Bitcoin, that capricious child of modern finance, had once again descended below the lofty heights of $90,000, as though burdened by the collective sighs of traders who had placed too much faith in its fickle nature. The market, much like a hesitant lover, wavered between fear and greed, unwilling to commit to either despair or hope. Buyers, their resolve weakened by repeated failures, hesitated like soldiers unsure of their commander’s orders, while sellers, ever vigilant, pounced upon every fleeting rebound with the precision of wolves circling wounded prey.

Darkfost, a man whose name carried the weight of whispered prophecies in dimly lit trading forums, declared that the on-chain signals now mirrored the solemn stillness of a battlefield after the last shot had been fired. His charts, dense with the hieroglyphics of unrealized profits and losses, whispered of a reckoning-one that had historically arrived only when the market had exhausted itself in the throes of despair. The numbers, cold and unfeeling, suggested a quiet tension beneath the surface, a pressure building like steam beneath the lid of a neglected samovar.

Since Bitcoin’s last triumphant ascent, Darkfost observed, many latecomers-those who had arrived at the feast only to find the wine sour-now found themselves trapped in the purgatory of dwindling profits and swelling losses. Their predicament was not unlike that of a man who, having gambled his last coin, must now decide whether to walk away or double down in desperation.

The Crossroads of Fate

Darkfost, with the solemnity of a monk illuminating ancient scripture, unveiled a chart-a twisted rendition of NUPL, designed to measure the anguish of investors with the precision of a scalpel. This metric, far removed from the crude arithmetic of market caps, instead weighed the suffering of Short-Term Holders against the stoic endurance of Long-Term Holders, blending their pain into a single, damning number. The result, smoothed into what he called “aNUPL,” was a mirror held up to the market’s soul.

The conclusion was inescapable: Bitcoin stood at the precipice of decision. When unrealized profits withered and losses swelled to such extremes, men were forced to choose-to cling to hope like a drowning man to driftwood, or to surrender, their dreams sinking beneath the waves. This choice, seemingly personal, would ripple through the market like a stone cast into a pond, shaping the tides of sentiment and liquidity.

Should the long-term holders endure, their resolve unshaken, the market might yet find its footing. But if fear took root, if the weaker hands faltered, then the descent could deepen, dragging Bitcoin into the abyss of a prolonged bear market. Such was the delicate dance of greed and fear, played out in the cold calculus of realized and unrealized profits.

