As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I have witnessed the ebb and flow of market trends, and the dominance of Bitcoin is no stranger to me. The recent surge in Bitcoin’s price, pushing it past the $64,790 mark, is reminiscent of the 2021 bull run, albeit with a slightly different perspective this time around.

Last week, the cryptocurrency market saw a substantial surge, offering short-term investors an opportunity to cash in their gains. Bitcoin spearheaded this rally, reaching over $64,790, but the upward trend seemed to slow down when this statement was composed.

Over the past week, this increase was reflected throughout the world of altcoins. Notably, cryptocurrencies like TRON, Avalanche (AVAX), and Chainlink (LINK) experienced significant growth, with gains varying from 20% to 30%.

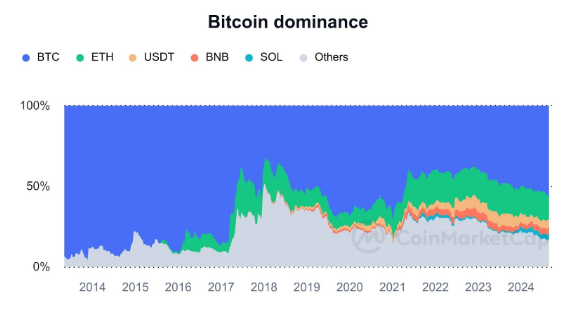

Even though various altcoins have made significant strides, Bitcoin still maintains its leading position across the market as a whole.

Bitcoin Increases Dominance: What Does It Mean For Altcoins?

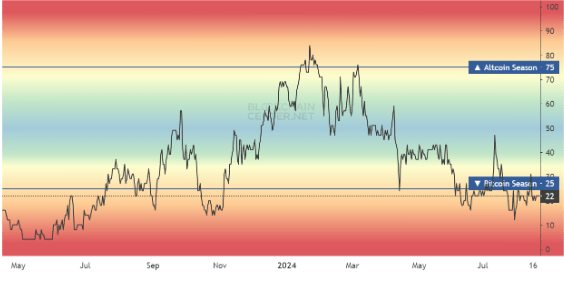

2021’s altcoin surge hasn’t picked up momentum as much as expected so far, with Bitcoin still dominating investor interest. This trend is evident in the Altcoin Season Index, which currently stands at 22, indicating a stronger preference for Bitcoin. Moreover, the Altcoin Monthly Index also shows a reading of 29, again suggesting more focus on Bitcoin.

In simpler terms, the index checks how well different alternative cryptocurrencies (altcoins) fare compared to Bitcoin. If more than 75% of the top 50 altcoins have grown more than Bitcoin over the past 90 days, we call it an “altcoin season” or “altcoin month.” Notably, the last recognized altcoin season took place during the 2021 bull market.

Based on the provided chart, it appears that altcoins almost surpassed market supremacy in January 2024, but only for a brief period of about three days when their dominance rose above 75%. Currently, the scale typically fluctuates between 20% and 30%, suggesting that the altcoin boom remains elusive. Intriguingly, on July 30, the index hit an all-time low of 12%, underscoring Bitcoin’s persistent dominance in the market.

Currently, Bitcoin is being traded at approximately $63,850, giving it a total market capitalization of about $1.26 trillion. Over the past week, its price has risen by 6.92%. This increase means that Bitcoin now accounts for around 56.3% of the entire value within the crypto market.

What’s The Performance Outlook For Altcoins?

Because Bitcoin is so powerful in the market, most other cryptocurrencies (altcoins) often follow its lead in terms of performance. However, there are times when certain altcoins buck this trend and experience significant independent surges. At the moment, Ethereum controls the largest portion of the altcoin market value at approximately $314.2 billion. The remaining altcoins combined hold a market value of around $438.48 billion, while stablecoins have a market value of roughly $161.97 billion.

In the past week, Sun Token, a stablecoin swap token built on TRON, has experienced remarkable growth with a staggering increase of 305%. Meanwhile, memecoins Dogwifhat (WIF) and POPCAT have also seen significant gains, rising by 32.7% and 76%, respectively, within the same timeframe.

Without a doubt, the performance of different altcoins will fluctuate due to factors such as their unique purpose and level of acceptance within the market.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD COP PREDICTION

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- ANKR PREDICTION. ANKR cryptocurrency

- PRIME PREDICTION. PRIME cryptocurrency

- SCOMP PREDICTION. SCOMP cryptocurrency

2024-08-25 23:11