As a seasoned researcher with years of experience tracking cryptocurrency market trends, I must admit that the recent large-scale Bitcoin transfers have piqued my interest. The $1 billion transfer from unknown wallets to brand new ones, particularly the possible connection to Fidelity Custody, is intriguing and somewhat reminiscent of a high-stakes game of chess being played in the digital world.

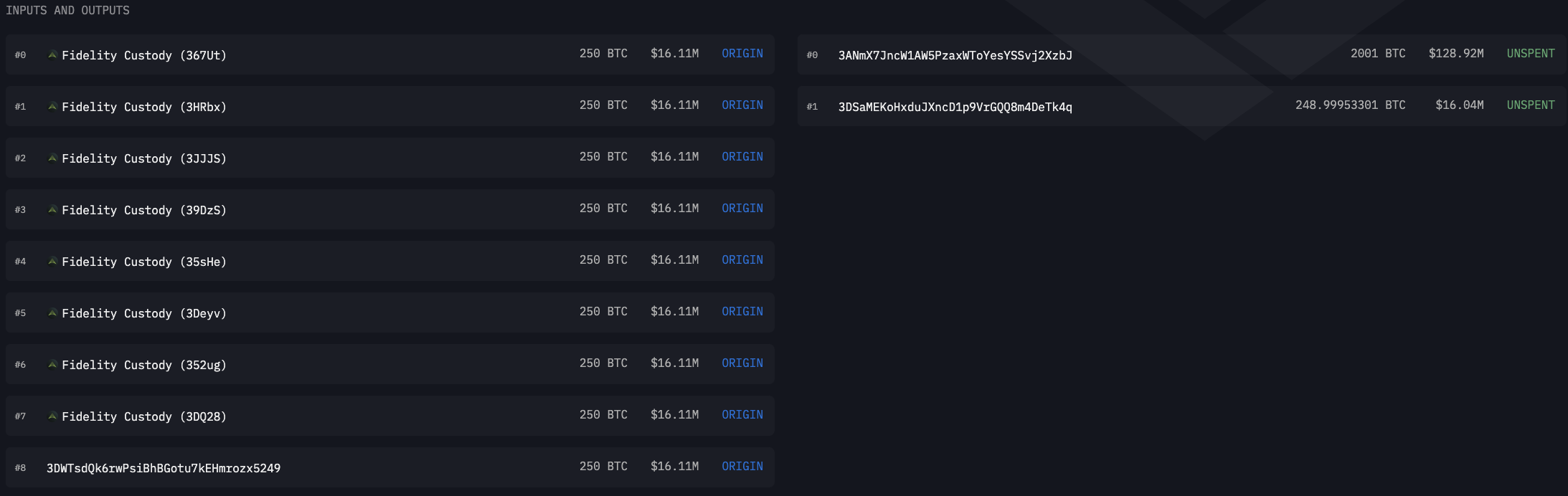

Large, mysterious transactions of Bitcoin (BTC) have been spotted recently, moving from one anonymous wallet to another. The most recent instance of this unusual activity involved the transfer of approximately $1 billion in Bitcoin from multiple unknown sources to newly created wallets, with each batch containing exactly 2,000 BTC.

The connection or intent of this remains unclear, along with the identities concealed by those email addresses.

However, one of the clues that has surfaced is that, thanks to data from Arkham Intelligence, one of the sender addresses may belong to Fidelity Custody, a crypto custodian for one of the largest hedge funds in the world with approximately $5.4 trillion in assets under management.

This year, Fidelity added its own spot Bitcoin ETF, FBTC, to its asset-heavy portfolio.

Fidelity and Bitcoin

According to the available data, the crypto asset custodian now holds approximately 287,153 Bitcoin valued at around $18.35 billion and 287,064 Ethereum worth roughly $753.91 million. It’s crucial to note that these funds encompass MicroStrategy, Fidelity’s Bitcoin ETF (FBTC), and Fidelity’s Ethereum ETF (FETH), all of which are clients of this custodian.

Is this a reorganization within their system for managing their digital wallets, or could there be additional factors involved?

It’s still up for debate, and it’s important to keep an open mind. Lately, there’s been a trend of more funds flowing into FBTC than being withdrawn.

It seems that a significant transfer of $1 billion in Bitcoin between accounts could signal an upcoming duration of increased investment in Bitcoin ETFs. This, in turn, might indicate a continued demand for cryptocurrency, a development that typically benefits the price of BTC. Currently, BTC’s price stands at 16.5% of its all-time high, suggesting it’s poised for potential growth due to this demand.

Read More

- USD ZAR PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- CKB PREDICTION. CKB cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- EUR ILS PREDICTION

- TAO PREDICTION. TAO cryptocurrency

- ANKR PREDICTION. ANKR cryptocurrency

- HUDI PREDICTION. HUDI cryptocurrency

- Best JRPGs That Focus On Monster Hunting

2024-09-25 13:54