As a seasoned analyst with years of experience tracking the cryptocurrency market, I’ve seen my fair share of price fluctuations and trends. The recent surge in Bitcoin’s price following the Federal Reserve Chairman’s speech is reminiscent of similar patterns we’ve witnessed before. Lower interest rates tend to create a ripple effect that favors riskier assets like Bitcoin, and this seems to be the case once again.

Over the weekend, the cost of Bitcoin rose early on, likely due to Federal Reserve Chairman Jerome Powell’s speech at the Jackson Hole symposium. As per recent analysis of blockchain data, the suggestion of possible interest rate decreases seems to have boosted Bitcoin demand over the past 24 hours.

BTC Demand Sees Growth In The US — Impact On Price?

Recently, Julio Moreno, the Head of Research at CryptoQuant, shared on their platform that there’s been an increase in demand for Bitcoin within the United States over the past day. This surge can be attributed to the Federal Reserve’s announcement of a forthcoming period of lower interest rates.

Reduced interest rates from the central bank can frequently be good news for riskier investments, including Bitcoin, the leading global cryptocurrency. This is because lower interest rates typically decrease the earnings on conventional investments like bonds. As a result, cryptocurrencies may become more appealing to investors searching for higher returns.

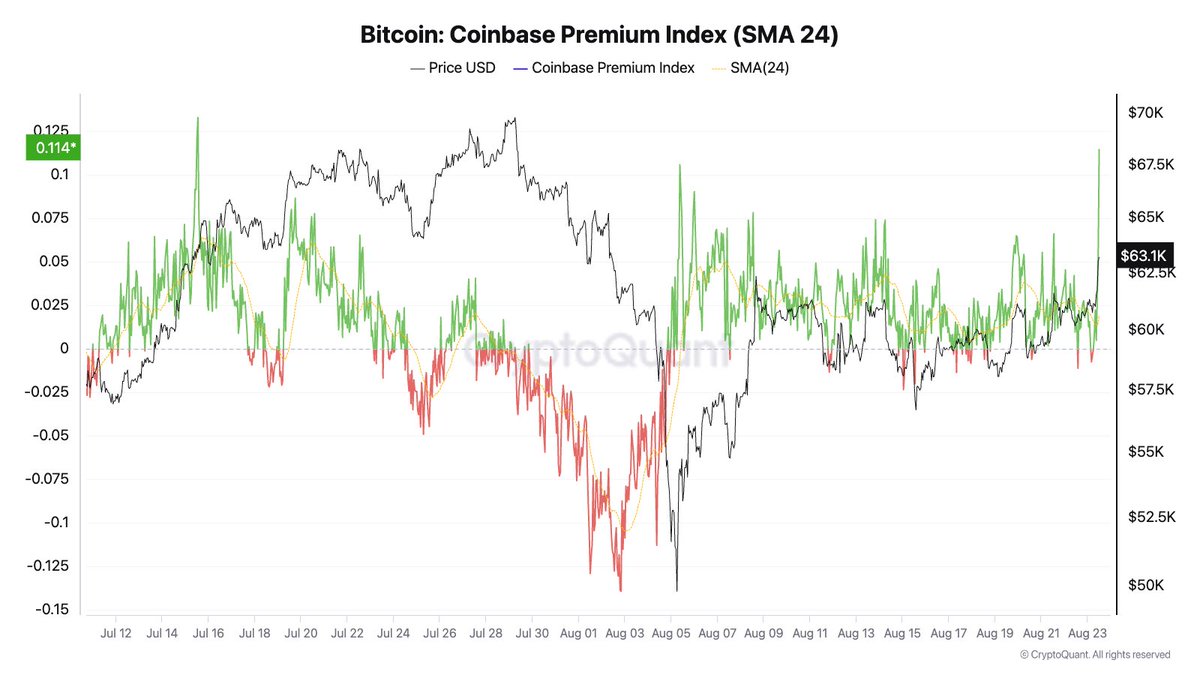

Based on Moreno’s findings, the price gap between Bitcoin on Coinbase (the leading US cryptocurrency exchange) has reached its peak since mid-July. To clarify, this premium is the variation in the coin’s value on Coinbase compared to other major centralized exchanges worldwide.

Normally, if the Bitcoin price gap between Coinbase is growing, it’s a sign that U.S. investors are eagerly seeking to buy Bitcoin, even at higher prices. This increased demand is reasonable considering the possibility of lower interest rates and fewer profitable options in conventional finance.

A surge in interest for Bitcoin indicates a positive trend, as it implies investors anticipate profit from a potentially lucrative cryptocurrency market. However, this heightened demand and increased price differential might lead to enhanced market turbulence.

As a crypto investor, I find it fortuitous that US Bitcoin demand is escalating at this juncture, as growth in demand had been stagnant for the past few weeks. According to a recent report by CryptoQuant, the perceived demand for BTC has been sluggish since April 2024, when the coin’s value was approximately $70,000.

As suggested by a blockchain intelligence company, it seems that the current demand for Bitcoin must increase for its price to become more visible again. If the rising interest in the U.S. market remains consistent and expands into other markets, investors might witness Bitcoin reclaiming its previous all-time peak value.

Bitcoin Price At A Glance

Currently, Bitcoin’s value stands approximately at $64,000, marking a rise of more than 5% over the past 24 hours. Based on information from CoinGecko, the leading cryptocurrency has seen a gain of about 7.5% in the last week.

Read More

- USD ZAR PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- CKB PREDICTION. CKB cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- EUR ILS PREDICTION

- USD COP PREDICTION

- Best Turn-Based Dungeon-Crawlers

- REF PREDICTION. REF cryptocurrency

- WELL PREDICTION. WELL cryptocurrency

2024-08-24 23:41