As a seasoned crypto investor who has weathered numerous market cycles and seen Bitcoin rise from its humble beginnings, I find it intriguing to see the latest surge being potentially linked to the Bitcoin Coinbase Premium Index. Having closely monitored this indicator for years, I can attest that it often provides a glimpse into the behavior of US-based investors, a crucial segment in our volatile market.

The data indicates that the Bitcoin Coinbase Premium Index has experienced a significant increase lately, hinting that this rise might partly explain the recent upsurge in its price.

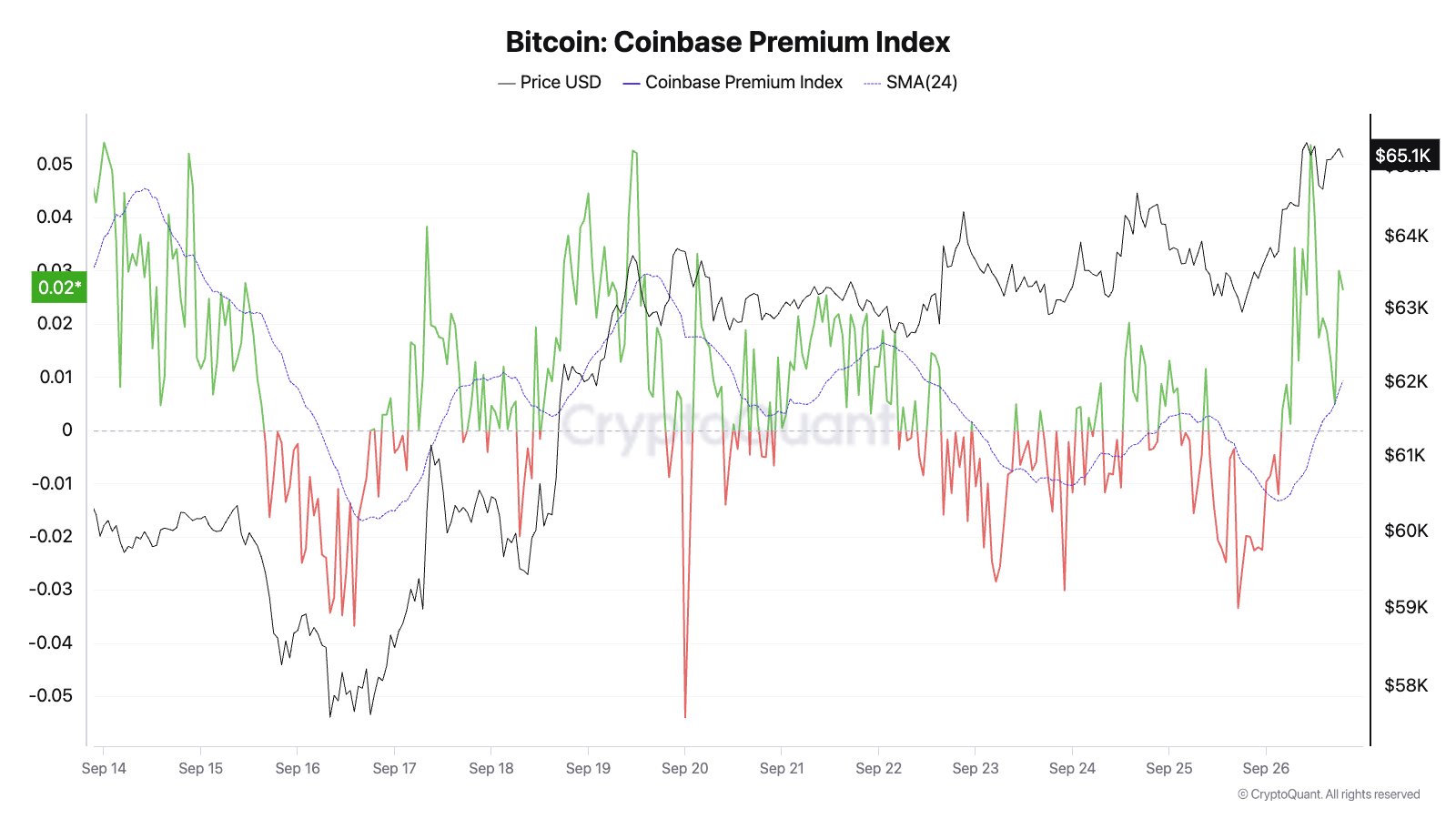

Bitcoin Coinbase Premium Index Has Now Assumed Notable Positive Values

According to a recent post by Julio Moreno, Head of Research at CryptoQuant, the Bitcoin Coinbase Premium Index has moved into positive territory. This index monitors the percentage gap between the price of Bitcoin traded on Coinbase (against USD) and that traded on Binance (versus USDT).

If this metric has a positive value, it’s indicating that the asset is currently priced higher on Coinbase than Binance. This pattern might be suggesting that Coinbase is experiencing more buying activity or less selling activity compared to Binance. Conversely, if the indicator is below zero, it shows that Coinbase users are selling more of the asset relative to Binance users right now.

Currently, I’d like to draw your attention to the graph provided by Moreno, which outlines the recent fluctuations in the Bitcoin Coinbase Premium Index over the past fortnight.

Observing the graph before me, I noticed that the Bitcoin Coinbase Premium Index had plunged into negative zones earlier. However, with the recent spike in Bitcoin’s price, there has been a significant uptick, propelling it back into the positive territory once more. This could suggest that investors on Coinbase have been actively buying and holding, potentially contributing to Bitcoin’s upward trend.

Coinbase primarily caters to U.S.-based investors, particularly large institutions, whereas Binance attracts a worldwide audience. Consequently, the Coinbase Premium Index signifies the distinct investment patterns observed between American investors and those from other parts of the globe.

So far in 2024, the cryptocurrency’s movements seem to align with this specific indicator, suggesting that major U.S. investors (often referred to as “whales”) have been influencing price fluctuations. Consequently, it’s reasonable to anticipate a similar trend persisting during the upcoming rally.

Currently, the Coinbase Premium Index is rising, but it’s crucial to monitor its movements closely because its worth could potentially change rapidly. If this happens, Bitcoin may also encounter turbulent weather, as it has experienced several bearish periods throughout the year so far.

Elsewhere, Bitcoin is getting close to the average purchase price of the last group of short-term investors, a topic that has been addressed by Axel Adler Jr in his recent Reddit post.

In simpler terms, if the price of Bitcoin rises above the current average purchase price ($66,300) for those who bought it between three to six months ago, all short-term investors (those who purchased within the past six months) will once again see a profit.

BTC Price

At the time of writing, Bitcoin is trading around $65,700, up more than 3% over the past week.

Read More

- USD ZAR PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- CKB PREDICTION. CKB cryptocurrency

- EUR ILS PREDICTION

- SEILOR PREDICTION. SEILOR cryptocurrency

- EUR RUB PREDICTION

- OOKI PREDICTION. OOKI cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- PRIME PREDICTION. PRIME cryptocurrency

- BLACK PREDICTION. BLACK cryptocurrency

2024-09-28 08:11