Two billion dollars. Gone. Just…vanished. Apparently, someone in the financial world didn’t read the fine print on the “inherent volatility” disclaimer of cryptocurrency. It’s like spending your rent money on Beanie Babies, but with more technical jargon and a higher chance of weeping. 💸 Bitcoin dipped below $83,000, and Ethereum decided that $2,800 was just a bit too ambitious. The whole thing just sort of…collapsed. It’s always the quiet ones.

Everyone’s a Genius…Until They’re Not

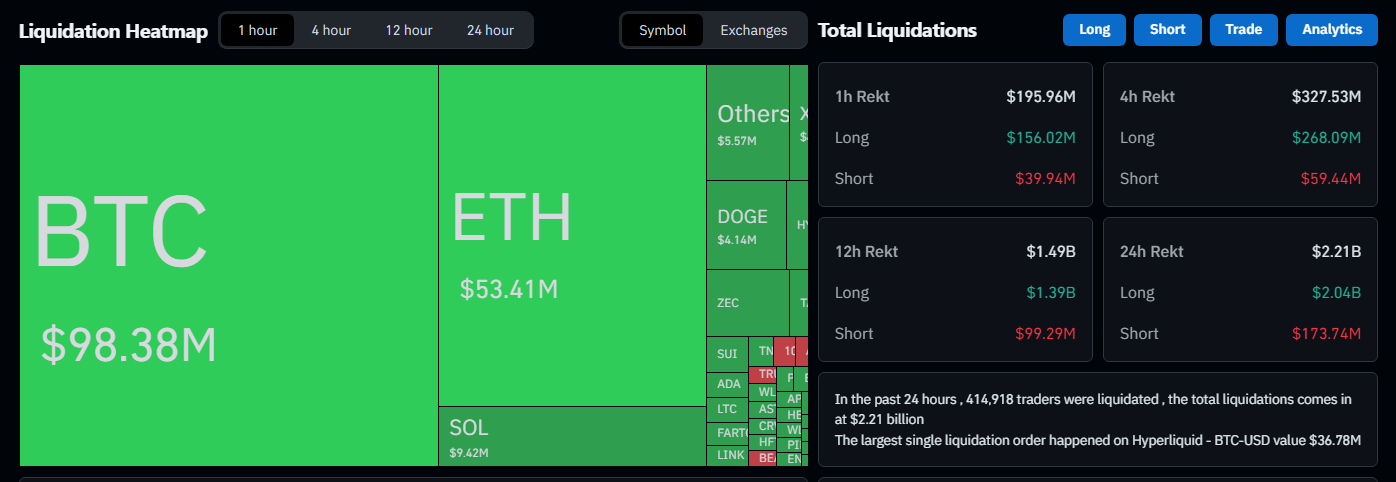

Nearly 400,000 accounts got wiped out. A single order on Hyperliquid? Thirty-seven million dollars. That’s a significant chunk of change, even for people who actively enjoy gambling with digital ones and zeros. The long bets – you know, the ones where people confidently predicted things would go up – took the biggest hit. Which, frankly, is how things usually work out. 🤔 I’m starting to think “HODL” is less of a financial strategy and more of a cry for help.

Long vs. Short: A Tale as Old as Time

A staggering $1.78 billion in long positions liquidated. Shorts? Barely a blip at $130 million. It’s like watching a stampede of overconfident bulls getting taken out by a handful of cynical short sellers. A strong US jobs report, conveniently, kicked things off. Apparently, the possibility of interest rates not being lowered was enough to send everyone into a panic. A truly baffling display of risk management. Or lack thereof. 🤷

Then there were the options expiring-$4.2 billion worth! Because nothing says “stable investment” like a bunch of contracts that are about to become…well, not worth very much. They were hedging, see. Protecting themselves. From themselves. It’s a very recursive system.

The “max pain level” for Bitcoin was $98,000. Which, at the time, seemed like a delightful fantasy. Ether was hovering around $2,800, also stubbornly refusing to cooperate with anyone’s financial plans.

Solana took an 11% tumble. XRP? A measly 8%. It was a freefall, a bloodbath, a… well, you get the idea. Even DOGE was shivering. 🐕 The problem wasn’t just where the losses were, it was how much everyone lost. A truly democratic distribution of financial sorrow.

