Ah, XRP. Once the darling of crypto enthusiasts, now the poor, misunderstood underdog. According to the latest on-chain data and market reports, the altcoin is feeling the heat as a large portion of its holders find themselves in the murky waters of losses. 😬

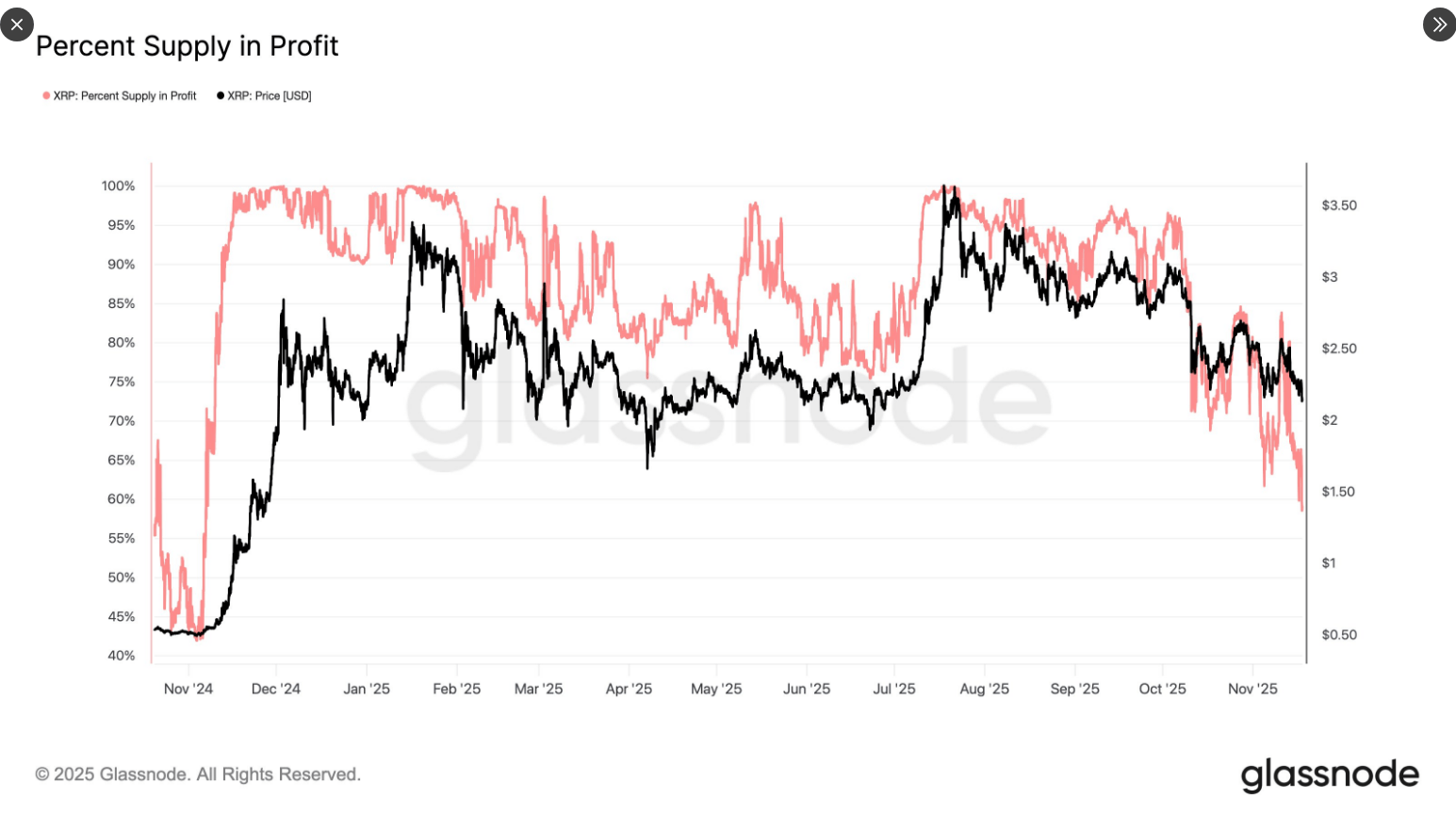

Glassnode has chimed in with some delightful news: a staggering 41.5% of XRP’s supply-around 27 billion tokens-are in the red. It’s the lowest profitability level since November 2024 when XRP was languishing around the quaint price of $0.53. Not a pretty sight for those who bought in at much higher levels, huh? 💸

