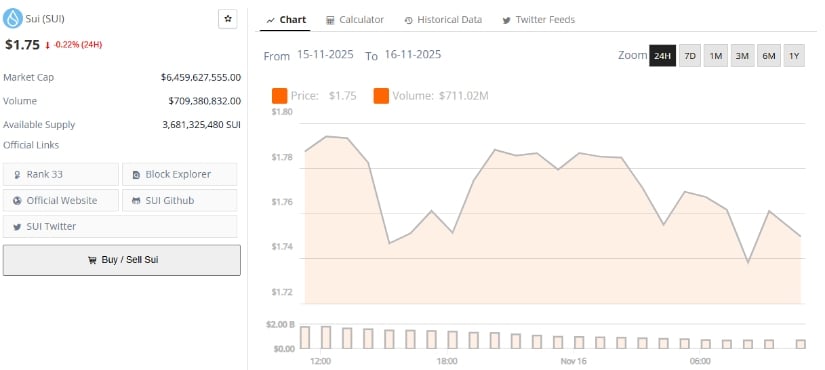

Ah, behold the grand spectacle of SUI, the token that danceth within its descending triangle, a pattern so critical it hath guided its market behavior for nigh a year! Trading at a modest $1.75 as of November 16, 2025, it reflecteth the broader market’s softness, yet lo! The ecosystem’s developments-including the USDsui launch and sustained transaction activity-provide a stabilizing support, like a courtier holding up a fainting maiden. Might this portend a renewed upward momentum? 🧐