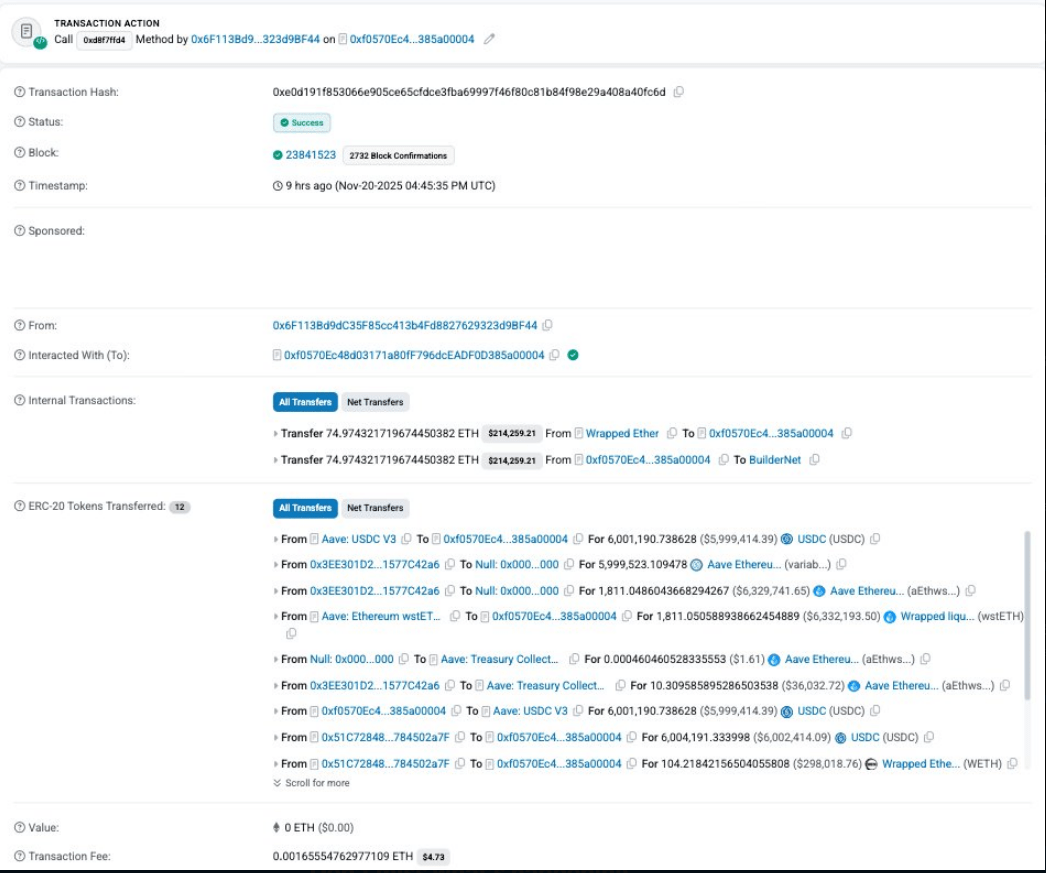

#PeckShieldAlert Apparently, a whale got rekt, losing $6.52 million on a long $wstETH position. Me? I’m just trying to remember where I put my keys. Priorities, people.

– PeckShieldAlert (@PeckShieldAlert) November 21, 2025

One individual lost close to $3 million. Another? A cool $6.5 million. And then there was “Machi,” whose paper losses topped $20 million, leaving them with a mere $15,530. It’s good to know even people with obscene amounts of money can experience existential dread. 😌 And don’t forget the “Anti-CZ Whale” – once a legend, now just…less legendary.

Honestly, I’m considering investing in a good, solid mattress. It seems like a more stable long-term investment at this point.

Read More

- The Winter Floating Festival Event Puzzles In DDV

- Sword Slasher Loot Codes for Roblox

- One Piece: Oda Confirms The Next Strongest Pirate In History After Joy Boy And Davy Jones

- Jujutsu Kaisen: Yuta and Maki’s Ending, Explained

- Jujutsu Kaisen: Why Megumi Might Be The Strongest Modern Sorcerer After Gojo

- Japan’s 10 Best Manga Series of 2025, Ranked

- Faith Incremental Roblox Codes

- Best JRPGs With Great Replay Value

- ETH PREDICTION. ETH cryptocurrency

- Non-RPG Open-World Games That Feel Like RPGs

2025-11-22 07:25