Good Lord, Bitcoin is doing the tightrope dance today, teetering just shy of the $90,000 mark like it’s still deciding whether it wants commitment or lovesickness. With a daily price range that’s tighter than a sausage casing, the crypto is flailing around sideways, boasting a market cap that would make some countries go “Whoa!”. Meanwhile, the $18.29 billion in trading volume hints that traders are either as indecisive as a committee or hungover enough to need a spinning class to detox from the volatility.

Bitcoin Chart Outlook

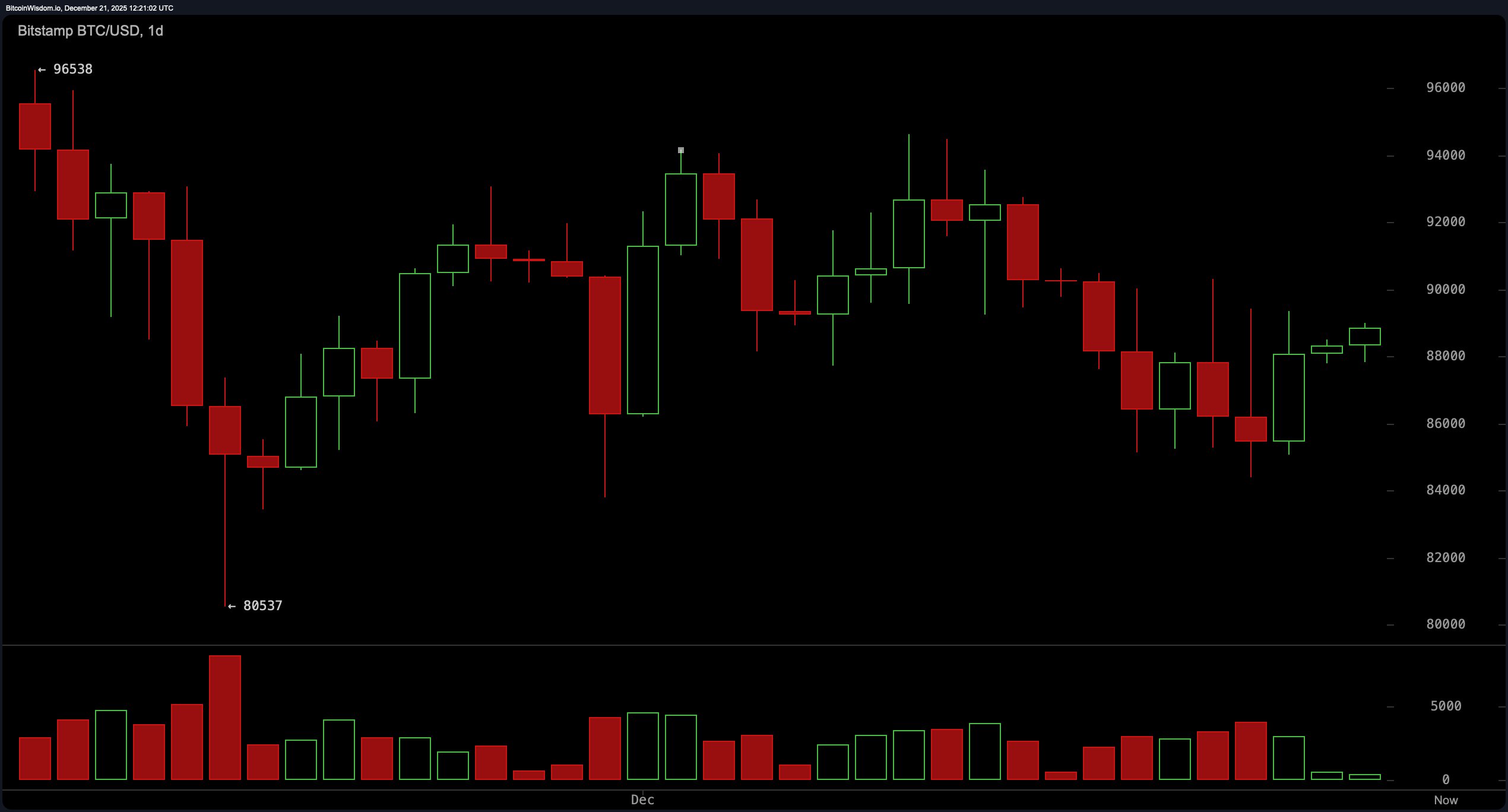

Bitcoin’s daily chart has apparently just gotten through a particularly dramatic existential crisis, plunging from a dizzying $96,538 to a still-sober $80,537. The price is coloring in the lines, trying to create higher lows like a valiant, terrified student. Now, it’s um… perched between $86,000 and $90,000, awkwardly eyeing the ceiling like a waiter eyeing a scandal.

