As a seasoned crypto investor with a decade of experience under my belt, I’ve learned to read between the lines when it comes to on-chain data like Bitcoin Active Addresses. The recent plunge to just 1 million active addresses is a cause for concern, especially considering the historical precedent set in July 2021 following China’s ban on BTC mining.

Recent on-chain data indicates a significant drop in the number of active Bitcoin addresses, suggesting possible changes in its price dynamics. Let’s explore the potential implications for the asset’s value.

Bitcoin 30-Day MA Active Addresses Now Down To Just 1 Million

According to a recent article by CryptoQuant’s Axel Adler Jr on X, the daily count of active Bitcoin addresses has been decreasing. This measurement tracks the overall number of unique addresses involved in any form of transactional activity on the Bitcoin network each day.

The unique number of active addresses may be considered the same as the unique number of users interacting with the network, so this indicator’s value can tell us about the amount of traffic that BTC is dealing with right now.

As the metric increases, it signifies an increase in the number of users on the network. This pattern indicates that the blockchain is currently gaining popularity. Conversely, when the indicator shows a decrease, it suggests that investor interest in the cryptocurrency could be waning, as fewer users are engaging in transactions.

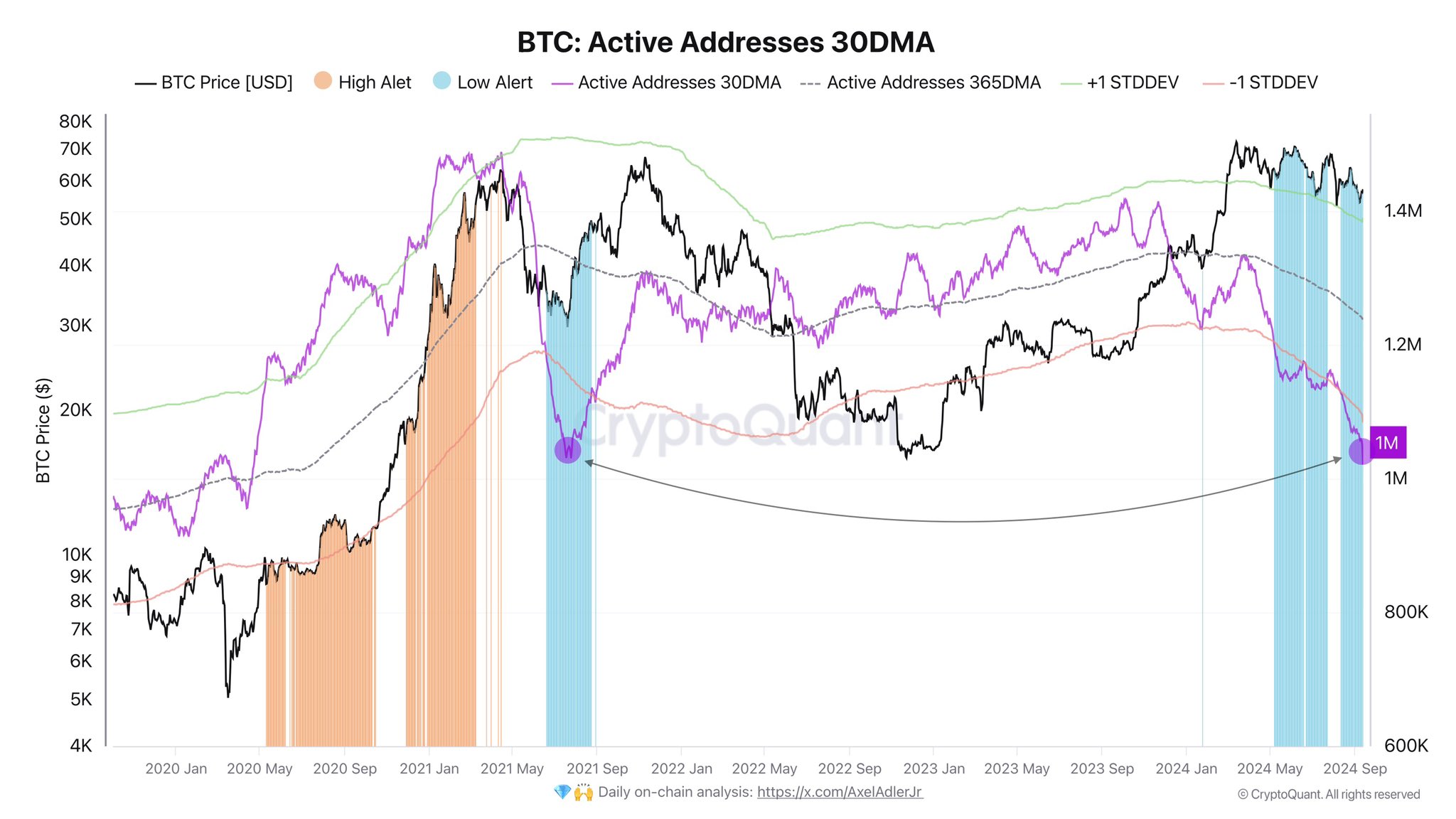

Here’s a graph displaying the progression of the 30-day and yearly moving averages (MAs) for the number of active Bitcoin addresses in recent years.

Over the past year, you can see in the graph that the 30-day Moving Average of Bitcoin Active Addresses has been on a downward trend. However, during the price surge towards the record high (ATH), the indicator briefly deviated from this decline. Once the asset’s price fell into consolidation, the indicator returned to its downward trajectory.

It’s no wonder that the initial price surges at the beginning of the year grabbed plenty of investor attention due to their thrilling nature. However, the subsequent price stability may have caused a rapid decline in investor enthusiasm, much like a fading interest in a less exciting event.

Following a reversal in the trend of the 30-day Moving Average (MA) of Active Addresses, the value dipped below the 365-day MA. Since that point, both lines have consistently remained in this inverse position.

This indicates that the recent monthly activity of Bitcoin has been less than the average for the last year. In reality, with its current value approximately 1 million, the 30-day moving average of Active Addresses is comparable to the level observed around July 2021.

In July 2021, a dip in performance occurred due to China’s prohibition of Bitcoin mining, causing a drop in its value. However, despite this initial downturn, the number of active addresses didn’t remain low for an extended period. The network quickly regained momentum, and the bull market spurred a second surge.

Historically, for any movement in Bitcoin to be sustainable, there needs to be an increase in active addresses. This is because new users coming into the system provide the momentum needed to continue these trends. Consequently, until the number of active addresses can recover, it’s unlikely that Bitcoin will experience another significant and prolonged rally at this time.

BTC Price

Earlier today, Bitcoin managed to rise above $58,000, yet it seems that the cryptocurrency has lost some ground and is currently being traded at $57,700.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- USD PHP PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- USD CLP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- CET PREDICTION. CET cryptocurrency

2024-09-13 08:12