Ah, Bitcoin – that fickle mistress of finance – has once again proven that her moods are as unpredictable as a dandy’s fashion choices. On-chain data reveals that her Market Value to Realized Value (MVRV) Z-Score has descended to depths not seen since she was a mere $35,000 debutante. How dreadfully common! 💅

The Tragic Plunge of Bitcoin’s Self-Worth

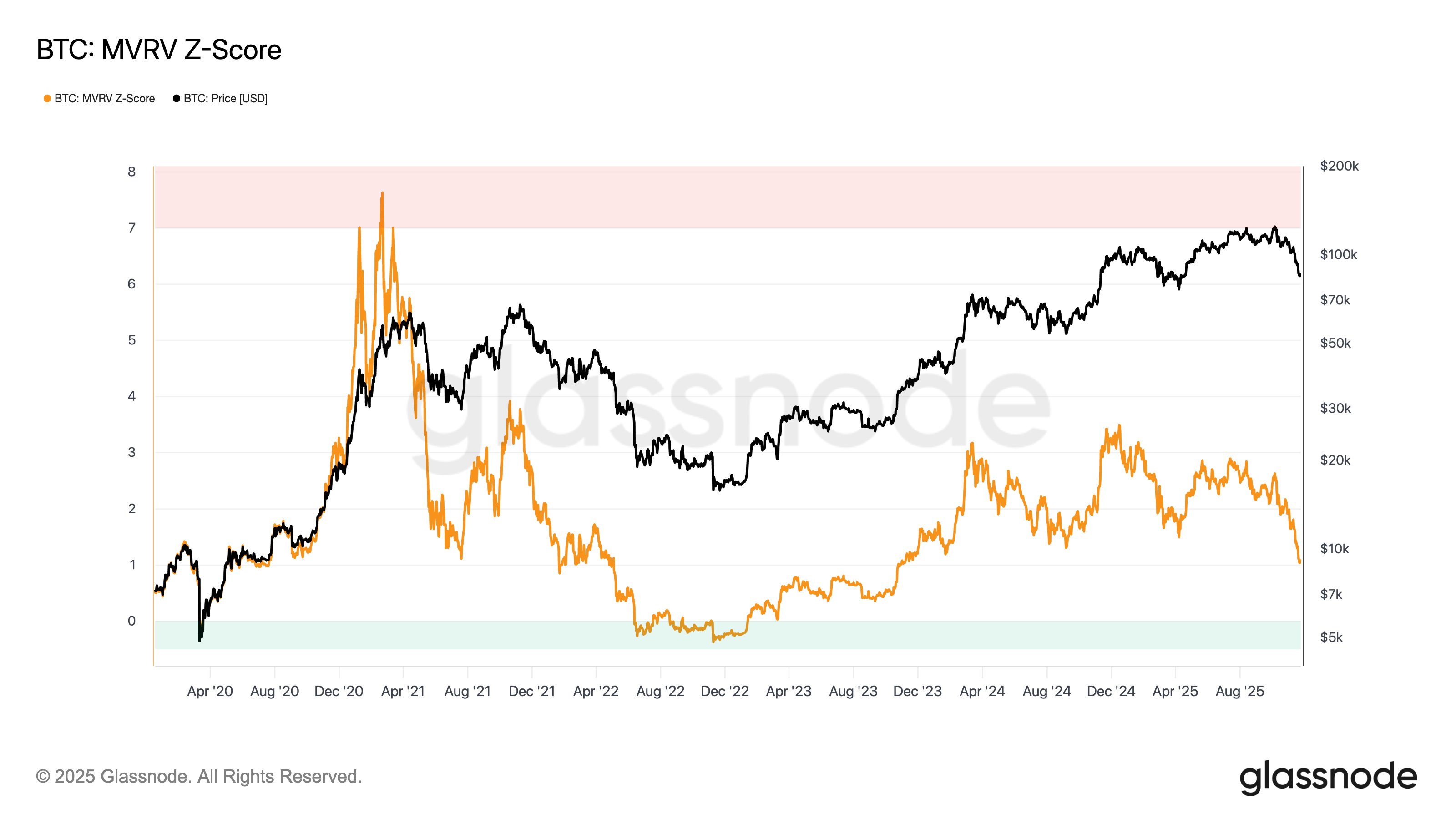

In a post on X that was undoubtedly more dramatic than necessary, Glassnode analyst Chris Beamish (who clearly has too much time on his hands) has chronicled Bitcoin’s latest existential crisis through the lens of the MVRV Z-Score. This indicator, much like society’s judgment of one’s choice in waistcoats, compares Bitcoin’s market cap with its Realized Cap – which is essentially asking, “Darling, are you worth what you think you’re worth?”

The Realized Cap, my dear reader, is that tedious calculation where we pretend each coin remembers its last transaction price like a fading socialite remembers her last husband. How quaint! In simpler terms, it’s the sum total of bad financial decisions made by investors who clearly didn’t listen to their mothers.

Now, feast your eyes upon this graph – it’s more dramatic than my last breakup! 👀

As you can see (unless you’re blind, in which case I apologize for my insensitivity), Bitcoin’s MVRV Z-Score has taken a nosedive worthy of a drunken aristocrat at a garden party. This decline in investor profitability is entirely Bitcoin’s own fault – she simply couldn’t maintain her upward trajectory, much like I can’t maintain interest in conversations about the weather.

The metric still lingers above zero like a bad odor at a dinner party, meaning investors haven’t completely lost their shirts yet – though their cuffs may be looking slightly frayed. The current profitability level is positively pedestrian compared to Bitcoin’s glory days, matching only those sad times when she was worth a mere $35,000. How embarrassing!

Historically, such displays of financial vulnerability have led to bottoms forming – much like how my self-esteem bottoms out when I see my reflection after a night of debauchery. However, Bitcoin usually only hits rock bottom when investors are completely underwater – though given the current state of affairs, they might want to invest in some water wings.

On the flip side (much like my opinion on most things), when the MVRV Z-Score gets too high, it leads to profit-taking explosions more dramatic than my Aunt Agatha’s last dinner party. The chart shows Bitcoin reached positively obscene levels during her 2021 bull run – she was practically indecent! This cycle’s peaks have been more modest, like a vicar at a brothel.

Bitcoin’s Price: A Comedy of Errors

After briefly flirting with the scandalous figure of $81,000 on Friday (how vulgar!), Bitcoin has somewhat recovered her dignity and is now priced at $88,600 – still not enough to buy good taste, but enough to keep the champagne flowing for now. 🍾

In conclusion, Bitcoin continues her melodramatic performance in the financial theater, proving once again that the only thing more volatile than cryptocurrency prices is my patience with people who don’t appreciate fine art.

Read More

- The Winter Floating Festival Event Puzzles In DDV

- Jujutsu Kaisen: Why Megumi Might Be The Strongest Modern Sorcerer After Gojo

- Best JRPGs With Great Replay Value

- Jujutsu Kaisen: Yuta and Maki’s Ending, Explained

- Sword Slasher Loot Codes for Roblox

- One Piece: Oda Confirms The Next Strongest Pirate In History After Joy Boy And Davy Jones

- Roblox Idle Defense Codes

- All Crusade Map Icons in Cult of the Lamb

- Non-RPG Open-World Games That Feel Like RPGs

- Dungeons and Dragons Level 12 Class Tier List

2025-11-25 09:20