The great people of the world, in their infinite wisdom, turned their gaze to “bitcoin” with such fervor in late October that one might have thought it the Second Coming. Alas, by early November, the crowd had grown weary, their interest cooling like porridge left on the windowsill.

From Peak to Pause: ‘Bitcoin’ Searches Shift as New Week Opens

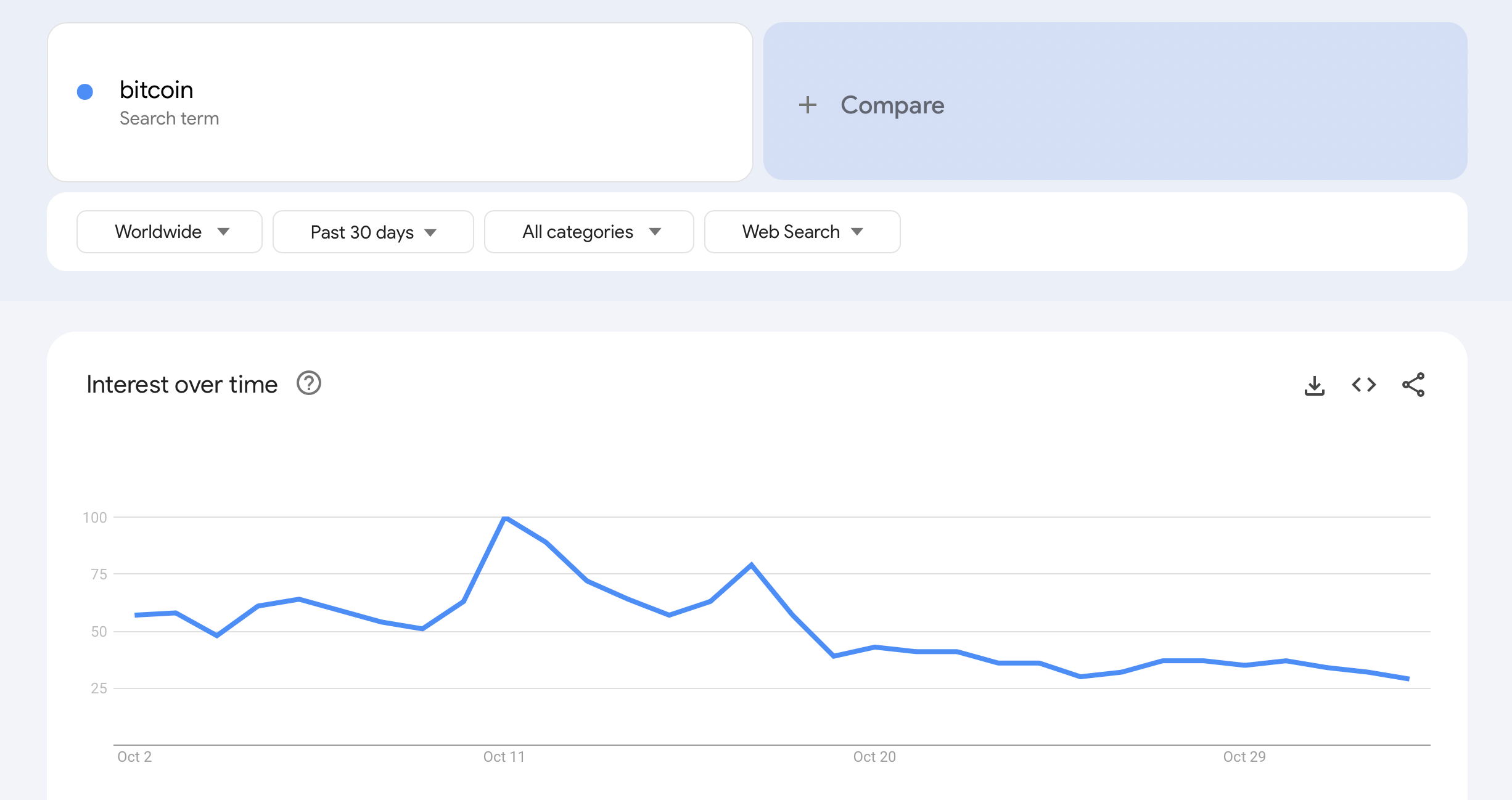

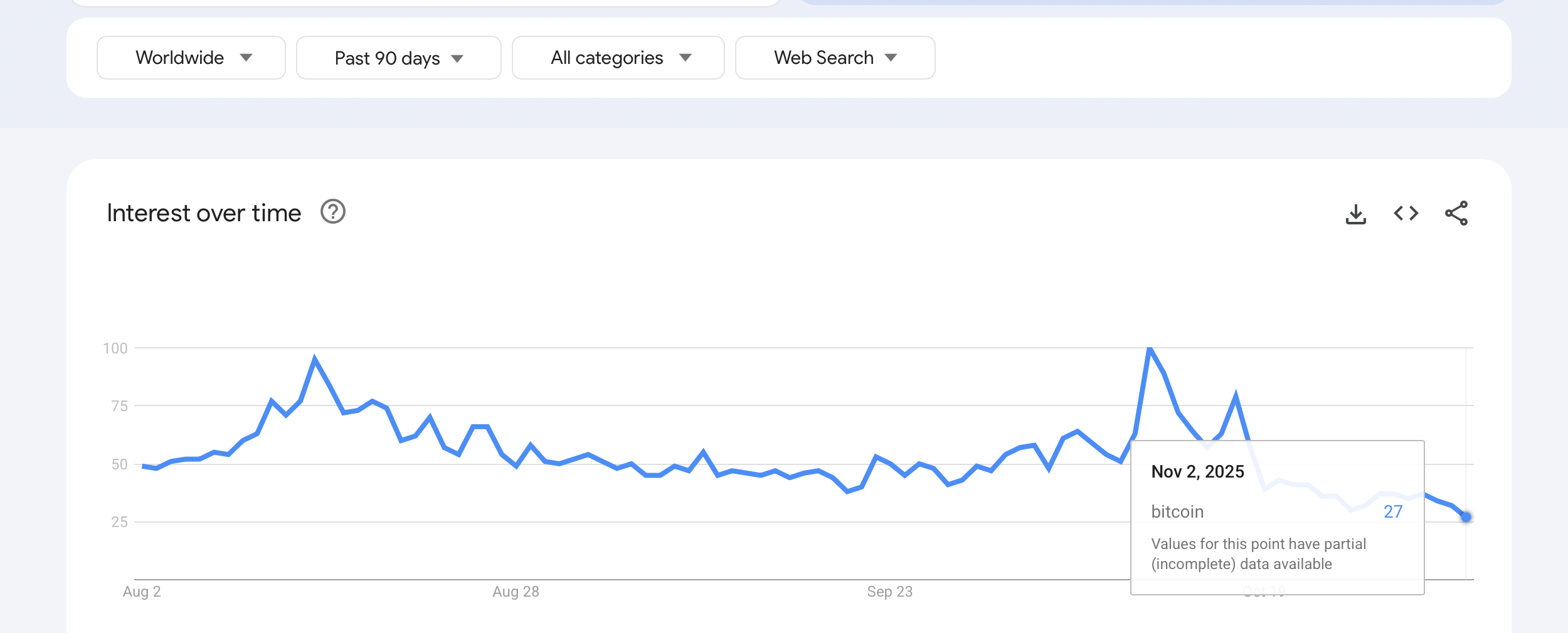

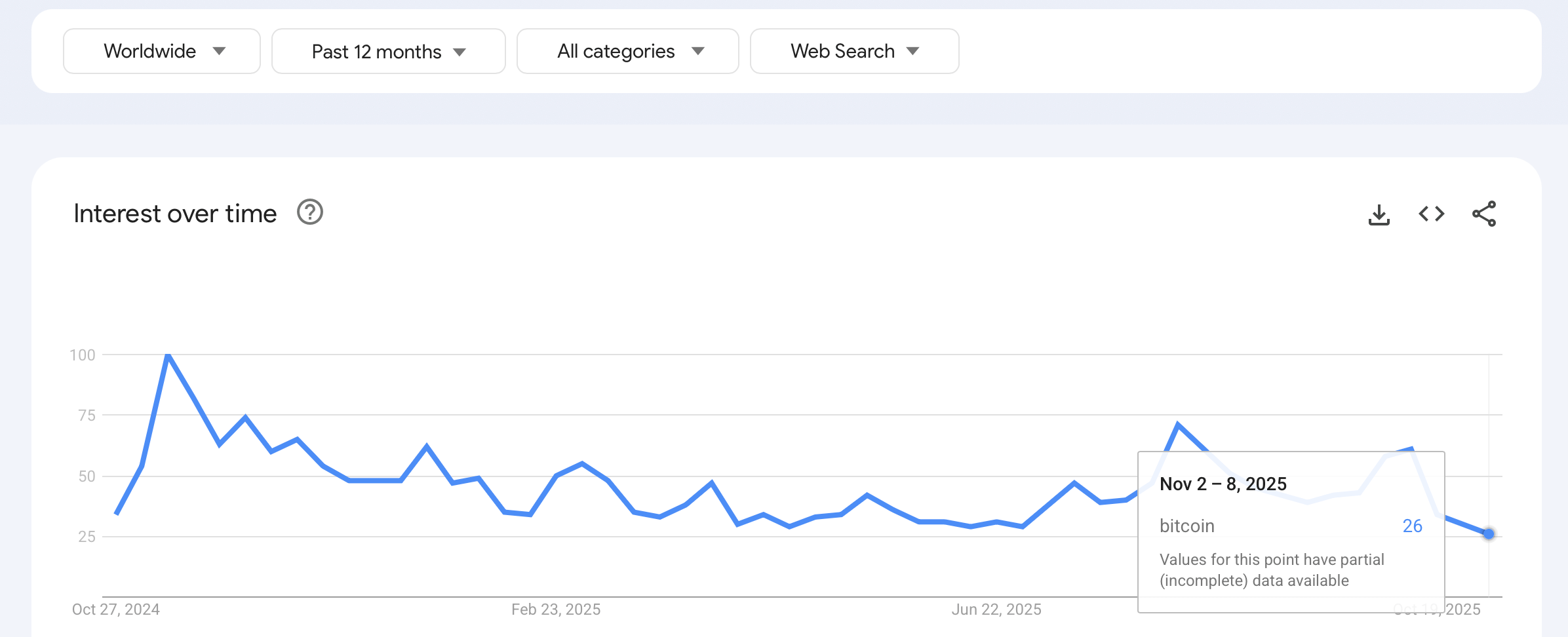

Behold, the Google Trends index, that sacred ledger of human curiosity, scales its search interest from 0 to 100-a metric as fickle as a court jester’s mood. It claims 100 as the pinnacle of obsession, a number so lofty it makes even the most ardent speculator blush.

Over the past 30 days, the “bitcoin” line danced from the low 50s, ascended to the heavens at 100 on October 11th, and then descended to the 30s by month’s end-a performance worthy of a tragic opera. The shape? A fleeting mid-month burst followed by a comedown smoother than a serf’s last meal.

Zooming out to 90 days, the pattern remains stubbornly consistent: a summer of mild curiosity (40s-60s), a sharp October spike that kissed 100, and then a reset so dramatic it made even the most stoic economist wince. As of Nov. 2, the “partial” label clings to the single-day reading of 27, a number so modest it might as well be written in cursive.

