As a seasoned analyst with years of experience in the cryptocurrency market, I find myself intrigued by the recent trend in the Binance Funding Rates for Tron (TRX), Stellar (XLM), and 1inch Network (1INCH). The negative values for these altcoins suggest a bearish sentiment among traders, but as we all know too well in this volatile market, the crowd’s wisdom is not always infallible.

A data analysis company has disclosed that there’s been an increase in bearish positions for three alternative cryptocurrencies on the Binance platform. This could potentially contribute to price recoveries.

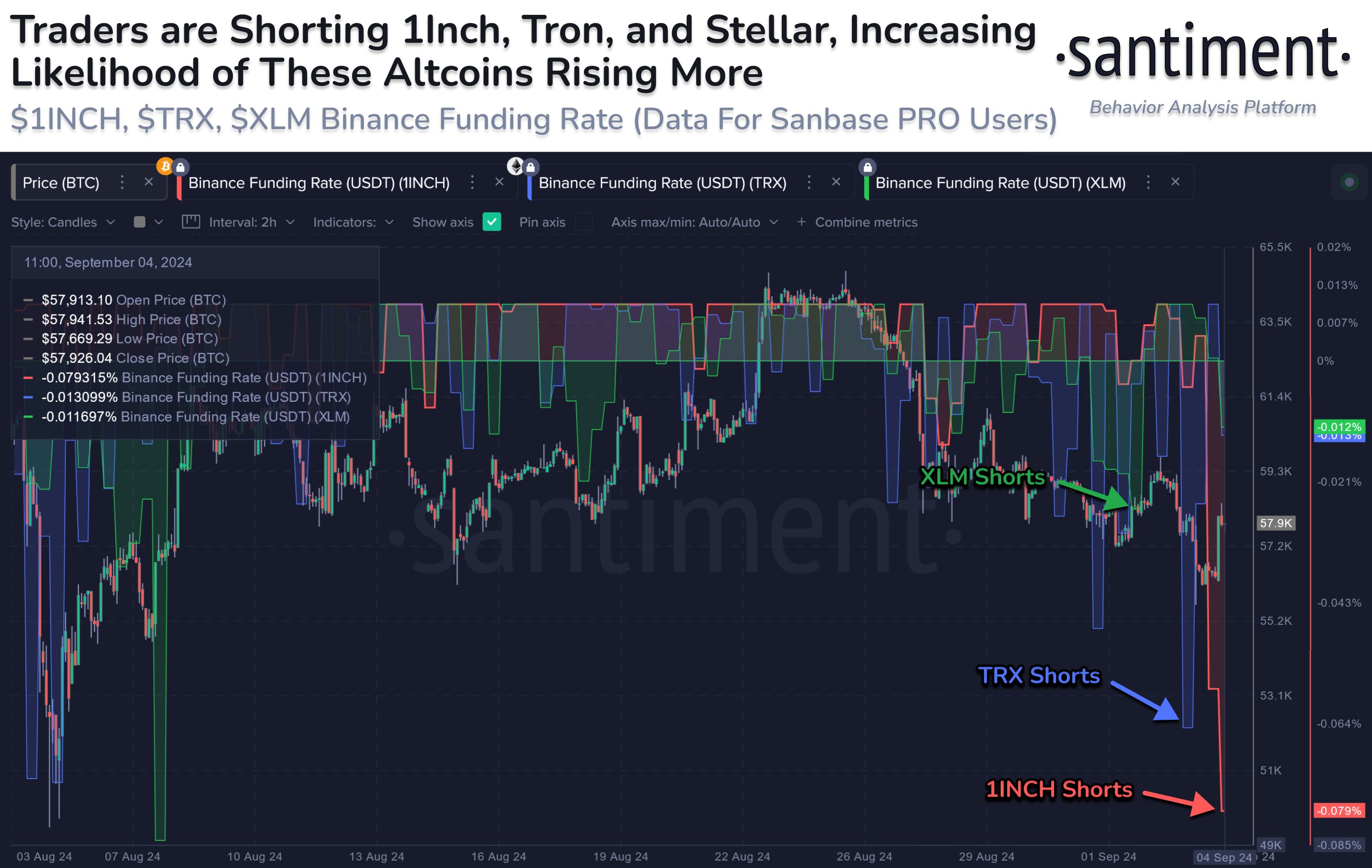

Tron, Stellar, And 1inch Have Seen Negative Funding Rates Recently

Recently, the topic of Binance Funding Rate trends for several alternative cryptocurrencies was covered by Santiment, an analytical company specializing in on-chain data, in their latest post on X.

The “Funding Rate” serves as a tool that monitors the recurring commission payments made by traders on a specific derivatives trading platform, such as Binance, which they exchange with one another over time.

If the metric is greater than zero, it signifies that long-term contract holders are currently paying an extra fee to short sellers for maintaining their positions. This situation suggests that there’s a prevailing optimistic outlook in the market, as investors seem bullish on the market’s future direction.

Instead, when we see the indicator positioned below the zero line, it implies that more short sellers are present than long buyers at the moment, suggesting a predominantly pessimistic or bearish outlook among them.

Currently, I’d like to share a graph that illustrates the recent development of the Funding Rates for three different cryptocurrencies – 1inch Network (1INCH), Tron (TRX), and Stellar (XLM) – over the course of the last month.

Over the past few days, the graph indicates that the Funding Rates on these three altcoins listed have been running below zero – a sign that a higher number of traders appear to be positioning themselves for a decline in coin prices rather than an increase.

1inch seems to be experiencing a setback with a -0.079% reading on this particular indicator, which might appear unfavorable at first glance due to its red color. However, these negative values don’t necessarily mean that the crowd is bearish towards the coin’s price. In fact, they may not be indicative of a negative trend for their prices.

This occurs due to the fact that a large-scale liquidation event tends to have the greatest impact on the market, particularly when it involves numerous positions. Furthermore, the likelihood of these liquidations increases significantly if the positions in question carry high leverage. In layman’s terms, Santiment points out.

If a lot of people are betting against a particular asset, it might lead to forced sales or liquidations. These events can serve as powerful propellants, pushing the asset’s value upward even further. Bucking the trend and investing contrary to the skeptics could potentially yield profitable returns.

In other words, we’ll need to observe further to determine if the costs of these altcoins will continue rising, considering the possible ignition source that seems to be building up.

TRX Price

Among these three digital currencies, Tron stands out as the largest one, and it experienced a downturn this past week, similar to the broader cryptocurrency market. However, when considering monthly performance, investors in TRX have actually fared quite well, as the asset has surpassed many others including Bitcoin (BTC), with its impressive 18% growth.

The below chart shows what the recent performance of Tron has looked like.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- USD PHP PREDICTION

- USD ZAR PREDICTION

- USD COP PREDICTION

- USD CLP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- XPRT PREDICTION. XPRT cryptocurrency

- RTM PREDICTION. RTM cryptocurrency

2024-09-06 18:12