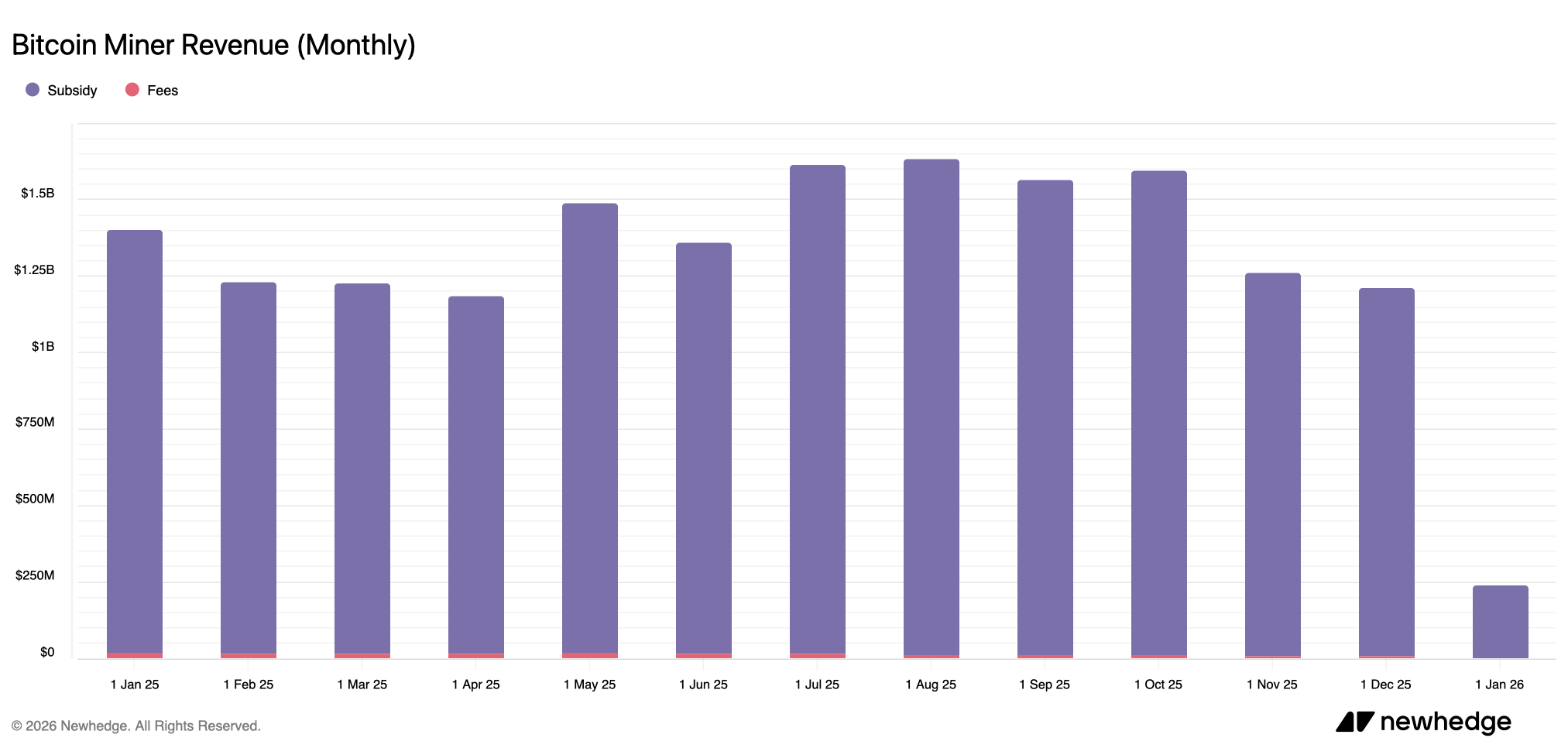

In the waning days of the year 2025, as the world prepared to bid adieu to its trials and tribulations, the bitcoin miners found themselves in a predicament most dire. Their coffers, once brimming with the fruits of their labor, now echoed with the hollow clatter of meager proceeds. November, a month of lackluster returns, was but a prelude to December’s even more slender harvest, with revenues scarcely reaching $1.21 billion-a sum that, in the grand tapestry of the year, stood as the second-most paltry.

