As a seasoned crypto investor with over five years of experience in this volatile market, I’ve learned to take price swings like the one we saw last week in stride. While it’s never fun to see my portfolio take a hit, I understand that these dips are often temporary and provide opportunities for long-term gains.

On Friday, August 16, Bitcoin‘s price started out just under $57,000, after experiencing a swift 7% drop on Thursday. Despite some encouraging signs of recovery, a well-known crypto analyst believes that the recent price decrease could have propelled Bitcoin into a bearish trend.

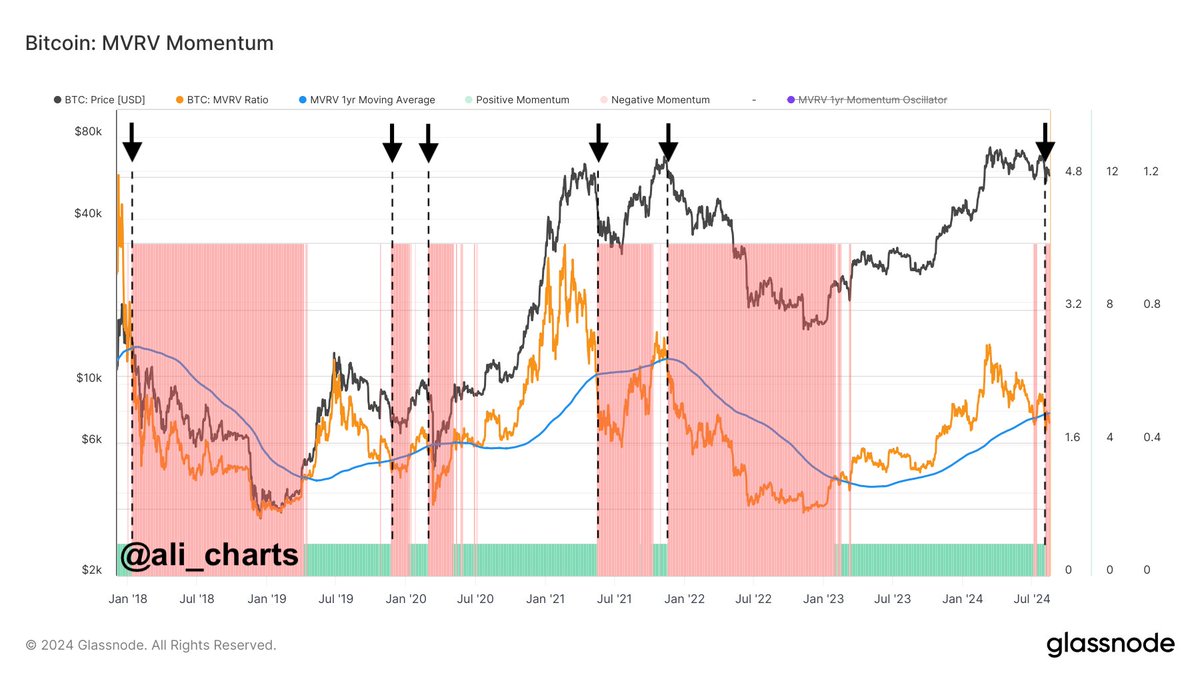

Bitcoin MVRV Drops Below 1-Year SMA – Impact On Price?

On X platform, renowned crypto analyst Ali Martinez recently posted that the Bitcoin price seems to have moved into a new phase in its cycle due to the recent price downturn. This insight from the on-chain perspective is derived from the Glassnode MVRV (Market Value to Realized Value) Momentum indicator, which helps in spotting broader market tendencies.

The MVRV Momentum indicator is built around two main components: the MVRV ratio and the 12-month Simple Moving Average (SMA). When the MVRV ratio surpasses this SMA, it suggests a move towards a bull market. Conversely, falling below the 12-month SMA indicates a change towards the bearish trend.

Usually, significant breaks over the 1-year MVRV SMA suggest that substantial amounts of Bitcoin were bought at prices lower than the current one, meaning the owners are now making a profit. Conversely, strong dips below the moving average imply that large volumes of BTC were acquired at prices higher than the current price, causing the holders to experience losses.

As per Martinez’s analysis, the Bitcoin cycle has shifted towards a bearish trend following its price drop below $61,500. A substantial number of Bitcoins were purchased at prices above $61,500, as indicated by the fall of the MVRV ratio under the SMA. Now that these coins are in a loss position, investors might choose to sell them off in an attempt to minimize their losses, which could lead to increased distribution.

If many people who have invested in Bitcoin are losing money, they might feel compelled to sell their holdings. This selling could potentially lower the value of Bitcoin even more. Over time, this trend could create a self-reinforcing cycle where the falling prices lead to more investors cashing out, exacerbating the downturn and deepening the bearish market conditions.

Bitcoin Price At A Glance

From my perspective as an analyst, at this moment, Bitcoin’s price hovers approximately $59,000, marking a 2.5% rise over the past day. However, it’s essential to note that Bitcoin has experienced a nearly 3% decrease on a weekly basis, as per data from CoinGecko.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD CLP PREDICTION

- RIDE PREDICTION. RIDE cryptocurrency

- SBR PREDICTION. SBR cryptocurrency

- PLI PREDICTION. PLI cryptocurrency

2024-08-17 19:11