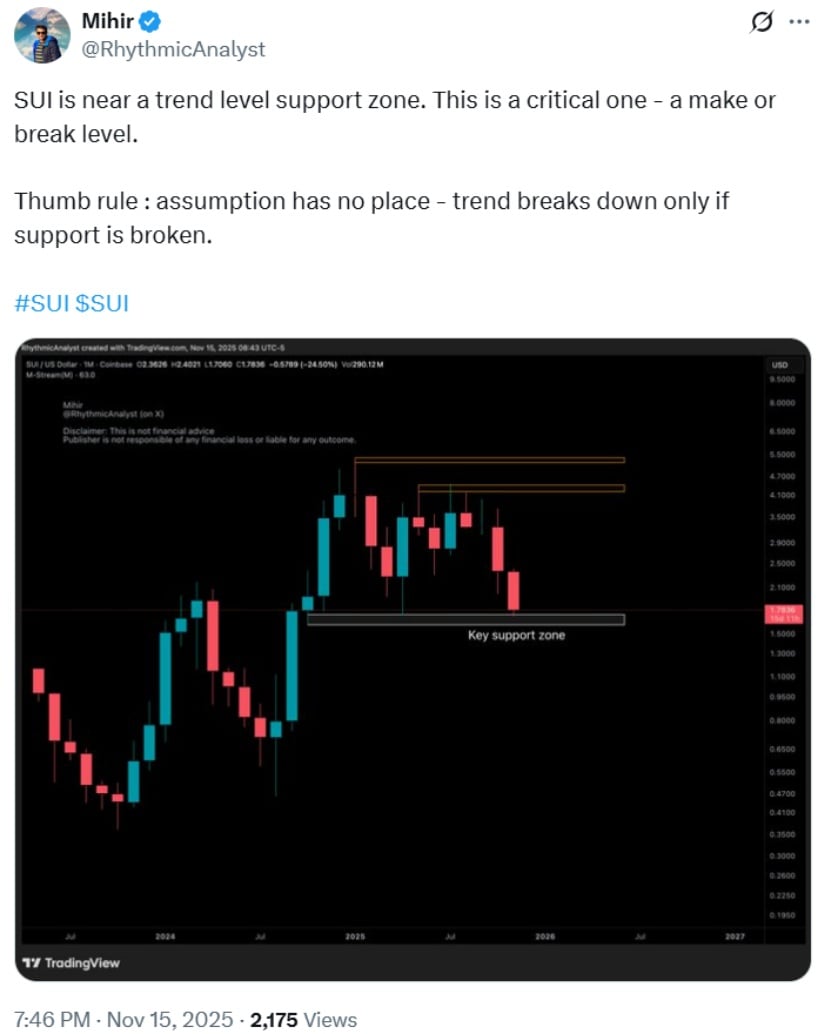

SUI Tests a Key Support Zone: The Monthly Chart Doth Signal Caution 🛑

A direct evaluation of the monthly chart doth highlight the $1.78 region as a pivotal structural support. This level sitteth near the mid-range of the multi-month volume profile and hath repeatedly acted as a pivot during prior corrections. Mark well, dear reader, SUI hath delivered multiple higher-timeframe wicks into this zone without a confirmed candle close below it-evidence that buyers remain active, even amid a 24% monthly drawdown. 🏹

In previous cycles, SUI’s price behavior showeth that retests of similar structural supports were followed by multi-week consolidation before attempts at recovery. Yet, alas! On-chain participation hath softened. According to publicly available DeFi analytics, Sui’s TVL hath declined in recent weeks, suggesting risk-averse capital is temporarily sidelined, despite growth in treasury metrics and utility infrastructure such as stablecoin integrations. A mixed backdrop indeed, one that traders should factor into their medium-term positioning. 🤔

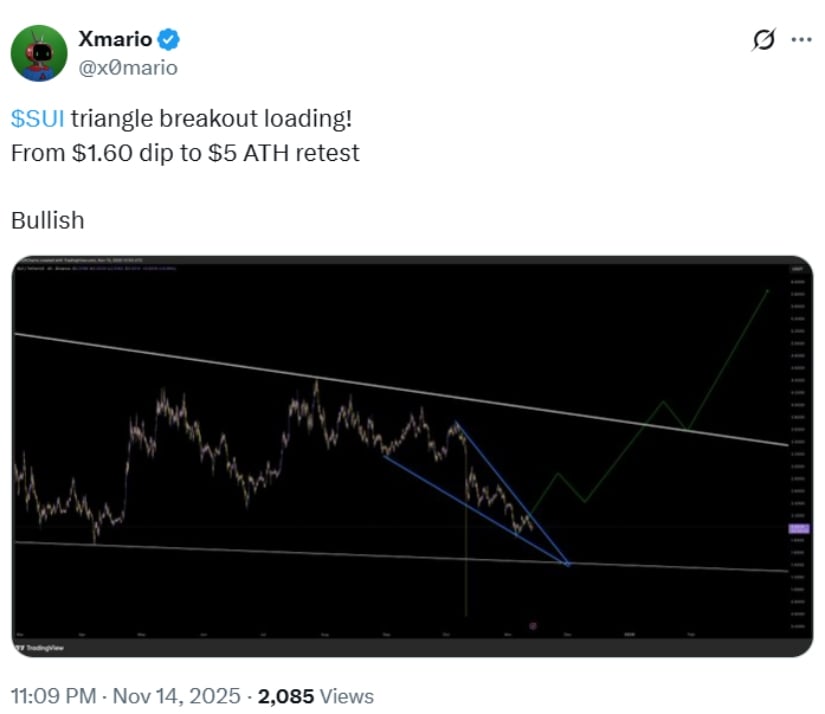

Short-Term Technical Setup: Tracking Breakout Signals 🔍

On the 1-hour chart, a firsthand review showeth SUI moving within a clearly defined descending channel, marked by lower highs forming on gradually diminishing volume. These volume contractions often precede expansion phases, though directionality remaineth uncertain. Attempts to reclaim the 100-period moving average have so far been met with resistance, while the RSI’s downward structure suggesteth seller dominance-though a curvature toward the upside is forming. 🌪️

The green support zone around $1.75 hath generated repeated micro-bounces, translating into short-term resistance targets at $1.80, $1.84, and $1.88. Traders using this range should consider volatility conditions: SUI’s intraday swings have widened slightly compared to late October averages. As a result, positioning strategies benefit from tighter invalidation levels-particularly for scalpers who rely on intra-channel rejections. ⚖️

Price Projection: $1.35-$2.28 Range Based on Technical Models 📏

Using Fibonacci retracement levels from the prior cycle, SUI’s key downside target of $1.35 aligneth with the 0.618 retracement and the lower boundary of the broader range structure visible on the daily chart. This level hath additional confluence with the lower 30-day volatility band, based on direct indicator readings.

