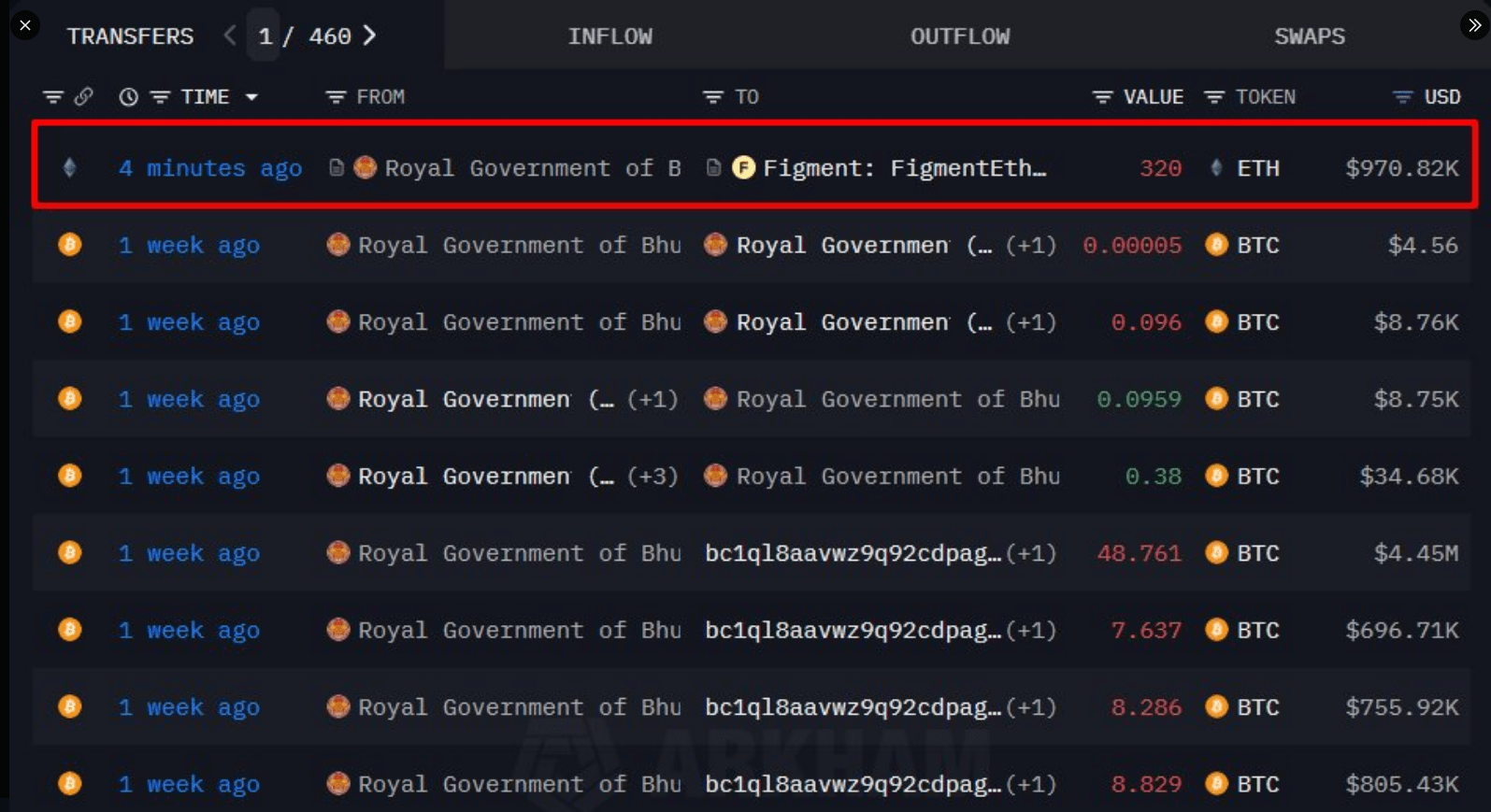

According to whispers in the crypto taverns, the government of Bhutan, a nation known for its serene landscapes and enigmatic ways, decided to send 320 Ethereum (ETH) into staking on November 27, 2025. The transaction, as smooth as a dragon’s tongue, was routed through Figment.io, an institutional staking provider. The sum, which could buy a dozen dragons or a small island, was valued at about $970,000. The move has sparked a frenzy among crypto enthusiasts and policy-makers alike, who are now wondering if Bhutan has finally lost its marbles-or perhaps found a new one.

Onchain Lens, that sly fox of the blockchain world, claims the 320 ETH created 10 new validators, each requiring 32 ETH. The payment and setup were recorded onchain, visible to blockchain trackers like a mischievous imp in a candy shop. This is Bhutan’s largest ETH action since May 2025, when the nation moved 570 ETH to a Binance wallet, a move so bold it could make a pirate blush.

The Royal Government of Bhutan sent 320 $ETH, worth $920.8K, for staking into #ETH2.0 @Figment_io.

– Onchain Lens (@OnchainLens) November 27, 2025

Observers, who are as curious as a cat with a ball of yarn, note Bhutan isn’t just holding crypto as an asset. By staking ETH, the country is helping to secure the Ethereum network and earning rewards that could be as sweet as a sugarplum. Reports have disclosed the move also ties into national plans to shift parts of its digital identity project from Polygon to Ethereum. Now, the chain isn’t just a place to park funds; it’s becoming part of public infrastructure, much like a well-worn path in a forest.

Bhutan, already known for its Bitcoin stash, is now experimenting with crypto as a tool for state services. Some analysts say it’s a small state testing new financial and technical models, which is like a toddler trying to build a rocket-adorable and slightly terrifying.

When ETH is staked, it becomes as illiquid as a grumpy bear in winter. The tokens can’t be used for immediate spending or trading. But validators earn rewards, which might add a modest income to the state treasury, like a few extra coins in a piggy bank.

The trade-offs are clear: more participation in protocol security, less short-term flexibility in asset use. Several commentators asked whether sovereign staking will affect how other small nations treat crypto reserves, all while sipping tea and plotting their next move.

On the world stage the amount is modest, but the move is symbolic. Sovereign actors rarely operate validators on major smart-contract chains. This step was noticed because it ties public services and reserve management to one blockchain, much like a tiny ant deciding to carry a feather.

Regulators, market watchers, and blockchain developers have been monitoring the transaction and related policy moves to see whether similar steps might follow elsewhere. The world, as always, is watching with bated breath-and a dash of skepticism.

Read More

- Gold Rate Forecast

- How to Unlock the Mines in Cookie Run: Kingdom

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- The Saddest Deaths In Demon Slayer

- Gears of War: E-Day Returning Weapon Wish List

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- Jujutsu: Zero Codes (December 2025)

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- FromSoftware’s Duskbloods: The Bloodborne Sequel We Never Knew We Needed

- Epic Pokemon Creations in Spore That Will Blow Your Mind!

2025-11-28 17:12