As a seasoned researcher with years of observing and analyzing market trends under my belt, I find myself standing at the precipice of Bitcoin’s potential journey to $60,000. The road ahead seems fraught with challenges, but the allure of the destination is undeniably tantalizing.

Currently, Bitcoin’s price is dipping below key resistance points, and many investors are eyeing the $60,000 milestone as the next significant goal. However, for Bitcoin to reach that level, three conditions need to align precisely.

Short orders with high leverage

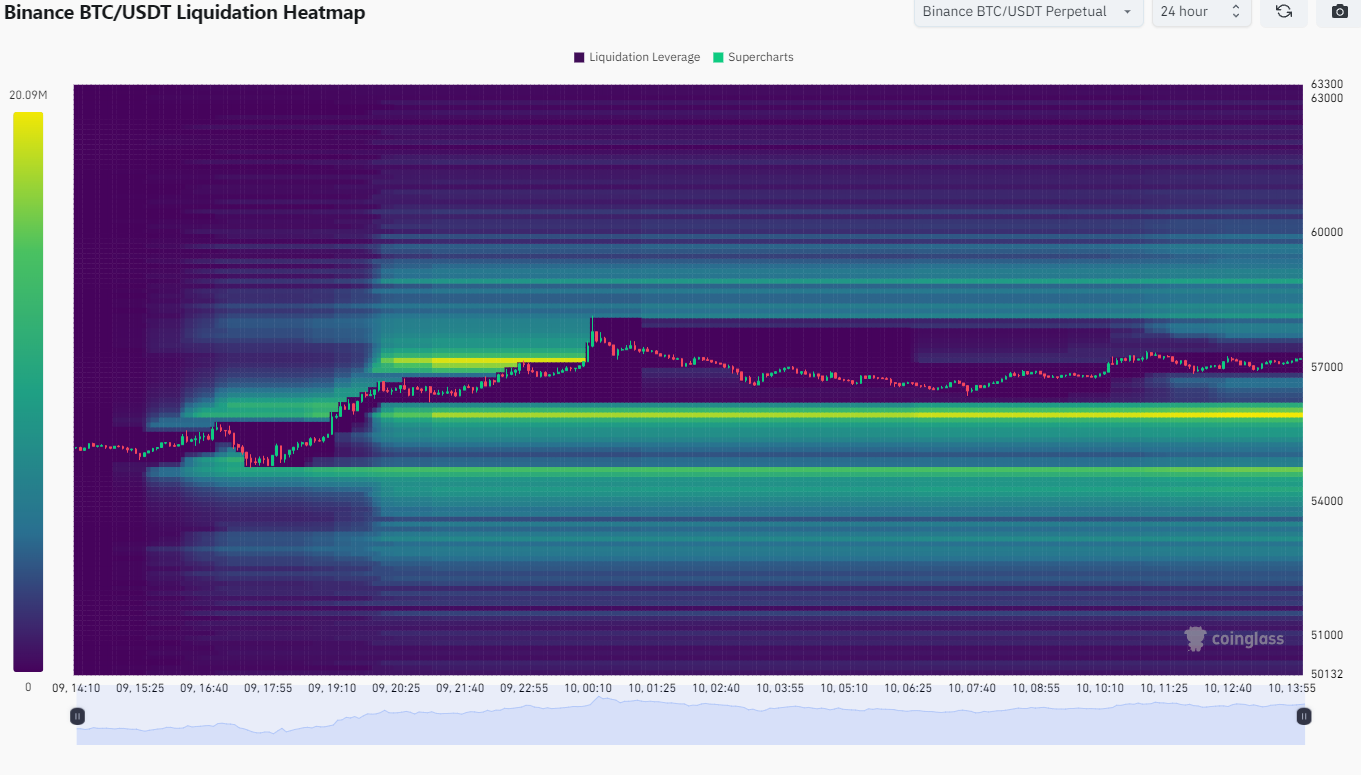

One significant reason for the rise in Bitcoin’s price is the forced liquidation of high-risk short positions. As Bitcoin nears higher value points, traders are often forced to sell their leveraged positions in a phenomenon known as a “short squeeze.” This mass selling drives up the price of Bitcoin even further. The Binance heatmap data shows substantial leverage between $58,000 and $60,000, indicating that liquidations at these prices could potentially propel Bitcoin to new record highs.

Investment inflows from institutions

The price of Bitcoin is still heavily influenced by retail traders, but institutional inflows are necessary for long-term growth. BlackRock is currently among the few institutional investors actively boosting cryptocurrency inflows, albeit the majority of its attention has been focused on Ethereum.

For Bitcoin to hit $60,000, it’s crucial that more financial institutions join the market. The chart showing weekly asset flow in cryptocurrency reveals a decrease in institutional involvement lately, leading to a pessimistic market atmosphere due to negative flows. However, if large financial players show renewed interest, Bitcoin will gain confidence and the liquidity required to surpass its resistance levels.

Change in sentiment

Currently, the market atmosphere leans heavily towards intense apprehension. Persistent selling waves have consistently thwarted any recent attempts for a rally, preventing Bitcoin from climbing higher. For us to witness a prolonged surge towards $60,000, it’s crucial that this negative sentiment improves.

It’s likely that more individuals will join the market as fear diminishes and faith in it strengthens, which will further boost the rising trend. Encouraging advancements within the market, combined with a change in perception, could provide the necessary push for Bitcoin to surpass the $60,000 barrier at last.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- TON PREDICTION. TON cryptocurrency

- USD COP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- Strongest Magic Types In Fairy Tail

- GLMR PREDICTION. GLMR cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

2024-09-10 16:37