As a seasoned researcher with a decade-long obsession with the cryptocurrency market, I find myself constantly intrigued by the dynamics of Bitcoin supply. The recent plunge in the short-term holder (STH) supply is a fascinating development that harks back to 2012, a time when Bitcoin was still finding its footing in the world.

Recent on-chain data indicates that the amount of Bitcoin being held by short-term investors is decreasing at its quickest monthly pace since 2012.

Bitcoin Short-Term Holder Supply Plunges As Investors HODL

According to a recent article by Axel Adler Jr on X, the amount of cryptocurrency held by short-term investors has significantly decreased over the past 30 days, moving into negative territory.

The individuals who have purchased Bitcoin within the last 155 days are referred to as “short-term investors” or simply “short-term holders” (STHs). Alongside them, there is another significant category in the Bitcoin market, which is made up of those who have held their coins for longer periods. This group is often called “long-term investors” or “long-term holders” (LTHs), and they are distinguished by their holding duration compared to STHs.

Investors who hold onto their assets for a prolonged period tend to become less inclined to sell them over time. In this context, Short-Term Holders (STHs) might be viewed as the impulsive or flexible part of the market, while Long-Term Holders (LTHs) could be seen as the persistent or steadfast group.

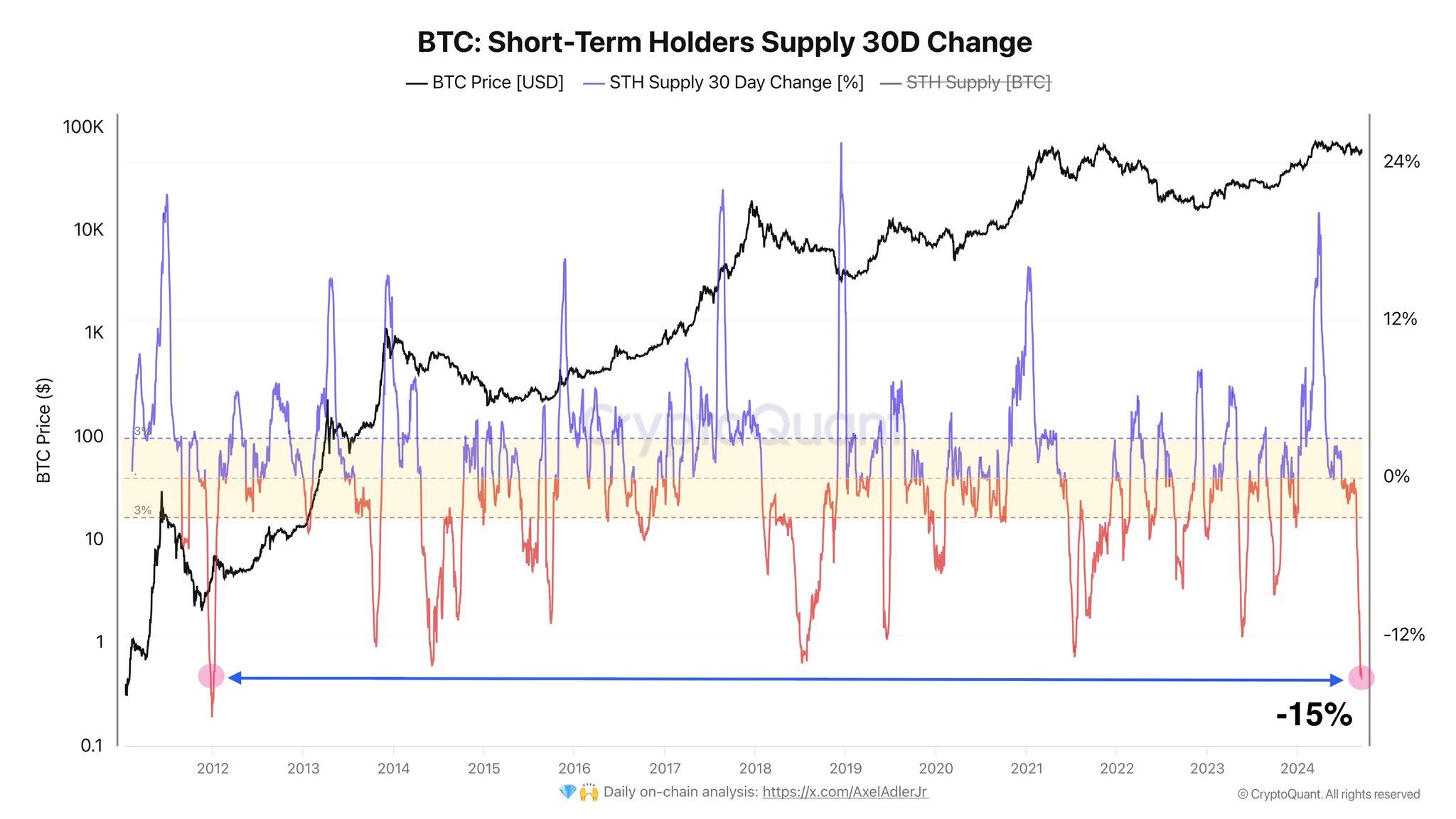

One method for monitoring the activities of these groups is by examining the current quantity of Bitcoins stored in their digital wallets. Here’s a chart provided by the analyst, displaying the 30-day variation in Bitcoin supply that is particularly controlled by the large-scale holders (STHs).

Earlier in the year, the increase over 30 days in the Bitcoin’s Stock to Flow (STH) Supply showed a significant upward surge, coinciding with the rally that led to a fresh record high (new all-time peak).

It appears there was a significant shift in supply from Large Token Holders (LTHs) to Small Token Holders (STHs), which isn’t uncommon during a bull market. In fact, it’s typical behavior for Large Token Holders to cash in some of their holdings when the asset price reaches record highs, as they have done so historically.

During rallies, these diamond hand sellers find their transactions being taken up by the fresh demand that enters the market, stirred by the excitement of the market surge.

After reaching a consolidation point, it seems Large Token Holders (LTHs) have slowed down their selling activity. Moreover, there’s a noticeable shift in trend, with Small Token Holders (STHs) increasing their accumulation, as evidenced by the 30-day change of STH supply dipping into negative territory.

For approximately a month now, there’s been a 15% reduction in STH supply, which marks the most significant decrease over a 30-day period since the cryptocurrency was just starting out in 2012 – back when it was still relatively new.

Indeed, what this implies is an increase in the Long-Term Holder (LTH) token supply, a point worth noting. However, it’s essential to clarify that such a trend doesn’t necessarily mean that the LTHs are purchasing these tokens from Short-Term Holders (STHs). Instead, they could be receiving them through various means like rewards, staking, or other activities within the cryptocurrency ecosystem.

Instead, we observe that the STHs (Significant Token Holders) are moving into their designated group, having surpassed the 155-day threshold. This suggests that these investors have remained patient during this phase of consolidation. The increased tendency to HODL (Hold On for Dear Life) among them could potentially be a favorable indicator for Bitcoin’s future growth.

BTC Price

At the time of writing, Bitcoin is floating around $59,500, up around 5% over the last seven days.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD CLP PREDICTION

- RIDE PREDICTION. RIDE cryptocurrency

- SBR PREDICTION. SBR cryptocurrency

- PLI PREDICTION. PLI cryptocurrency

2024-09-19 16:12