Over 12 months, the tale is one of peaks and valleys. An early peak near 100, a mid-year lull in the 30s and 40s, and a late-October bounce that fizzled like a candle in the wind. The weekly marker for Nov. 2-8 sits at 26, still “partial”-a number so low it could double as a coupon code. Yet, as of Nov. 2, 2025, bitcoin trades at $110,281 per coin, a 58.6% year-over-year gain. Thus, the age-old lesson: price and popularity rarely waltz hand in hand.

Geographically, the 12-month view reveals El Salvador at 100 (a nation so enamored it’s practically engaged to the blockchain), followed by Switzerland (88), Austria (78), Slovenia (74), and the Netherlands (69). One might infer that Latin America and Europe are hosting a digital gold rush, though the rest of the world seems content to spectate with a cup of tea and a shrug.

Rising topics over 12 months include “Documentation” (Breakout) and “September” (+4,150%), a figure so absurd it could only be explained by a drunken spreadsheet. Related queries? “Bitcoin 2025” (Breakout), “Trump coin price” (+1,950%), and “latest bitcoin” (+1,050%). One wonders if these searches stem from genuine interest or the desperate hope that someone, somewhere, will finally explain it all.

In conclusion, across 30-, 90-, and 12-month spans, the world’s fascination with “bitcoin” surged in October and slumped in November. Yet, the regional leaderboard and rising queries hint that the dance of speculation continues-perhaps with a new partner in 2025.

FAQ ❓

• What does a Google Trends score mean? – A number from 0-100, measuring your obsession relative to others. 100 is the height of madness.

• Why do some points say “partial”? – The data is still cooking. Check back tomorrow, or perhaps never.

• Which regions led for ‘bitcoin’ over 12 months? – El Salvador (100), Switzerland (88), Austria (78), Slovenia (74), and the Netherlands (69). A who’s who of crypto enthusiasts.

• What queries are rising on the 12-month view? – “Bitcoin 2025” (Breakout) leads the pack, trailed by “Trump coin price” and “latest bitcoin.” A testament to humanity’s boundless curiosity-or sheer desperation.

Read More

- The Winter Floating Festival Event Puzzles In DDV

- Sword Slasher Loot Codes for Roblox

- One Piece: Oda Confirms The Next Strongest Pirate In History After Joy Boy And Davy Jones

- Jujutsu Kaisen: Yuta and Maki’s Ending, Explained

- Japan’s 10 Best Manga Series of 2025, Ranked

- Jujutsu Kaisen: Why Megumi Might Be The Strongest Modern Sorcerer After Gojo

- Faith Incremental Roblox Codes

- ETH PREDICTION. ETH cryptocurrency

- Non-RPG Open-World Games That Feel Like RPGs

- Toby Fox Comments on Deltarune Chapter 5 Release Date

2025-11-03 02:40