As a seasoned researcher with years of experience tracking cryptocurrency markets, I find it intriguing to see the behavior of Bitcoin sharks and whales. Their recent accumulation trend, as shown by Santiment’s Supply Distribution data, is a clear sign that these market heavyweights are confident in BTC‘s future price movement.

Data from the blockchain indicates that large Bitcoin investors, or sharks and whales, have maintained their grip on the market even as the asset’s value has experienced a significant increase.

Bitcoin Sharks & Whales Have Been Increasing Their Holdings Recently

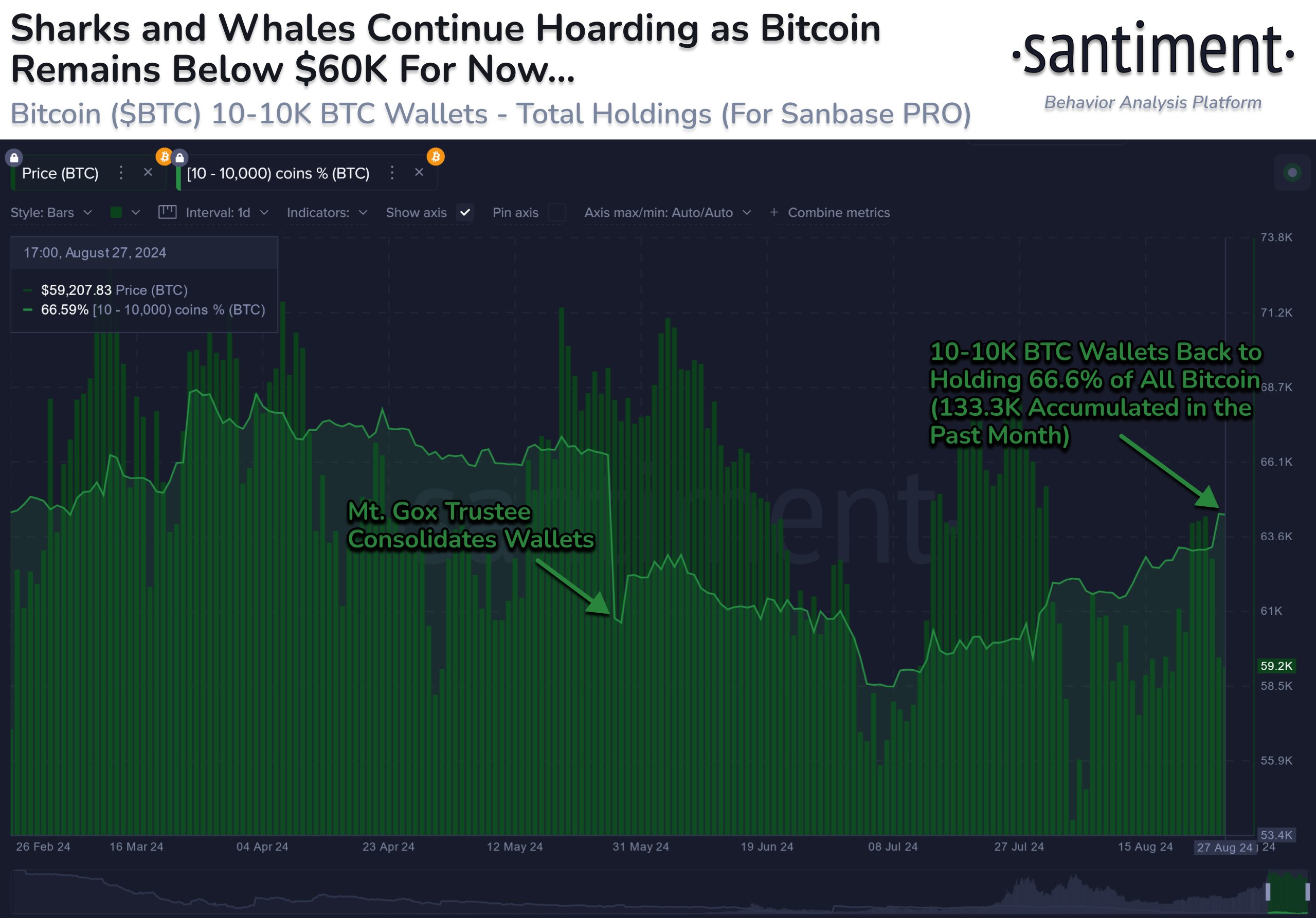

Based on information from the blockchain analysis company Santiment, large-scale Bitcoin investors known as “whales” and those with even larger holdings, referred to as “sharks,” have been buying or accumulating Bitcoin over the past month. The key statistic here is the “Supply Distribution,” which provides insight into the percentage of the total Bitcoin supply that a specific group of wallets owns.

Investors or account holders are categorized into various groups according to the quantity of coins they currently possess. For example, the group with 1 to 10 coins encompasses all wallets that contain anywhere from 1 to 10 Bitcoins at present.

When discussing the subject at hand, we’re focusing on the collection of entities that possess between 10 to 10,000 units (coins). At the present exchange rate, the lower boundary equates to approximately $598,000, while the upper limit translates to a staggering $598 million.

This range includes some key investor groups, like sharks and whales, who are considered to be influential entities in the market because of the scale of their holdings. Naturally, the whales are the more powerful of the two, as they are larger than the sharks.

Keeping an eye on the actions of these entities, given their strategic locations within the network, could be valuable due to their potential impact on the value of assets. A practical method for observing such behavior is by analyzing the Distribution of Supply.

The following chart provided by the analytics company illustrates the range in which Bitcoin investors hold their cryptocurrency, specifically between 10 and 10,000 Bitcoins.

Over the past month, I’ve noticed a significant increase in the number of Bitcoins held by influential investors, often referred to as ‘whales’. My analysis indicates that they’ve accumulated approximately 133,300 additional tokens within this period, suggesting a growing interest and confidence in the cryptocurrency market.

Despite the recent drop in BTC prices, this accumulation phase continues unabated, as the distribution of coins between 10 and 10,000 shows a consistent upward trend. This indicates that major investors remain unfazed by the downward market trends, suggesting they are not overly concerned about the bearish price fluctuations.

It seems that the coins purchased by these holders are likely originating from small-scale investors who are quickly selling their tokens to larger entities, as suggested by Santiment’s analysis.

The current optimism among sharks and whales regarding Bitcoin is undeniably encouraging, yet it’s crucial to keep an eye on this trend in the upcoming days. A potential reversal in its value might suggest a bearish scenario, implying that major investors are choosing to offload their assets, which could lead to a decline.

BTC Price

At the time of writing, Bitcoin is trading at around $60,100, down 2% over the past week.

Read More

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD ZAR PREDICTION

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- WIF PREDICTION. WIF cryptocurrency

- USD VES PREDICTION

- HYDRA PREDICTION. HYDRA cryptocurrency

- USD COP PREDICTION

2024-08-29 20:12