As a seasoned researcher with years of experience tracking the crypto market, I find myself intrigued by the recent surge of Bitcoin to $64,000 and the subsequent shift in sentiment from fear to greed as indicated by the Bitcoin Fear & Greed Index.

The data indicates that Bitcoin investors are exhibiting a sense of excessive optimism or greed, following the recent spike in Bitcoin’s value to around $64,000. This suggests that they might be expecting further increases in its price.

Bitcoin Fear & Greed Index Is Now Pointing At ‘Greed’

The “Fear & Greed Index” is an indicator created by Alternative that tells us about the sentiment currently present among the investors of Bitcoin and other large cryptocurrencies.

The metric uses data from five factors to determine the net market mentality: volatility, trading volume, social media sentiment, market cap dominance, and Google Trends.

The index employs a range from zero to one hundred to express investor sentiment. Numbers higher than 53 suggest that greed is prevalent among investors, whereas figures below 47 indicate fear in the market. Values landing between these two thresholds indicate a neutral mindset overall.

Now, here is what the Bitcoin Fear & Greed Index is looking like right now:

It’s clear from what you see that the indicator currently stands at 55, indicating that investors are presently feeling quite greedy. This shift towards greediness represents a change in the market dynamics compared to the recent trends.

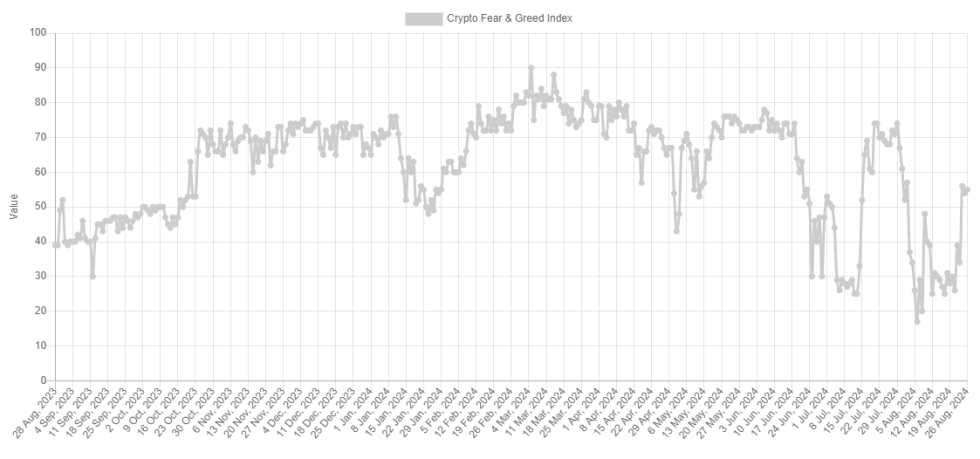

The chart below shows how the value of the index has changed over the past year.

The graph shows that the Bitcoin Fear & Greed Index had relatively low values just last week. More particularly, the indicator had been deep inside the fear region and quite close to a special zone called the extreme fear.

In simple terms, an extreme level of fear is reached when the reading on the scale is 25 or less. This level has been breached multiple times over the last month, with a particularly significant instance happening coinciding with the price dip on August 5th.

In the past, when Bitcoin’s price has fallen significantly (into the “extreme fear” zone), it often signals a low point from which the value begins to recover.

A reverse trend, much like its counterpart, has been observed in the extreme greed area, initiating at a score of 75 on the Fear & Greed Index. Remarkably, previous peak prices (all-time highs) occurred when sentiment soared into this region as well.

It seems that Bitcoin often moves in the opposite direction of popular expectations, with the strongest sentiment extremes indicating when this anticipation is at its peak. Consequently, it’s logical to assume that a reversal is more probable during these periods of intense expectation.

As the shift from apprehension to optimism among investors has occurred lately, there’s been a resurgence of positive outlooks. Since the excitement surrounding Bitcoin isn’t intense just yet, it may not be significantly impacted negatively.

Over the approaching days, I’ll be keeping a close eye on the index, particularly any surges indicative of excessive optimism or greed. Such peaks might signal that the market is overheating and that the asset could be at risk.

BTC Price

Yesterday, Bitcoin reached an impressive peak of $65,000, but it seems to have experienced a decrease and is now trading around $63,600.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- USD ZAR PREDICTION

- USD COP PREDICTION

- USD PHP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD CLP PREDICTION

- EUR RUB PREDICTION

2024-08-27 03:42