Ah, Bitcoin, always the dramatic star of the financial show. Currently limping below the $92,000 mark, with the market feeling more exhausted than an over-caffeinated squirrel. The sellers are having a field day, pushing the sentiment into a bear market frenzy. Analysts, clutching their charts and calculators, are now whispering ominously that BTC might be diving headfirst into a bear pit. With key support levels crumbling faster than a soggy biscuit, it’s no wonder short-term holders are fleeing faster than you can say “panic sell!” 🐻💸

But hold your horses, folks! Not all is doom and gloom. Some brave souls (and analysts) are holding onto the belief that Bitcoin might just be forming a “local bottom” – whatever that means. They’re comparing the current “correction” to those magical mid-cycle retracements during strong bull runs. Ah, optimism. They claim the macro environment is still on Bitcoin’s side and that long-term holders aren’t showing signs of turning into weaklings anytime soon. So, as panic-stricken sellers unload, the hope is that the market will eventually see the light at the end of the tunnel. 🌟

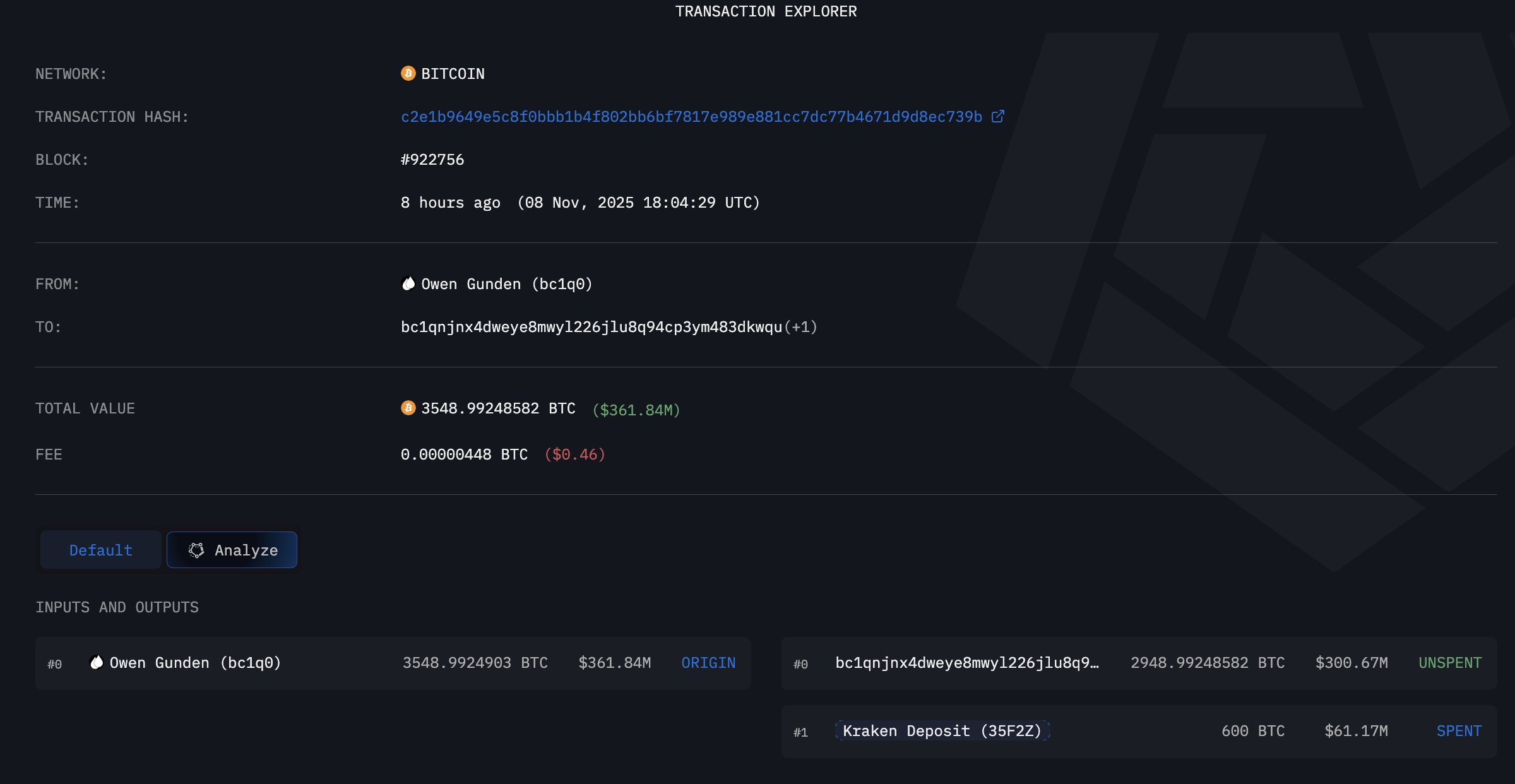

And then there’s the curious case of Owen Gunden, the Bitcoin OG who decided to shake things up by depositing his remaining 2,499 BTC (worth a mere $228 million, no biggie) into Kraken just an hour ago. I mean, sure, let’s all watch the market hold its breath and wonder if this is a sign of impending doom. Large exchanges deposits from ancient Bitcoin whales are often seen as prelude to massive sell-offs, but hey, who’s counting? The last time Gunden was in the news, he was reportedly getting ready to sell off his entire stash of 11,000 BTC worth $1.12 billion. Now it seems like the man has made the final move. 🎬💥

Massive BTC Transfer – Is It Panic or the Calm Before the Storm? 🤷♂️

According to the latest gossip from Lookonchain, Bitcoin legend Owen Gunden has officially deposited his last 2,499 BTC into Kraken, stirring up all sorts of speculation. You see, when a whale like Gunden moves his stash, it can send shockwaves through the market. Is he about to dump everything? Or is this just the equivalent of a drama queen’s final exit before a big twist? History has shown that big moves like this often happen at market bottoms – just when everyone’s losing their heads in fear. 🐋📉

