As a seasoned crypto investor with battle scars from numerous market cycles, I find myself both concerned and intrigued by the recent Bitcoin price drop. The rollercoaster ride of cryptocurrencies is not for the faint-hearted, but it’s the thrill that keeps us hooked.

Over the past couple of days, the value of Bitcoin has experienced a significant drop. On Monday, it was trading at prices above $64,000, but by yesterday, it had fallen to as low as $58,000 – that’s a 10% decrease within this period.

It seems this sudden drop has sparked worry within the cryptocurrency community, leading to different perspectives on the market’s actions.

According to a recent analysis by CryptoQuant, a platform that offers on-chain data, there are five potential reasons that could explain this drop in value.

Short-Term Holders And Market Fragility

According to CryptoQuant’s analysis, they have identified and displayed five key charts that showcase the market status both prior to and throughout the recent price decline.

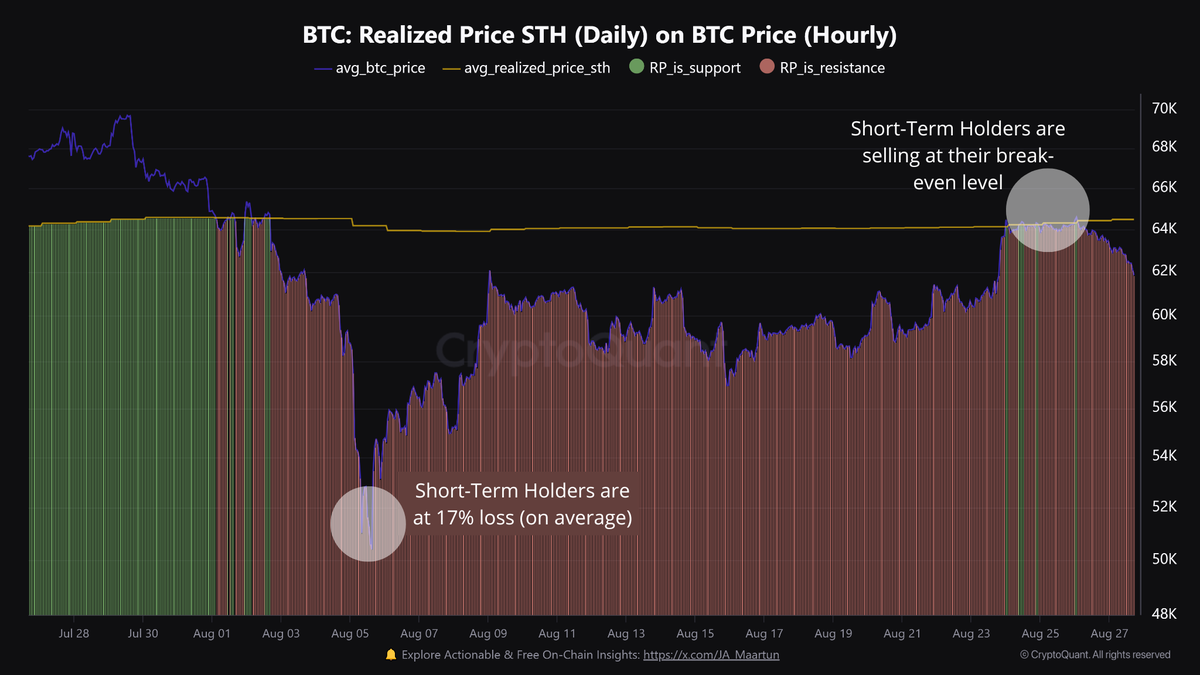

Among the crucial elements noted by CryptoQuant, it’s the influence of short-term investors setting up a resistance point at their cost-recovery level that stands out.

In the recent past this month, the value of Bitcoin plummeted significantly, causing a typical loss of around 17% for short-term investors. Once the price bounced back to its initial level, those investors decided to cash out, thereby establishing a barrier that hindered any further upward momentum.

Beyond analyzing the actions of short-term investors, the report also emphasizes the unstable market conditions brought about by traders betting on rising Bitcoin prices. The value of open interests in Bitcoin futures has significantly grown, increasing from $13.5 billion to $17.9 billion – a 31% surge since August 5th.

