs fireworks when you have charts like these? 🎆

At $2.51, XRP remains a juggernaut, up over 200% year-to-date. Support holds firm at $1.80-$1.60, a sanctuary forged during the summer rally. The upper echelons, $3.10-$3.20, remain the same ceiling that halted the 2021 frenzy, where long-term holders sharpen their knives for profit-taking.

Trader DonAlt, the maestro who rode XRP’s 700% surge earlier in the cycle, has cashed out with a 300% profit. Technicals remain promising, but he’s moved on, perhaps to sunnier pastures. Still, XRP’s November rhythm persists-five out of the last eight Novembers have been green. The window is open; will traders step through?

Coinbase’s Brian Armstrong: Promises, Promises

Brian Armstrong, the self-anointed prophet of crypto, took to X with a tantalizing proclamation: “Big month for us at Coinbase. Much more to come-excited to close out 2025 with a bang.” For once, the hype matched reality. Coinbase wrapped October with $1.8 billion in net revenue and a litany of product rollouts:

Big month for us at Coinbase. Much more to come – excited to close out 2025 with a bang.

– Brian Armstrong (@brian_armstrong) November 1, 2025

- Partnered with Citi to build global payment rails.

- Rolled out DeFi USDC lending for U.S. users.

- Expanded DEX trading to nearly all users (except New York, naturally).

- Applied for a U.S. national trust charter via the OCC.

- Invested in CoinDCX, expanding into India and the Middle East.

- Partnered with Samsung, embedding crypto into 75 million U.S. Galaxy devices.

COIN stock ended October at $343.78, up nearly 2% for the month. Supports hover near $240, while resistance looms above $350. The stock mirrors the crypto landscape-steady, unspectacular, but quietly building.

Bitcoin’s Bearish Whisper

For Bitcoin, November begins on a cautious note. DonAlt, the trader who rode its rise, now sounds the alarm: the first bearish signal since $88,000. Unless BTC reclaims the $113,000 zone, it’s time to “cool off a little.” 🐻

BTC trades at $110,513, up less than 1% for the week. Support zones lie at $84,600 and deeper at $56,000. Long-term holders remain steadfast, exchange balances stay low, but the short-term crowd is fading. History whispers that weak Novembers often precede strong December rallies. For now, the mantra remains: respect the range, don’t chase candles.

November’s Balancing Act

The market enters November balanced but jittery-XRP with its historical edge, Bitcoin losing steam, and Coinbase flexing its muscles. Short-term watchpoints:

- XRP: breakout confirmation above $2.70, key support at $1.80.

- BTC: hold above $100,000 to maintain trend.

- ETH: mid-range at $3,200-$3,400, breakout target $3,600.

- COIN: strength above $350 could attract institutional flows.

Macro catalysts remain scarce-only U.S. employment data and early ETF flow readings are on the docket. The stage is set for technicals to drive the narrative. Historically, the first half of November sets the tone for the quarter. This year feels no different-a market navigating sentiment, waiting for the next decisive moment.

Read More

- Insider Gaming’s Game of the Year 2025

- Faith Incremental Roblox Codes

- Say Hello To The New Strongest Shinobi In The Naruto World In 2026

- Roblox 1 Step = $1 Codes

- One Piece: Oda Confirms The Next Strongest Pirate In History After Joy Boy And Davy Jones

- Jujutsu Kaisen: The Strongest Characters In Season 3, Ranked

- Sword Slasher Loot Codes for Roblox

- Jujutsu Zero Codes

- Top 10 Highest Rated Video Games Of 2025

- My Hero Academia: Vigilantes Season 2 Episode 1 Release Date & Time

2025-11-02 16:20