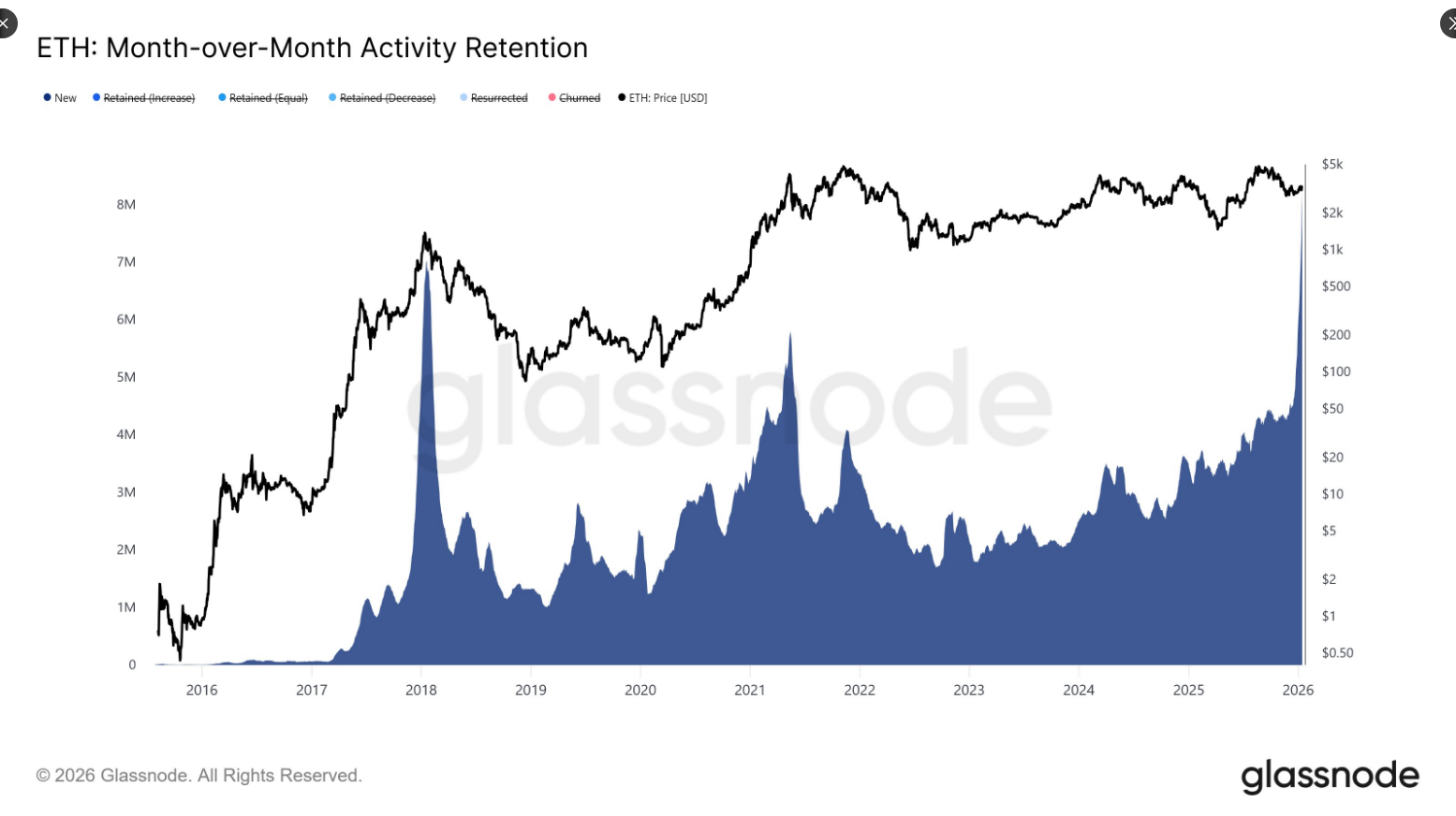

In the vast theater of human aspiration, where coins glitter like fallen stars and men measure time by the tick of a blockchain, Ethereum‘s activity rises as if summoned by a distant conscience. The ledger grows heavy with the footsteps of novices, and the old patrons blink at the bright spectacle of faces newly drawn into its circle. Glassnode whispers that the flame of new activity has not merely flickered but doubled, from about four million addresses to eight million, as if a fresh company has entered the world and, with it, a chorus of questions about fortune and fate. And yet one must smile at the absurdity: many come to dance with numbers, not knowing that numbers, like knives, can open doors and wounds alike. 😏