Now, here’s where it gets juicy: Two weeks ago, Gunden seemed ready to offload his entire 11,000 BTC stash. But with this final deposit, it looks like he’s either out of the game or preparing for an epic exit. Traders are in a frenzy, wondering if this is a signal that one of Bitcoin’s oldest, most steadfast holders is abandoning ship. No one likes it when the whales leave the party, especially when Bitcoin can’t get its act together below $92K. 📉🐋

But, let’s not get carried away with the panic just yet. Historically, when long-term holders give up their positions, it can actually mark a turning point – like a plot twist in your favorite soap opera. If Gunden’s sell-off is over, we could soon see the market absorb the pressure and recover. Let’s just pray the fear subsides before we all need therapy. 🙏

Short-Term Trend: Still a Hot Mess 💀

If you take a peek at Bitcoin’s 4-hour chart, you’ll see that the market is still stuck in a downward spiral, with short-term selling pressure squeezing the life out of it. BTC is desperately clinging to the $92,000 level, which was once a comfy support but now seems like an elusive dream. The price keeps making lower highs and lower lows, as if it’s trying to prove just how persistent a downtrend can be. You go, Bitcoin. 💀

All the major moving averages (50 SMA, 100 SMA, and 200 SMA) are sitting smugly above the current price action, pointing downward. It’s like Bitcoin’s favorite sports team has lost all their games. Every time BTC tries to rally, it hits resistance at these downward-sloping MAs, which makes it feel like the market is saying, “Nice try, but not today.” And those little bounces? They barely even make it past the 50 SMA before getting smacked back down. Ouch. 💔

Meanwhile, volume remains high during the sell-offs, suggesting that this isn’t just a random dip – nope, these are conviction-driven sell-offs. Buyers are stepping in around $89,000-$91,000, but it’s only been a temporary pause, not a full-on recovery. If BTC wants to prove it’s got some fight left, it’s going to need to reclaim the $95,000 area and break through the 100 SMA. Until then, the bears are still winning. 🐻🎯

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Engineering Power Puzzle Solution in Poppy Playtime: Chapter 5

2025-11-21 05:15