Conversely, the $2.28 upper range is consistent with the 0.382 Fibonacci level and a significant horizontal supply zone where SUI previously faced multi-day rejections. Current volatility compression supporteth a high-probability scenario of SUI operating within the $1.35-$2.28 band unless an external catalyst breaketh the structure. 🧙♂️

Analysts remain divided: momentum-based models point toward a potential retest of the $1.35 support, while oversold indicators-particularly on the 4-hour chart-suggest stabilization may come first. Both interpretations remain technically valid until the price closeth decisively outside the compression structure. 🤷♂️

SUI Technical Indicators Point Toward Possible Consolidation 🧲

Multiple indicators point to an emerging consolidation phase. The RSI around 30 on the higher timeframes showeth early oversold conditions, which often attract value-oriented traders. Meanwhile, the MACD histogram’s weakening downward momentum indicateth a possible inflection point, though a bullish crossover hath yet to form. 🧪

SUI currently tradeth near the lower Bollinger Band on the daily chart. Historically, Sui’s reversals tend to emerge when price interacteth with these lower volatility bands, but this should not be interpreted as a guarantee. With the price still below both the 20-day and 200-day moving averages, any meaningful recovery will require sustained volume increases rather than isolated spikes. 📉

Bullish and Bearish Scenarios: What to Watch 🐂🐻

A bullish scenario requireth SUI to reclaim the $2.28 resistance level with strong buying volume. A breakout above this structure historically leadeth to multi-week expansions, with the next key upside target at $2.72. For such a move, traders should look for confirmation signals: RSI exiting oversold territory, MACD crossing upward, and volume profiles expanding. 🚀

The bearish scenario activateth if SUI loseth the $1.71 support on a closing basis. A break of this level-combined with rising sell-side volume-would increase the likelihood of a deeper move toward the $1.35 zone. If macro risk-off conditions intensify or if Sui ecosystem metrics weaken further, a temporary overshoot below $1.35 cannot be ruled out. 🌧️

Should You Buy SUI Now? Contextual Entry Strategy 🛒

Entry strategies depend heavily on risk tolerance. Traders with higher risk appetite may treat current oversold conditions as an opportunity for near-term range trading, especially if the $1.75-$1.78 support continueth to hold. Bucketing entries across multiple price levels can also reduce noise in volatile environments. 🎢

More conservative investors may prefer dollar-cost averaging, especially while the price remaineth within the broader triangle structure. Stop-loss levels below $1.60 align with the chart’s structural invalidation zones and help minimize exposure to potential breakdowns. 🛡️

Looking Forward: Cautious Optimism if Key Supports Hold 🌅

Current data suggesteth SUI is likely to trade within the $1.35-$2.28 band in the near term as the market awaiteth a clear directional catalyst. The sustainability of the $1.75-$1.78 support zone will play a decisive role in determining whether SUI formeth a recovery base or continueth downward toward lower cycle levels. 🧭

As Sui entereth a critical stretch in December and January-periods that historically deliver strong volatility-the interaction between price, support stability, and transaction volume will shape both short-term reactions and the broader trajectory of Sui’s technical outlook. Let us watch with bated breath and a touch of humor, for the market, like life, is a comedy of errors. 🎭

Read More

- Jujutsu Kaisen Modulo Chapter 18 Preview: Rika And Tsurugi’s Full Power

- How to Unlock the Mines in Cookie Run: Kingdom

- Upload Labs: Beginner Tips & Tricks

- ALGS Championship 2026—Teams, Schedule, and Where to Watch

- Top 8 UFC 5 Perks Every Fighter Should Use

- Jujutsu: Zero Codes (December 2025)

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- Roblox 1 Step = $1 Codes

- Mario’s Voice Actor Debunks ‘Weird Online Narrative’ About Nintendo Directs

- The Winter Floating Festival Event Puzzles In DDV

2025-11-17 01:43