As a seasoned analyst with years of experience navigating the volatile world of cryptocurrencies, I find the recent developments in the crypto market intriguing and somewhat predictable. The surge in Bitcoin ETF inflows last week is reminiscent of the market’s reaction to potential interest rate cuts – a dance we’ve seen many times before. Yet, the contrast between month-to-date outflows and year-to-date inflows serves as a stark reminder that the crypto market remains unpredictable, even for veterans like myself.

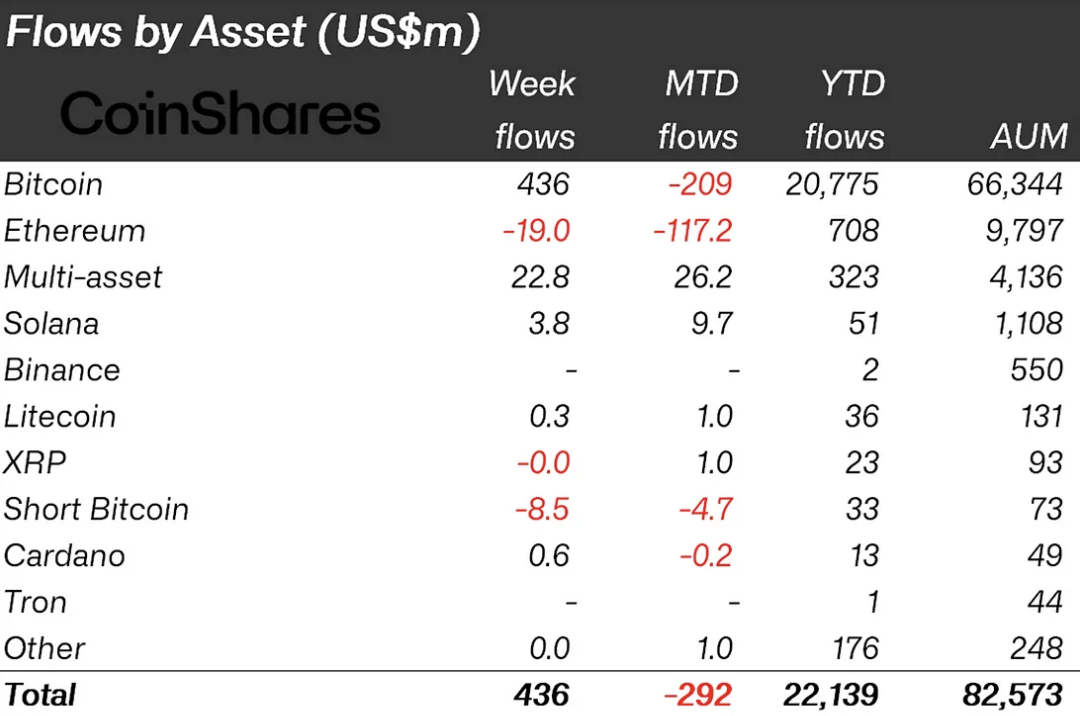

In its latest weekly report, CoinShares has revealed an incredible change in the flow of funds into crypto exchange-traded products, with Bitcoin (BTC) seeing a massive $436 million in ETF inflows last week. This surge came after a period marked by $1.2 billion in outflows over the previous 10 days.

According to analyst James Butterfill’s explanation, the significant increase in inflows primarily stems from a shift in market perception regarding the likelihood of a 50 basis point interest rate reduction scheduled for September 18th.

Although it has experienced a recent improvement, Bitcoin’s monthly statistics indicate a significant outflow of approximately $209 million, quite different from its yearly figures that have soared to an astonishing $20.775 billion in inflows.

What’s more?

Meanwhile, it is worth noting that short-Bitcoin vehicles saw an outflow of $8.5 million, after three weeks of inflows. Ethereum is facing its own set of challenges and saw $19 million in outflows, with still $708 million year-to-date inflows.

Conversely, Solana demonstrated resilience, accumulating approximately $3.8 million in a fourth consecutive week of investments flowing in.

Blockchain-focused vehicles have experienced a favorable change, receiving approximately $105 million through the introduction and growth of various new ETFs on the American stock market.

Matt Hougan, as the Chief Investment Officer at Bitwise, has expressed interest in introducing Exchange-Traded Funds (ETFs) focusing on meme cryptocurrencies. This could potentially make it easier for investors to invest in digital assets such as Shiba Inu (SHIB) or Dogecoin (DOGE), expanding the investment options available to them.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- WIF PREDICTION. WIF cryptocurrency

- BRISE PREDICTION. BRISE cryptocurrency

- VINU PREDICTION. VINU cryptocurrency

- EUR NZD PREDICTION

2024-09-16 18:16