As a seasoned analyst with over two decades of experience in traditional finance and cryptocurrency markets under my belt, I find Rekt Capital’s analysis to be intriguing yet plausible. His approach is rooted in historical trends and key market cycles, which aligns well with my belief that the past can often serve as a guide for the future.

In the midst of heated debates among crypto enthusiasts regarding Bitcoin‘s impending cycle high, an industry analyst shares valuable perspectives and estimates a possible timeframe when the leading digital currency might hit its highest price point within the current market cycle.

The Next Cycle Top For Bitcoin Set To Occur In 2025

As a crypto investor myself, I’ve been closely following the insights of Rekt Capital, a renowned cryptocurrency expert and trader. He recently shared his bold prediction on a popular platform (formerly Twitter), outlining a particular timeline for Bitcoin’s next cycle top. His analysis indicates that we might witness a significant Bitcoin rally in the near future.

According to Rekt Capital’s analysis, it’s possible that the peak of the next Bitcoin (BTC) cycle might occur in the coming year. This prediction is based on historical patterns and significant market cycles, focusing particularly on the Bitcoin Halving event. Remarkably, this pattern seems to align consistently with past bull runs.

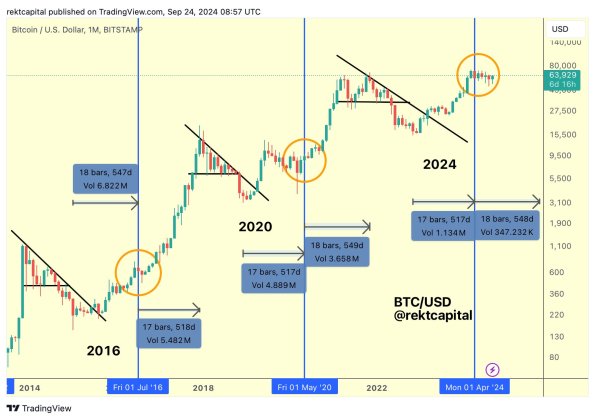

As reported by a market analyst, prior to the Bitcoin Halving in 2016, it had reached its lowest point approximately 547 days earlier and peaked around 518 days later during its bull run. Similarly, the price of BTC peaked in its latest bull market about 549 days after the Halving event in 2020, having dropped to a low point approximately 517 days prior.

Before the April 2024 Halving, Bitcoin’s price had reached its lowest point after a stretch of 517 days. This has led Rekt Capital to believe that the crypto asset could reach its maximum value within about 549 days following the Halving, which would put the cycle top around October 2025. Given these repeating patterns, the analyst has highlighted two crucial insights for investors and traders as they prepare for potential substantial price fluctuations leading up to the peak of the cycle.

According to Rekt Capital, the Bitcoin Halving reflects a pattern similar to a mirror. This is due to the fact that Bitcoin’s Bear Market bottoms tend to occur approximately the same number of days before the halving as it takes for the digital asset to reach its Bull Market peaks following the halving. Furthermore, they predict that the peak of the Bitcoin bull market has yet to be reached.

BTC Is About To Enter The Parabolic Upside Phase

It’s important to mention that Bitcoin (BTC) might be approaching a cycle peak, according to an analyst’s prediction. As the market sentiment could change imminently, Rekt Capital has observed from analyzing BTC’s current price movements that there are indications suggesting the asset may transition from its Reaccumulation phase into its Parabolic Upside phase within the next week or so, based on historical trends.

Previously, around 154 to 161 days post-Halving, Bitcoin surpassed its Period of Reaccumulation. Since the current cycle has seen it lingering in this phase for approximately 157 days following the event, an expert predicts a breakthrough in the coming days.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- USD PHP PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- USD CLP PREDICTION

- NAKA PREDICTION. NAKA cryptocurrency

- CKB PREDICTION. CKB cryptocurrency

2024-09-25 12:41