As a seasoned crypto investor with a decade of experience navigating the ever-evolving digital asset landscape, I find myself both intrigued and cautiously optimistic about the recent launch of Bitcoin ETFs in the United States. While they have certainly generated excitement, it’s essential to approach them with a dose of realism and patience.

Despite the initial enthusiasm surrounding the debut of Bitcoin ETFs in the U.S., as suggested by Jim Bianco, CEO of Bianco Research, these investment tools have thus far failed to fulfill their expected function as a significant driving force behind widespread cryptocurrency adoption.

On Elon Musk’s social network, user Bianco posited that Bitcoin Exchange-Traded Funds (ETFs) might require additional maturation before they can function effectively as significant “tools for widespread adoption” instead of merely serving as “novelty items for casual use.

Bitcoin ETF Outflows And Lack of Institutional Involvement

Bianco’s comments highlighted growing skepticism about the performance of Bitcoin ETFs since their debut for trading in January.

Despite high anticipation surrounding the prospect of spot Bitcoin ETFs prior to launch, Bianco highlighted various indicators suggesting the market might not be as robust as initially believed.

The expert’s main points highlight current withdrawals, losses experienced by investors in these Bitcoin ETFs, as well as a scarcity of significant institutional backing. This implies that the Bitcoin ETF sector might require additional time to mature and grow properly.

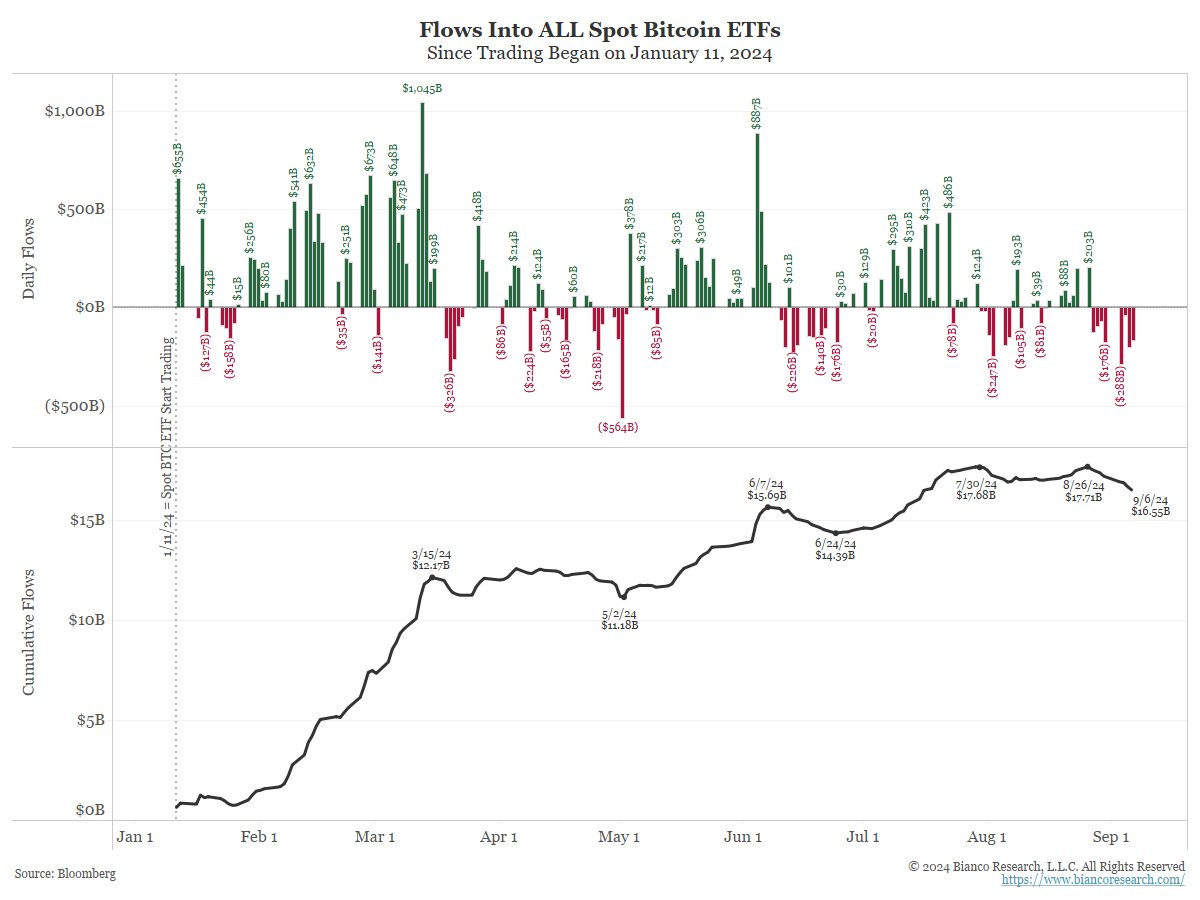

One critical point Bianco raised is the substantial net outflows within the Bitcoin ETF market. Citing data from Farside Investors, Bianco showed that there has been over $1 billion in net outflows from the 11 US Bitcoin ETFs in just the last eight trading days.

The amount managed by Bitcoin ETFs has dropped significantly, from a high of approximately $61 billion in March to about $48 billion currently. According to Bianco’s perspective, this decrease indicates a requirement for continuous investor interest and substantial institutional investments to be sustained.

He further pointed out that most inflows into Bitcoin ETFs were from existing cryptocurrency holders who shifted their positions back into traditional finance (Trad-Fi) accounts rather than from new investors entering the market. This indicates that the ETFs may not have attracted fresh capital as initially hoped.

Enhancing doubt’s validity, Bianco pointed out that it seems institutional investors are not fully engaged in the Bitcoin ETF market, as even BlackRock indicates that about 80% of Bitcoin ETF transactions might be carried out through self-directed online accounts.

The expert added:

According to crypto-quant analysis, it appears that most Bitcoin Spot ETF inflows stem from cryptocurrency owners transferring their assets to traditional financial institutions. This indicates a relatively small amount of fresh capital has entered the digital currency market. Contrary to expectations, these financial tools have yet to attract significant numbers of baby boomers, as was initially anticipated. In fact, there’s been a notable exodus of over $1 billion in the last eight days from these instruments, suggesting that many investors may be experiencing losses and choosing to leave the market.

What Does The Bitcoin ETF Market Need To Mature?

Although Bitcoin ETFs haven’t lived up to their initial anticipations so far, Bianco maintains a positive outlook, believing they could yet prove instrumental in promoting wider cryptocurrency usage.

As an analyst, I underscore the necessity for exercising “patience” and creating additional on-chain tools to propel the market. According to Bianco’s perspective, it might take “several seasons, with a few winters and significant breakthroughs in development” before the Bitcoin ETF market fully reaches its potential.

The CEO noted:

Could it be possible that these tools will facilitate wider acceptance by 2028, following substantial advancements in on-chain technologies such as Bitcoin’s DeFi, NFTs, and payment systems?

Featured image created with DALL-E, Chart from TradingView

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- USD COP PREDICTION

- USD CLP PREDICTION

- USD ZAR PREDICTION

- USD PHP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- PLI PREDICTION. PLI cryptocurrency

2024-09-10 08:12