December’s Cruel Jest Upon the Miners of Bitcoin, Yet a Glimmer of Dawn Looms

As the year drew to its close, the miners, those stalwart sentinels of the blockchain, found themselves beset by circumstances most unforgiving. Though the dawn of 2026 brought whispers of improvement, December’s tally remained a testament to their struggles, second only to April’s meager $1.18 billion, as chronicled by the sages at newhedge.io. November, with its $1.26 million, had offered little solace, and December’s figure, a mere 4.13% lower, was but a bitter jest played upon their endeavors.

On the 18th of December, the hashprice, that elusive measure of their toil, reached its nadir, sinking to $36.25 per petahash per second-a level so low, it stirred murmurs of despair among even the most hardened of miners. 🌪️

Yet, amidst this gloom, the network’s hashrate stood firm, a beacon of resilience, surpassing 1,000 exahash per second (or 1 zettahash, if you prefer grandeur). As January’s first week unfolded, it climbed to 1,046 EH/s, a testament to the miners’ unyielding spirit. A new difficulty epoch, mere days away, promised a modicum of relief, though the block times, stretching to 10 minutes and 8 seconds, hinted at a world not yet ready to yield its treasures. 🕰️

The difficulty, it is said, may ease by 1.4%, a small mercy in a sea of challenges. Yet, this is no grand reset, but a mere adjustment, a sigh of mechanical relief. The hashrate, strong and steady, and the block times, though lengthened, are but reflections of a revenue stream that trickles rather than flows. The hashprice, now at $40.26 per PH/s, offers a glimmer of hope, a 11% ascent from its December low. 🌱

Yet, the miners, ever dependent on the whims of the market, find themselves at the mercy of BTC‘s price. Onchain fees, a mere whisper at less than 1% of the block reward, offer little solace. Their fate, it seems, is tied to the rise and fall of bitcoin’s value, a dance as old as the blockchain itself. 💃

If the stars align, and BTC’s price ascends, early 2026 may yet offer firmer ground. Until then, the miners’ lot is one of efficiency, endurance, and patience-virtues tested in the crucible of uncertainty. 🛠️

FAQ ⛏️

- Why did the bitcoin miners toil in vain in December 2025?

Revenue, a mere $1.21 billion, was stifled by a hashprice that plunged to depths unseen in years, while transaction fees remained but a pittance. 🤑 - What glimmer of hope emerged for the miners as 2026 dawned?

The hashprice, rebounding by 11% from its December low, and the network’s hashrate, steadfast and strong, hinted at better days ahead. 🌅 - How did the bitcoin network endure despite the miners’ plight?

The hashrate, ever above 1 zettahash per second, stood as a testament to the miners’ unwavering dedication, even in the face of adversity. 💪 - Upon what do the miners pin their hopes for 2026?

Their fortunes remain tied to BTC’s price, for onchain fees, a mere fraction of the block reward, offer little more than a whisper of relief. 🎢

Read More

- One Piece: Oda Confirms The Next Strongest Pirate In History After Joy Boy And Davy Jones

- Sword Slasher Loot Codes for Roblox

- The Winter Floating Festival Event Puzzles In DDV

- Faith Incremental Roblox Codes

- Toby Fox Comments on Deltarune Chapter 5 Release Date

- Japan’s 10 Best Manga Series of 2025, Ranked

- Non-RPG Open-World Games That Feel Like RPGs

- Jujutsu Kaisen: Yuta and Maki’s Ending, Explained

- Insider Gaming’s Game of the Year 2025

- ETH PREDICTION. ETH cryptocurrency

2026-01-06 20:38