Markets & Mayhem

What to Know:

- Onchain lending now dominates the scene, accounting for 66.9% of all crypto-collateralized borrowing. DeFi loans hit a jaw-dropping $41 billion-probably more than the GDP of some small countries-thanks to incentives, snazzy collateral types, and chains growing faster than rabbits in spring. Galaxies of debt, folks! 🪐

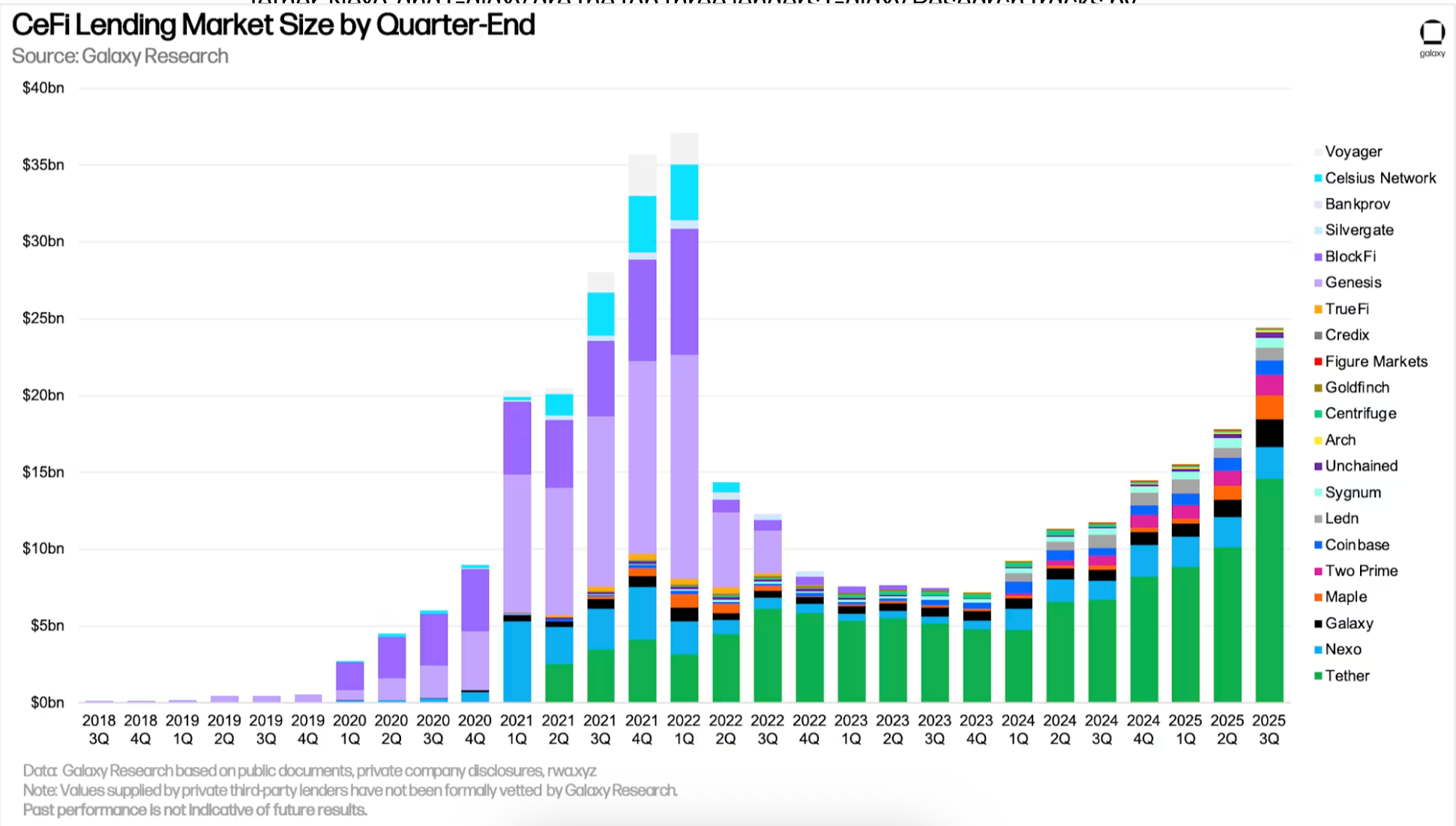

- Centralized lenders are not far behind, swelling their loans by 37% to $24.4 billion. Yet, they play the strict collateral game-Tether hoarding nearly 60% of all CeFi loans, like a dragon guarding its gold. 🐉

- The October 10 liquidation event-more dramatic than a soap opera-wiped out $19 billion in one go, making it the largest in crypto history. But fear not! Galaxy assures us that it’s just exchange tech messing around, not the end of civilization as we know it. 📉

Crypto borrowing soared to a staggering $73.6 billion in Q3-the most leveraged quarter ever. And guess what? It looks healthier than during the 2021-22 chaos (perhaps because everyone learned to count). 💪

Galaxy Research reports that the boom was driven mainly by onchain lending-up from 48.6% four years ago to a hefty 66.9%. DeFi lending alone skyrocketed 55% to hit an all-time high of $41 billion. That’s a lot of digital IOUs driven by user incentives and shiny new collateral gadgets like Pendle Principal Tokens. 🎩

Meanwhile, traditional lenders are trying to get back in the game, with loans rising 37% to $24.4 billion, though still a third smaller than the 2022 peak. The race to the top continues, or so they hope. 🏁

Survivors from the last crypto crash have dumped uncollateralized lending faster than last season’s saviors in a soap opera, favoring full-collateral models-seeking institutional cash or shiny new listings. Tether still rules CeFi, controlling nearly 60% of tracked loans like a digital overlord. 👑

This quarter, DeFi shifted gears-apps now dominate over 80% of onchain market activity. Meanwhile, stablecoins backed by CDPs shrank to just 16%. New chains like Aave and Fluid on Plasma flooded the scene-fueled by over $3 billion in borrows within five weeks of launch. That’s rapid growth, or a liquidity carnival! 🎢

But wait, the pièce de résistance: just after Q3, a leverage-fueled bloodbath wiped out over $19 billion in liquidations-the biggest in crypto futures history. Yet Galaxy insists it’s just exchange auto-deleveraging and not a systemic meltdown. Phew! 😅

Corporate crypto treasuries still love the leverage life, with over $12 billion owed by firms dabbling in crypto acquisitions. Industry debt, including debt issuance, hit a record $86.3 billion-welcome to the wild, leveraged west. 🤠

All signs point to rising leverage, but this time on solid ground-more transparent, collateral-based structures replacing the shady, unbacked credit of yore. The show goes on! 🎭

Read More

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Mewgenics Tink Guide (All Upgrades and Rewards)

- 8 One Piece Characters Who Deserved Better Endings

- God Of War: Sons Of Sparta – Interactive Map

- Top 8 UFC 5 Perks Every Fighter Should Use

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- How to Play REANIMAL Co-Op With Friend’s Pass (Local & Online Crossplay)

- How to Discover the Identity of the Royal Robber in The Sims 4

- Sega Declares $200 Million Write-Off

- Full Mewgenics Soundtrack (Complete Songs List)

2025-11-19 22:35