Surge In New Users

On a single day, the drumbeat of transactions rose to 2.8 million, a record that speaks not only of volume but of the thrumming hunger of a crowd seeking something beyond the common purse. This surge, a spectacle of appetite, is reported to be up about 125% from the same period last year. Etherscan confirms that active addresses have more than doubled, from roughly 410,000 to over a million by January 15, signaling more than a fleeting fancy; it signals a habit, perhaps even a belief, that this ledger might bear witness to more than dry arithmetic. The people arrive, and one cannot help but wonder what they seek among the digits-bread, glory, or a new creed for their coins. 😂

Ethereum’s Month-over-Month Activity Retention shows a sharp spike in the “New” cohort, indicating a surge in first-time interacting addresses over the past 30 days. This reflects a notable influx of new wallets engaging with the Ethereum network, rather than activity being…

– glassnode (@glassnode) January 15, 2026

Transaction Boom And L2 Effects

Some observers, with the patience of old monks and the sway of merchants who know a coin when they see one, attribute this growth to a rising tide of stablecoins and a gentler hand at the gas pump. They note that many transfers migrate execution to Layer 2 networks while settlement remains on Ethereum’s main stage, preserving finality and, one might add wryly, saving the purse from a torch of fees. Staking ascends as well, nearing 36 million ETH, weaving yet another strand into the intricate web of supply and desire.

Meanwhile, the market moves with the cautious grace of a winter parade. The sturdy march of US equities steadies crypto prices, but inflows to Ethereum appear deliberate rather than a reckless carnival. A prudent comedy persists: actors await the right cue, for in this theatre, timing is everything, and bravura is often a mask for fear. 😅

Positioning is restrained; traders prefer the sober arithmetic of ranges to the fevered prophecy of breakouts. ETH wallets remain in a quiet room, not shouting, while the clock ticks toward potential momentum that may or may not arrive.

Analyst Views & Price Movement

There are voices that see virtue in the ascent of on-chain fundamentals. LVRG Research notes that the rising cadence of transactions and staking encourages a halo of optimism about the network’s health. Yet other observers remind us that compressions in price action are not the heralds of a grand ascent but the quiet, patient work of repair before any true renewal. Ether had flirted with a two-month high near 3,400 dollars on a midweek, and hovered around 3,300 in early trading on Friday, a tug-of-war between renewed demand and enduring caution.

Even with numbers that glimmer, the path forward remains strewn with challenges. Some declare the market in a repair phase rather than a triumphal march, while overhead resistance-such as the 200-day EMA-casts a long shadow over enthusiasm. Many participants, prudent in their mischief, await a reclaim of those long-term gates before pouring capital with abandon.

Thus the short-term players move within a defined circle, while the longer-term souls hold back, awaiting clearer signs that the dawn is truly breaking. 🔒

What This Means For Traders And Investors

The health of the network has improved in measurable ways-more users, more transactions, more staking. Yet price action has not kept pace with these triumphs, a comic tragedy of cause and effect. Based on the tale the data tells, a cautious optimism is reasonable. Traders may find the chance to trade within a range, while investors seeking conviction would do well to wait for cleaner, more persuasive technical confirmations before pledging their fortunes to a sustained rally. 🤹

Read More

- The Winter Floating Festival Event Puzzles In DDV

- Jujutsu Kaisen Modulo Chapter 18 Preview: Rika And Tsurugi’s Full Power

- Upload Labs: Beginner Tips & Tricks

- Top 8 UFC 5 Perks Every Fighter Should Use

- Best Video Game Masterpieces Of The 2000s

- How to Unlock the Mines in Cookie Run: Kingdom

- How To Load & Use The Prototype In Pathologic 3

- How to Increase Corrosion Resistance in StarRupture

- USD COP PREDICTION

- Jujutsu: Zero Codes (December 2025)

2026-01-16 14:30