Significantly, high funding rates suggested a higher value for long-term contracts, implying traders’ beliefs in further market growth. But CryptoQuant warned that such enthusiasm might lead to a risky scenario, as even minor price declines could potentially cause instability in traders’ positions.

Spot Inflows And Market Liquidations

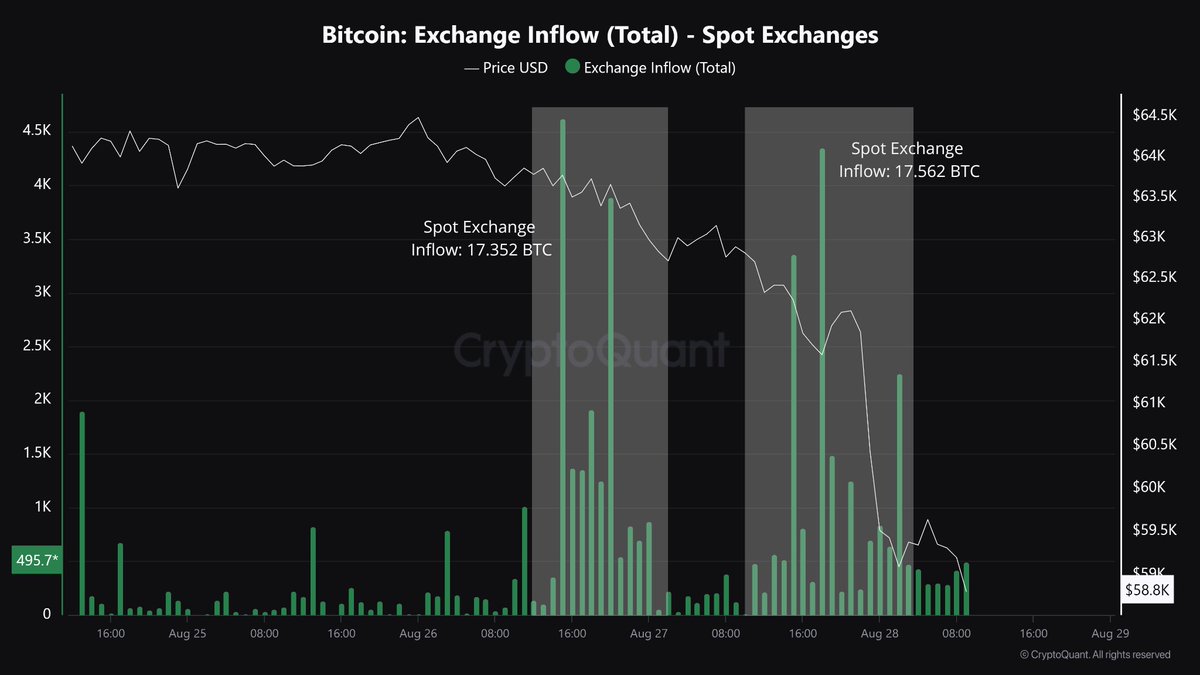

As a crypto investor, I’ve observed a notable surge in spot inflows coinciding with a drop in Bitcoin prices. This could mean that major Bitcoin holders were transferring their coins to exchanges, possibly to offload them. This extra selling pressure seems to have intensified the already precarious situation in the futures market.

According to CryptoQuant’s recent report, the prices of Bitcoin and Ethereum kept falling, leading to a large number of long positions being terminated (liquidated). The total amount liquidated for Bitcoin was approximately $90 million, while for Ethereum, it was around $55 million.

The significant liquidations, the largest ones since August 5th, have decreased the total outstanding contracts by approximately $2.2 billion. This action has added to the instability in the market.

CryptoQuant concluded by noting:

Here’s my interpretation: In the wake of the recent price decline, it seems clear that the market requires some breathing room to regain equilibrium. Over the next few days, I’ll be keeping a close eye on on-chain metrics to gauge the market’s progress towards stability.

Over the last day, the trend has been similar to the previous ones, with Bitcoin continuing to fall. Specifically, during this period, it has decreased by 3.2%, currently selling for $59,841 as I write this.

Featured image created with DALL-E, Chart from TradingView

Read More

- SOL PREDICTION. SOL cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- WIF PREDICTION. WIF cryptocurrency

- USD VES PREDICTION

- USD COP PREDICTION

- EUR CLP PREDICTION

2024-08-29 08:42