As a seasoned researcher with a knack for blockchain technology, I find myself intrigued by the recent developments surrounding Ripple and its stablecoin, RLUSD. Having closely followed the crypto landscape for years, I can’t help but notice that Ripple seems to be taking significant strides towards its launch. The beta testing on the XRP Ledger platform is a testament to their commitment and progress, even if it does make me wonder why Ethereum seems to be lagging behind.

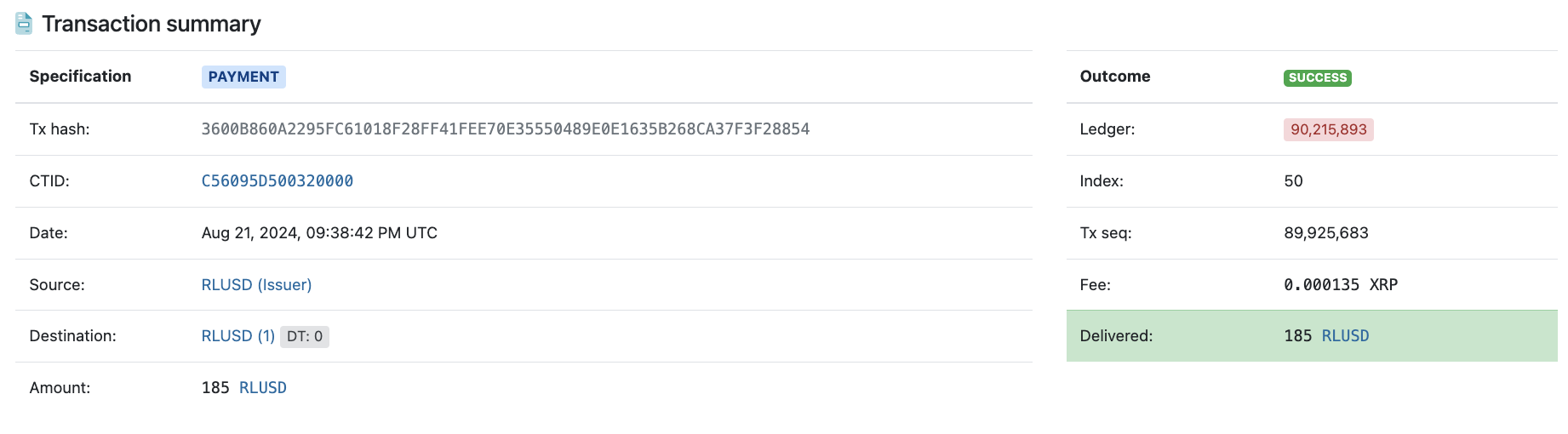

Today saw Ripple resuming the production of its stablecoin, called Ripple USD (RLUSD), as indicated by on-chain data from XRP Scan. This production occurred during a beta test on the Ripple’s blockchain platform, the XRP Ledger, resulting in 185 new tokens being minted. The transaction hash shows that the commission for this process was a small amount of 0.000135 XRP.

Earlier this month, the cryptocurrency company announced the commencement of beta testing for Ripple USD. This testing began concurrently on both the XRP Ledger and Ethereum blockchains, where RLUSD will eventually be introduced. However, it appears that progress is happening more swiftly on the XRP Ledger.

More about Ripple USD (RLUSD)

As a seasoned investor with over a decade of experience in the cryptocurrency market, I have always been intrigued by Ripple’s stablecoin. Having closely followed its development and legal battles, I am excited to see it launch later this year. The company has shown resilience and adaptability in navigating through the regulatory challenges posed by the U.S. Securities and Exchange Commission. If successful, this could mark a significant milestone for Ripple, potentially catapulting them into a new league of crypto companies. I am confident that they will continue to push forward with this project as they conclude their legal battle, further solidifying their position in the ever-evolving world of digital currencies.

The fact that an appeal has not yet been filed against the judge’s decision, which significantly reduced the amount of the required $2 billion fine, may be a particular reason for the company to speed up with RLUSD.

Currently, the specific rate at which Ripple will issue its stablecoin isn’t clear. What we do know is that Ripple USD will maintain a 1:1 relationship with the U.S. dollar.

As per the proposed strategy, RLUSD intends to challenge well-established stablecoins like Tether’s USD Tether (USDT) and Circle’s USD Coin (USDC). Its primary focus will primarily cater to payment systems, businesses, and institutional clients.

Read More

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD PHP PREDICTION

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD COP PREDICTION

- USD ZAR PREDICTION

- ENJ PREDICTION. ENJ cryptocurrency

2024-08-22 18:43