A Pause in the Storm

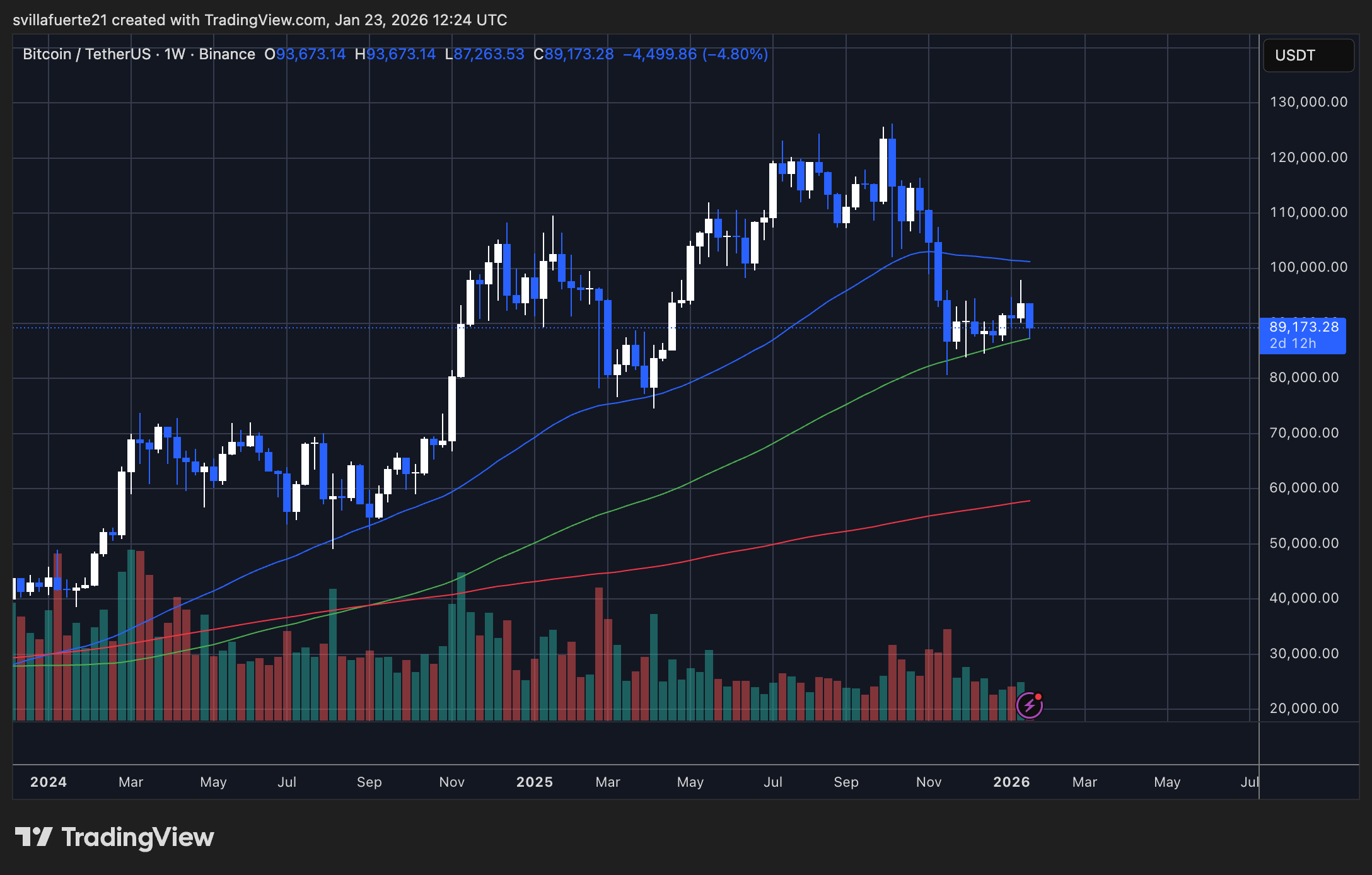

Bitcoin now lingered near $89,000, a weary traveler resting after a brutal journey. The weekly chart bore the scars of a violent selloff, the price ejected from its former domain like an unwelcome guest. The latest candle, a grim testament to the week’s suffering, showed a decline of 4.8%, as though the market itself had sighed in resignation.

Having failed to reclaim the sacred $90,000, Bitcoin now drifted in a narrow range, like a ship becalmed, its crew awaiting a favorable wind. The moving averages, those cruel arbiters of trend, loomed overhead, their resistance unyielding. The rejection from the low-$100K region was a stark reminder of Bitcoin’s fall from grace-its peak near $120K now a distant memory, its momentum shattered in the early days of 2026.

Yet, like a wounded beast, Bitcoin was not yet defeated. Should buyers rally, should they defend the $88K-$90K line and push beyond $92K-$95K, then hope might yet flicker anew. But failure here would invite a darker fate-a plunge toward the low-$80K abyss, where only the ghosts of past demand lingered.

Read More

- How to Build Muscle in Half Sword

- Top 8 UFC 5 Perks Every Fighter Should Use

- One Piece Chapter 1174 Preview: Luffy And Loki Vs Imu

- Epic Pokemon Creations in Spore That Will Blow Your Mind!

- How to Play REANIMAL Co-Op With Friend’s Pass (Local & Online Crossplay)

- All Pistols in Battlefield 6

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Gears of War: E-Day Returning Weapon Wish List

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- How To Get Axe, Chop Grass & Dry Grass Chunk In Grounded 2

2026-01-24 08:16