The relative strength index (RSI) sits at 46, which, in trader-speak, means it’s about as enthusiastic as me on a Monday. Meanwhile, the moving average convergence divergence (MACD) level at -1,561 is slightly more optimistic – or is it just overly hopeful? The 10-period exponential moving average (EMA) and simple moving average (SMA) are being supportive couches – but the 20-, 30-, 50-, 100-, and 200-period variants? They’re aloof, hovering like strict butlers just above current levels, snobbishly forming a resistance phalanx that would make Sparta look like a yoga class. 🧘♀️

Narrowing to the 4-hour chart, Bitcoin’s short-term story reads like a self-help book with unresolved issues. After a rough-riding liquidation candle knocked it down to 84,398 from 90,317 on Dec. 18, it’s been inching forward with higher highs and higher lows. This more structured rebound, now testing the 88,500 to 90,000 supply zone, lacks the cover of strong volume, making it clear that while the price wants to rally, the conviction hasn’t bothered picking up nachos. The stochastic oscillator at 39 and the commodity channel index (CCI) at -47 are whispering cautious advice rather than full-throated shouts, leaving traders scrambling to interpret signals as if in some universally misunderstood modern art installation. 🎨

At the hourly level, bitcoin is clinging onto a cozy pattern, trading nervously between $88,000 and $89,000 like someone doing the tax audit shuffle. The awesome oscillator at -1,590 and momentum reading of -3,804 suggest it’s either catching its breath or nursing a serious bout of crypto fatigue. And with low volume, any breakout over $89,500 would need significant backup. Until then, this micro-range action might be the most exciting thing since watching DIY glue-drying tips on YouTube.

Structurally speaking, Bitcoin has a plot that somewhat resembles a bullish storyline but keeps forgetting the lines. The formation of higher lows is like getting a thumbs-up, and support at $86,000 is fortifying like a globe-trotting spa day-but the macro resistance at $90,000 looms like a nightclub velvet rope. Price wants to enter, yet the bouncer (volume) isn’t budging. If volume finally wakes up the party animals and the ceiling breaks, we could see a momentum shift that rivals a reality show finale. Until then, patience remains the order of the day.

Bottom line: bitcoin is engaged in a particularly delicate balancing act on Dec. 21. With mixed signals from oscillators and moving averages alike, and price consolidation that’s practically begging for confirmation, this is definitely not the moment for rash decisions. Instead, observe the charts, honor the ranges, and cling to that $90,000 mark like a suspicious great aunt with a juicy family secret. Because if that breaks convincingly, Bitcoin might have quite a sock puppet monologue lined up.

Bull Verdict:

If prices manage to do the high-five above $90,000 with strong volume in tow, the bullish case just upped its own game. With higher lows forming across all timeframes and short-term moving averages doing a cheerleading routine, Bitcoin might just be mustering up the energy for another upward charge. Breakout confirmation would see the bias tilt in favor of ongoing upsides-granted volume dares to break its vow of silence.

Bear Verdict:

If prices can’t shimmy above $90,000 – especially if they tumble below $85,000 with a convincing volume bump – it might just be a ‘dead-cat bounce’. Persistent resistance haunts those long-term moving averages like a bad sitcom punchline, and the momentum is drifting towards the ‘maybe’ column with neutral oscillator readings. A downward drag under $84,000 would officially cancel the comeback story and swing open the doors for a more extended correction.

FAQ 🧠

- What’s Bitcoin’s price doing today?

Bitcoin is chilling at $88,787 as of December 21, 2025. - Is Bitcoin likely to swoop past $90,000?

Only if volume decides to step up and not just drown in the noise. - What’s the VIP access – key support and resistance levels?

Support is lounging around $86,000, and resistance is hogging attention at $90,000. - Is now the time to trade Bitcoin?

Based on current chart readings, it’s advisable to wait for clearer trend confirmation – play it cool and avoid the hasty moves.

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- All 100 Substory Locations in Yakuza 0 Director’s Cut

2025-12-21 17:05