As a seasoned crypto investor with battle scars from past market corrections and a few triumphant victories under my belt, I can’t help but feel cautiously optimistic about Bitcoin’s recent performance. The supply squeeze as demand continues to rise is reminiscent of a well-stocked store during a sale, where everyone wants a piece of the action.

For approximately two weeks now, Bitcoin has maintained a level above $60,000, demonstrating robust resilience amidst a wider surge in the cryptocurrency market. This consistent strength is igniting hope in both traders and investors.

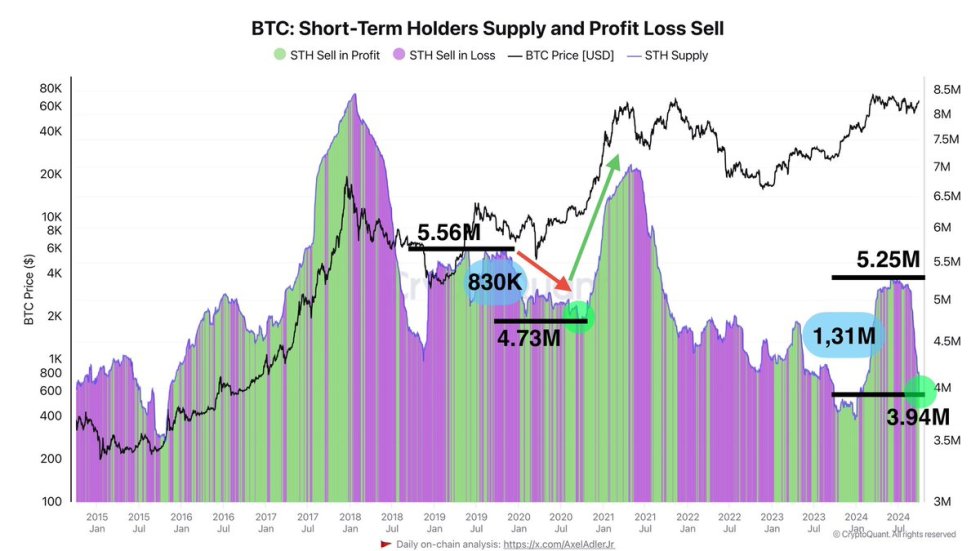

Based on statistics from CryptoQuant, it appears that short-term investors are currently cashing out their Bitcoin profits. This has resulted in a significant drop in the circulating Bitcoin supply. The reduced availability of Bitcoin could indicate an impending supply shortage as demand persists, particularly after the recent reductions in interest rates by the Federal Reserve.

According to leading experts and financial backers, this development is seen as a favorable indication. Many of them think that Bitcoin might be preparing for another significant price increase. With the desire for Bitcoin exceeding its availability, traders are growing more optimistic about a potential rise in BTC values within the near future.

Nevertheless, an important benchmark lies at $70,000. Overcoming this barrier could signal the continuation of Bitcoin’s rising trend. Until that happens, investors keep a close eye on the price action, looking for indications of a prolonged surge above this level.

Bitcoin Supply Suggests A Coming Rally

The price of Bitcoin has recently surged significantly, causing both enthusiasm and apprehension among investors. Some interpret this as the beginning of a new upward trend, while others worry it might be a deceptive move leading to a sudden drop in value. A notable analyst in the field, Axel Adler, has contributed to the discussion by publishing an enlightening analysis on topic X.

As an analyst, I’ve noticed Adler’s observation that short-term holders (STHs) are cashing in their profits, as evidenced by the green circle on his chart. However, contrary to this selling activity, the reduction of 1.31 million BTC in STH supply points towards a potentially optimistic perspective.

A smaller number of Bitcoins are being actively traded between investors (STHs), indicating an increase in trading frequency. This decrease in circulation, coupled with a rise in investors choosing to ‘hold on for dear life’ (HODL), suggests growing faith in Bitcoin’s future value and long-term prospects.

According to a chart Adler provided, it displays Bitcoin’s Stored-to-Hodl (STH) supply along with Profit/Loss/Sell metrics. At present, the STH supply of Bitcoin is approximately 3.94 million, which is notably lower than the 5.25 million recorded in April.

A reduced availability suggests that there are fewer short-term traders actively trading Bitcoin, which in turn fortifies its value. There’s growing confidence among investors that this decline in supply will lead to escalating prices over the next few weeks, further supporting the notion that Bitcoin might be on the brink of a fresh surge in price.

BTC Technical Analysis: Key Levels To Watch

Currently, Bitcoin stands at approximately $63,617 following a 4% decrease, which brings it close to the daily moving average (MA) of around $63,719. This significant level is important for Bitcoin (BTC), as its price has found it challenging to stay above this marker since early August. Maintaining this level will be vital for bulls to sustain their upward trend and avoid potential additional risks going downward.

Should the price drop by half above the 200-day moving average, it might indicate restored vigor, enabling Bitcoin to retake the $65,000 region. Such an event could pave the way for a more powerful advance toward higher volume zones and possibly initiate a fresh bullish trend.

If Bitcoin can’t maintain its position above this significant support, it might lead to a more substantial decline. Not being able to finish above the one-day 200 Moving Average hints at an impending dip towards demand areas around $60,500, a crucial support area that has been relevant in past corrections. The coming days are vital for Bitcoin as they could shape its near future price trends, and many market participants are keeping a close eye on this level.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD PHP PREDICTION

- USD ZAR PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- USD CLP PREDICTION

- MOVR PREDICTION. MOVR cryptocurrency

- RDNT PREDICTION. RDNT cryptocurrency

2024-09-30 19:12