Currently, XRP is trading at levels four times that figure, yet many holders are now nursing their wounds, having purchased at much higher prices. Ouch. You can almost hear the collective sigh of regret. 😔

It’s All About That Holder Concentration (And It’s a Mess)

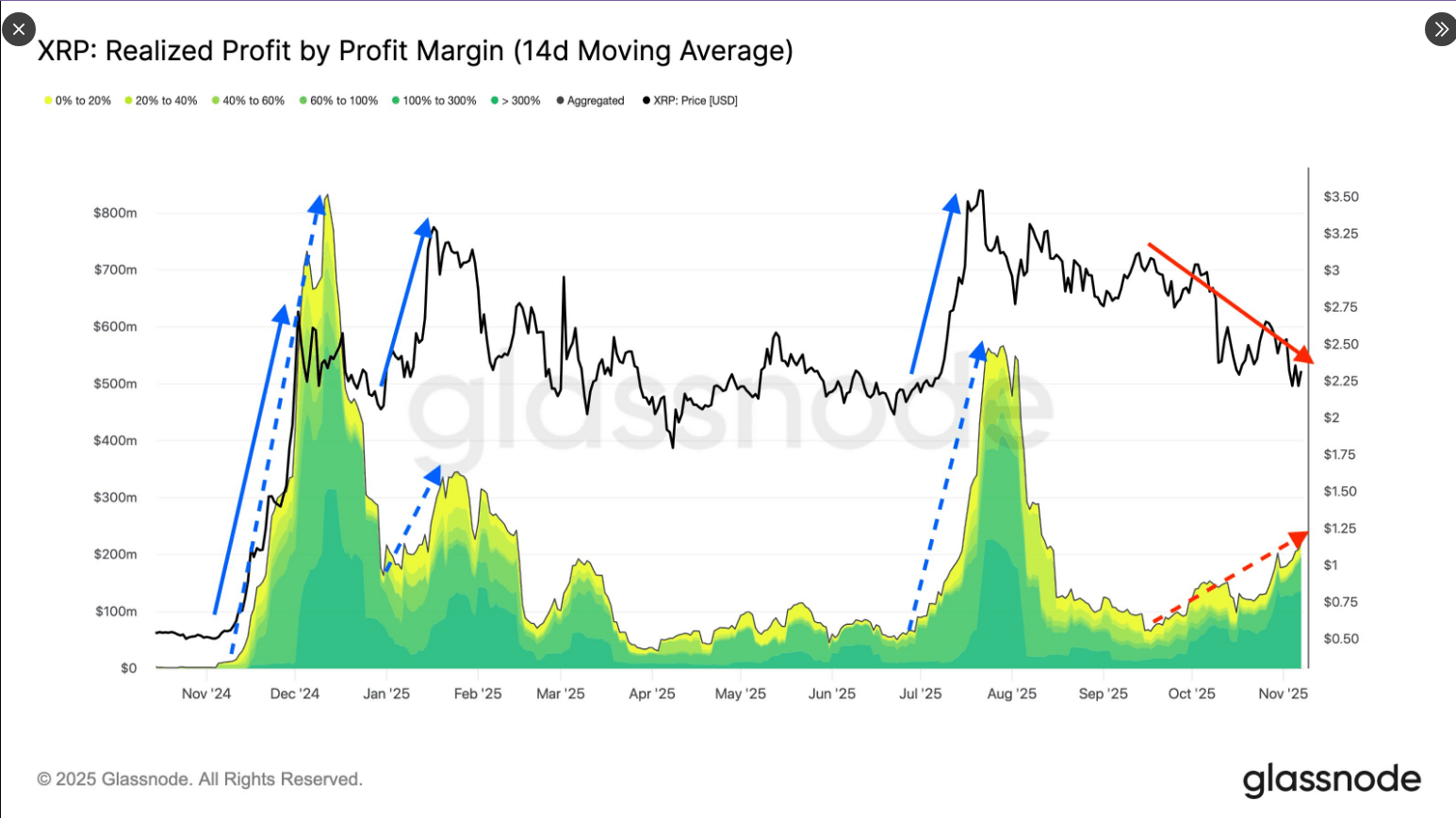

Market analysts, the ever-optimistic bunch, say the current positioning of XRP holders has completely shifted trader behavior. Tony Sycamore, a market analyst at IG Australia, suggested that many wallets likely picked up XRP when it was partying above $3.00, during the months of January, July, August, September, and early October. Big mistake, or just bad timing? You decide.

Now, a sizable group of holders are sitting on paper losses after XRP’s catastrophic 40%+ drop from its peak in July. Some investors may soon decide to jump ship if prices continue to slide. After all, who wants to hold the bag when things are looking grim? 🛳️

“The share of XRP supply in profit has fallen to 58.5%, the lowest since Nov 2024, when price was $0.53. Today, despite trading ~4× higher ($2.15), 41.5% of supply (~26.5B XRP) sits in loss – a clear sign of a top-heavy and structurally fragile market dominated by late buyers.”

– glassnode (@glassnode) November 17, 2025

ETFs: A Potential Savior or Just Another Distraction?

And here comes the cavalry-or at least, that’s what we’re supposed to think. A wave of exchange-traded funds tied to XRP has been launched in the hopes of bringing in fresh demand. The first spot-XRP ETF, launched by Canary Capital on November 13, posted the best first-day results for US ETFs in 2025. But let’s not get too excited just yet. ETFs can either make or break the market, and no one really knows how this one will play out. 🧐

Then there’s Franklin Templeton’s EZRP, slated to begin trading on November 18. Will it pump XRP’s price or just fall flat on its face like many before it? Time will tell. Meanwhile, traders are hoping that these products will attract fresh money into XRP-but history tells us that ETF demand is about as predictable as a cat in a room full of laser pointers. 😺💡

