As traders squint at whale accumulation patterns, ETF flows, and key technical levels, all eyes are now on whether Bitcoin can hold on to support and, more importantly, challenge recovery targets at $99,600 and $103,800. Can you feel the excitement? Or is that just the cold sweat of uncertainty? 🤔

Bitcoin Tests $90K After CME Gap Fill

Bitcoin (BTC) is hanging around the $93,413 mark, trying its best to act casual after dipping below $90,000. The reason? The completion of the ever-so-dramatic CME futures gap – a nifty little pattern that happens when Bitcoin futures are unleashed after weekend trading breaks. A study from YieldFund tells us that about 98% of these gaps fill, so they’re basically the cool kids of technical analysis.

Market analyst Ted (@TedPillows), who’s practically the Sherlock Holmes of derivatives, pointed out that the $88,000-$90,000 range is a liquidity zone that won’t let go easily. “Bitcoin filled the CME gap and dropped below $90,000. The level I’m watching is $88,000-$90,000,” he said, as if we didn’t already have enough to worry about. A liquidity sweep, anyone? Basically, that’s a fancy term for a quick dip to gobble up any leftover orders. Sounds fun, right? 😅

Traders are torn on the next move. Some say Bitcoin might plummet to $84,000 before bouncing back. Others are hopeful that we’ll see a dramatic rebound, because that’s just how Bitcoin rolls. One thing’s for sure: With tightening U.S. liquidity, risk appetite shifting faster than a cat on a hot tin roof, and people wondering why Bitcoin’s falling when ETFs are still in the game, no one has a clue what happens next. Hold on tight, folks. 🚀

Whale Activity Signals Accumulation Phase

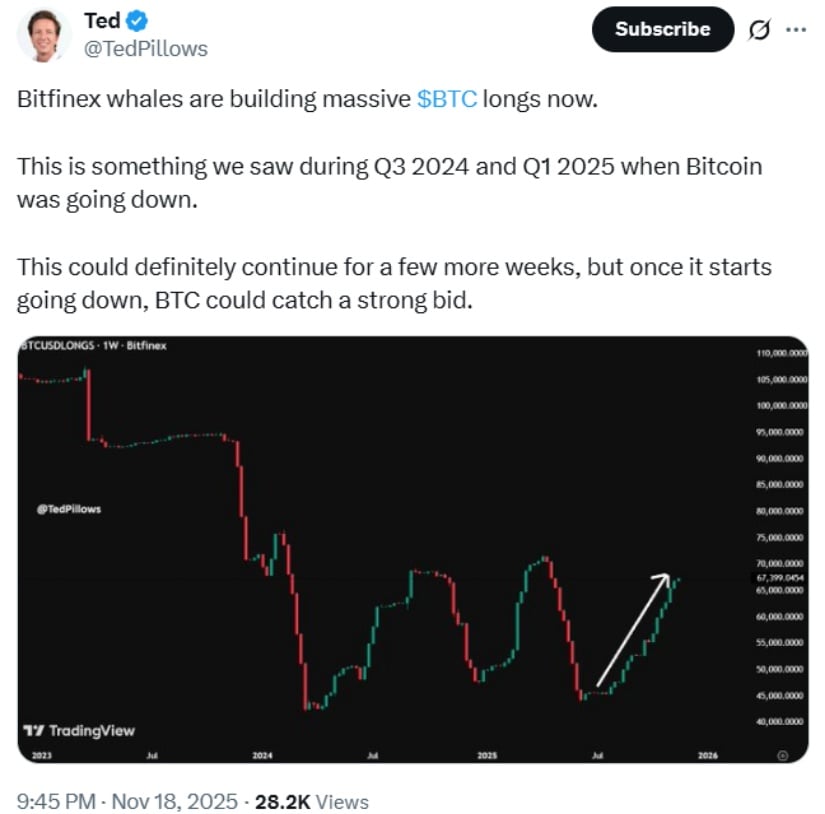

Despite all the drama, on-chain data suggests that whales are getting fat on BTC. Ted, who’s practically living in the blockchain, notes that Bitfinex BTCUSDLONGS (fancy term for leveraged long exposure) is on the rise, a pattern we last saw in Q3 2024 and Q1 2025. Basically, whales are buying the dip, so maybe they know something we don’t? Or maybe they’re just doing what they do best: buying and waiting. 🐋💸

“Bitfinex whales are building massive BTC longs now,” Ted remarked, like we didn’t have enough to worry about. The chart shows long positions approaching 67,399. Historically, rising leveraged longs signal the start of something big. Or maybe not. It’s complicated, just like trying to figure out what your cat is thinking. 😹

But beware! Whale positioning isn’t a crystal ball. Institutions often hedge their bets with short positions or derivatives, which makes things a tad murky. Still, whale behavior is an excellent mood ring for the market. Combine it with spot Bitcoin ETF flows and institutional involvement from the likes of BlackRock and Fidelity, and you’ve got a cocktail of uncertainty that’s just begging for a drama-filled sequel. 🍸

Short-Term Bullish Recovery On the Table

Technical analysts, the unsung heroes of the crypto world, are keeping their eyes peeled on a descending channel pattern. Klejdi Cuni, the trend-mapping wizard, noticed that BTC is respecting the lower boundary of this channel. Apparently, this is a sign of buyer interest. Or maybe it’s just trying to convince us that it has some direction. We’re not sure. 😏

If Bitcoin breaks above the upper trendline of the channel, we could be in for a recovery party. Cuni suggests that a breakout could trigger a stronger rebound. Of course, this requires a “break-and-retest” move, which is crypto-speak for “let’s see if this lasts more than five minutes.” If it does, the next targets are $99,600 and $103,800, which, frankly, sound like numbers pulled from a magic eight ball. 🔮

However, there’s a catch. Bitcoin must stay above the $88,000-$90,000 support zone. If it drops below, we might see another liquidity sweep. Because why not add another plot twist to the drama? Keep your seatbelt on, this could get bumpy. 🛑

Final Thoughts

Bitcoin’s current position near the $90,000 support zone is like watching a soap opera unfold. While the CME gap completion and whale accumulation hint at potential recovery, the truth is, everything hinges on market liquidity, ETF demand, and macroeconomic conditions. In other words, no one has the faintest idea what happens next. 😜

If Bitcoin manages a breakout from its descending channel, we could see a short-term rebound. But don’t hold your breath. Traders are watching carefully, and the possibility of another downward spiral is always lurking just around the corner. Will it be a recovery? Or just another dip into the abyss? Only time will tell. ⏳

Read More

- One Piece: Oda Confirms The Next Strongest Pirate In History After Joy Boy And Davy Jones

- Sword Slasher Loot Codes for Roblox

- The Winter Floating Festival Event Puzzles In DDV

- Faith Incremental Roblox Codes

- Toby Fox Comments on Deltarune Chapter 5 Release Date

- Japan’s 10 Best Manga Series of 2025, Ranked

- Non-RPG Open-World Games That Feel Like RPGs

- Jujutsu Kaisen: Yuta and Maki’s Ending, Explained

- Insider Gaming’s Game of the Year 2025

- ETH PREDICTION. ETH cryptocurrency

2025-11-19 02:34