As a seasoned researcher with years of experience tracking the cryptocurrency markets, I’ve seen my fair share of volatility and market swings—more than a few rollercoaster rides, if I may say so myself! The recent 4% retracement in Bitcoin following its strong surge is just another chapter in this ongoing saga.

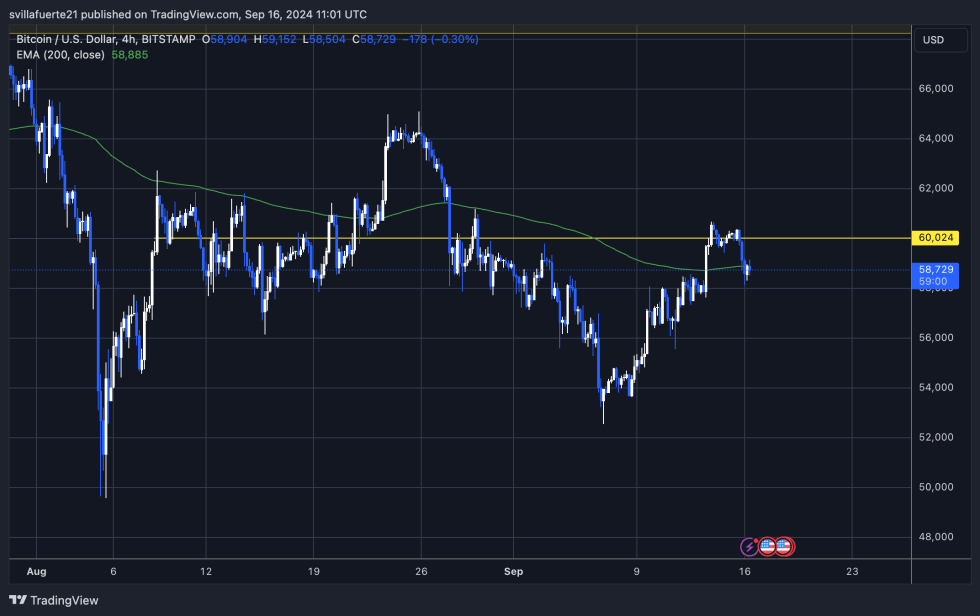

Over the past few days, Bitcoin has experienced a 4% decline, coming after a powerful 15% rise from its previous lows. Even with this positive trend, the market remains unpredictable and volatile because Bitcoin is currently trading below the significant $60,000 threshold – a level that often signifies potential direction changes.

As a researcher, I’m keeping a keen eye on the Bitcoin market to determine whether it will gather momentum and surpass this significant resistance level, or if it will face temporary challenges in the near future.

Despite some initial setbacks, there’s evidence of a comeback, as Coinbase data suggests Bitcoin is back to trading above its actual value, which points to high demand. Furthermore, data from Coinglass hints at crucial liquidity thresholds that Bitcoin might aim for in the near future.

The current circumstances seem to indicate that Bitcoin has reached a crucial juncture, where its short-term movements could significantly shape the market trend during the upcoming months. Everyone from traders to investors is preparing themselves for Bitcoin’s significant price shift in the near future.

Bitcoin Consolidation Could Be Over: $70,000 Next?

Over the last several weeks, Bitcoin has experienced growth, instilling confidence and optimism within investors who were preparing for a more significant downturn. Latest market trends suggest a change towards more favorable sentiments.

Daan, the analyst, pointed out on X that Bitcoin has been selling at a higher price on Coinbase. This suggests increased demand for spots from U.S. investors and potential interest from ETFs. Usually, this premium indicates bullish sentiment, showing increased buying activity and optimism about Bitcoin’s future.

As a researcher, I’ve observed that substantial price reductions on trading platforms, which are frequently spotted near market lows, might indicate a pessimistic outlook among traders. Yet, these discounted prices can serve as attractive investment opportunities for those who are keen and knowledgeable enough to seize them.

In addition to this, Coinglass has shared essential statistics about Bitcoin’s liquidity, revealing that on August 5th, a significant pool of liquidity below $50,000 was taken up during the sell-off on Binance‘s BTC/USDT market. This action eliminated crucial support levels, reducing the number of substantial liquidity clusters nearby.

Significant amounts of liquidity can currently be found near the $47,000 price point and below, while there is growing curiosity or demand evident above $70,000.

These findings imply that although Bitcoin might encounter obstacles with possible support and resistance levels, the present market trends seem to lean towards a more optimistic perspective.

In simpler terms, there’s not much buying or selling activity happening around the current Bitcoin price on major exchanges like Coinbase, and a higher price tag is being asked for it. This might suggest that Bitcoin could keep rising if it continues to perform well and gather more support.

BTC Technical Analysis: Key Levels To Watch

Currently, Bitcoin is being traded for approximately $58,593, representing a 4% decrease from its highest point last week, which was $60,670. The digital currency encounters hurdles in keeping its value above the significant 4-hour 200 exponential moving average (EMA) of $58,883. This level, which Bitcoin reclaimed last Friday, indicates a short-term display of power.

In simple terms, this Economic Moving Average (EMA) has been acting as a strong barrier for Bitcoin (BTC) prices since early August. If the BTC price manages to stay above this EMA, it could potentially transform into a new level of support.

To maintain a positive perspective on Bitcoin’s future, it needs to regain and sustain its position above the 4-hour 200 Exponential Moving Average (EMA) and the $60,000 price point. These thresholds are crucial in determining the market’s overall mood. If it doesn’t manage to rise above the 4-hour 200 EMA, there might be a test of the next potential support zone around $57,500, which offers a more robust foundation.

If the adjustment continues, Bitcoin might encounter possible dips down to $55,500. This significant drop could challenge lower support thresholds and suggest tougher market conditions that may lie ahead. Maintaining above these crucial levels will be vital in predicting Bitcoin’s near-term trend and market equilibrium.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD PHP PREDICTION

- WIF PREDICTION. WIF cryptocurrency

- USD COP PREDICTION

- EUR CLP PREDICTION

- MDT PREDICTION. MDT cryptocurrency

- LOVELY PREDICTION. LOVELY cryptocurrency

2024-09-17 00:42