Key Foothold: At the time of writing, XRP is hovering around $2.19, down more than 10% in the past week. Analysts are eyeing the $2.16 level as a crucial point. Will it hold? Or will XRP tumble further down the crypto rabbit hole?

JUST IN: FRANKLIN TEMPLETON’S SPOT $XRP ETF (EZRP) LAUNCHES TOMORROW.

BULLISH 😎

– Amonyx (@amonbuy) November 17, 2025

If $2.16 holds, XRP could bounce back to the $2.35-$2.60 range. But if it falters, brace yourselves-further declines are not out of the question. The market is a delicate beast, and one wrong move could lead to a feeding frenzy of sell-offs.

The data paints a rather gloomy picture. The market appears top-heavy, with many late buyers now holding XRP at a premium. Unfortunately, this makes the market ripe for instability, as rallies become fragile, and profit-taking pressure mounts. Not exactly a recipe for sustained success. 🏚️

However, there is some hope. XRP Ledger activity is on the rise, and with new regulatory clarity around digital assets in certain regions, sentiment could improve. But let’s not pop the champagne just yet-XRP’s fate will likely hinge on ETF inflows and whether the $2.15 support level holds. Hold on tight, it’s going to be a bumpy ride. 🎢

For now, XRP is caught in a tug-of-war between holders trying to minimize losses and the glimmer of hope brought on by potential ETF-driven capital inflows. Will it break free? Or will it sink further into obscurity? Only time will tell.

Read More

- One Piece: Oda Confirms The Next Strongest Pirate In History After Joy Boy And Davy Jones

- The Winter Floating Festival Event Puzzles In DDV

- Sword Slasher Loot Codes for Roblox

- Faith Incremental Roblox Codes

- Toby Fox Comments on Deltarune Chapter 5 Release Date

- Japan’s 10 Best Manga Series of 2025, Ranked

- Jujutsu Kaisen: Yuta and Maki’s Ending, Explained

- Non-RPG Open-World Games That Feel Like RPGs

- Insider Gaming’s Game of the Year 2025

- Roblox 1 Step = $1 Codes

2025-11-18 19:36