As a seasoned researcher with a keen interest in economics, I find this partnership between Pennsylvania State University and Truflation to be an exciting development in the field. Having spent years grappling with the complexities of housing inflation, I can attest to the shortcomings and inconsistencies of traditional methods like the PCE and CPI.

Pennsylvania State University and Truflation are collaborating on a groundbreaking research project aimed at creating alternative indicators, offering a clearer depiction of housing price fluctuations within the United States.

A critical economic indicator that impacts everyone from individuals to businesses to policymakers is inflation, particularly in the housing sector. The standard techniques for calculating inflation have been to use traditional instruments like the Personal Consumption Expenditure Price Index (PCE) and the Consumer Price Index (CPI).

In many cases, conventional methods struggle to fully grasp the subtleties of housing price increases. As we grapple with these challenges, it’s worth noting that a significant chunk of household budget goes towards shelter costs, which encompass various housing expenses and significantly impact both the Personal Consumption Expenditures (PCE) and Consumer Price Index (CPI) indices.

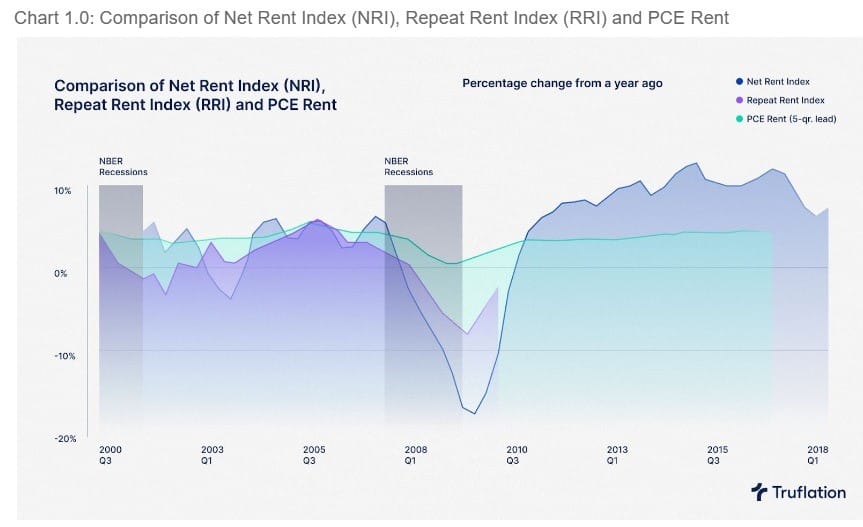

Although current methods for estimating housing price increases have flaws and inconsistencies, they are still crucial. For example, Truflation’s housing index indicates a more moderate rate of growth in recent times compared to the Consumer Price Index (CPI), which consistently shows increasing housing costs. This discrepancy casts uncertainty on the accuracy of traditional inflation measurements in truly capturing the dynamic nature of the housing market.

Introduced through their collaboration, two fresh inflation measures – the Truflation Index and the ACY Inflation Index – developed by researchers Ambrose and Yoshida from Pennsylvania State University, are now in the spotlight. These indices aim to offer a more accurate portrayal of housing inflation by factoring in a wider range of variables such as mortgage rates, property taxes, and household upkeep expenses.

1) The latest indices provide a more comprehensive view of housing market inflation by factoring in additional variables. The approach taken by Truflation to determine housing inflation involves advanced statistical modeling and thorough data examination. This research utilizes various data sources, including household expenditure distribution, publicly accessible spending details, and analysis provided by the Personal Inflation Calculator at Truflation.

Yearly, the components of these indexes get rebalanced to ensure they stay current and precise in reflecting recent housing price fluctuations, which is crucial for many interested parties. Accurately measuring housing inflation is vital, as it helps federal policymakers adjust entitlement programs and tax brackets fairly, based on inflation data like the Consumer Price Index (CPI), to maintain equitable taxation and social assistance.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- USD CLP PREDICTION

- USD ZAR PREDICTION

- USD COP PREDICTION

- USD PHP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- SBR PREDICTION. SBR cryptocurrency

2024-08-14 12:57