In the grand cosmic comedy of the universe, Ethereum whales are doing their best impression of a sinking ship-only instead of water, it’s their holdings that are disappearing faster than socks in a tumble dryer. Since the beginning of the year, these aquatic investors (who, unlike actual whales, probably won’t sing) have been shedding ETH like a cat with too many baths, dropping from a lofty 31 million tokens to a measly 29 million – a loss so dramatic it could qualify as an Olympic sport.

Meanwhile, the price of ETH, that volatile digital substance beloved by gamblers, speculators, and people who just like shiny things, has been doing the rollercoaster dance. It’s tumbled more often than a toddler after too much sugar, dipping below key support levels with all the grace of a drunken giraffe-prompting traders to nervously clutch their digital pearls and hope for a miracle.

Whales and ETFs Take a Dive-No Flippers Included

According to data from the oh-so-reliable Santiment, our whale friends initially shrugged off the crypto crush, adding a modest few million ETH at the start of the year. But by mid-month, they’ve decided to play hard to get, redistributing over 1.63 million ETH faster than a magician pulls rabbits out of hats-except instead of rabbits, it’s just their investments vanishing into thin air.

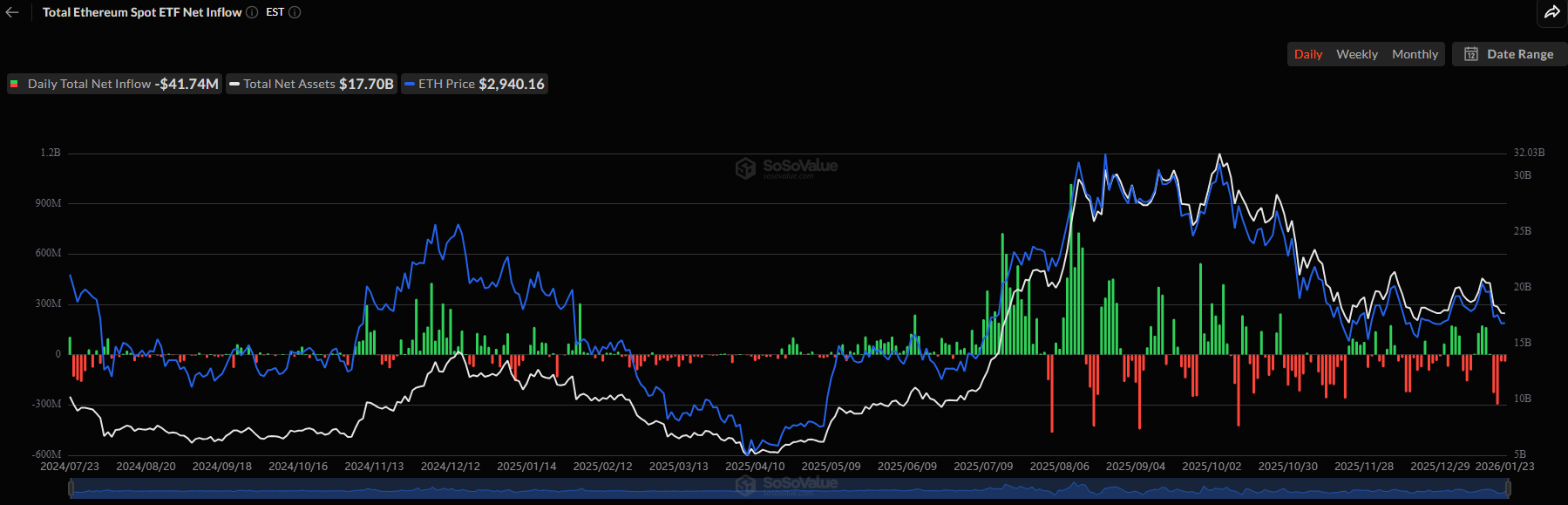

The ETF funds are having a similar meltdown. They got a brief taste of fame, netting over $400 million-and then, just as suddenly, they decided the party was over, pulling the same amount out with all the grace of a toddler tugging at their parents’ wallet. By mid-January, the total net happiness (investments, that is) had plummeted to a shocking $12.30 billion-about enough to buy a small island or at least a really fancy latte.

ETH’s Price: A Tale of Rise and Fall (and a Bit of a Tragedy)

ETH wrapped up 2025 with a bang and an all-time high, only to find itself crying into its digital pillow by the year’s end. Come 2026, it briefly flirted with the $3,400 mark but then realized that gravity (and perhaps market sentiment) are quite persistent. It’s now struggling below the mystical $3,000 level, looking every inch like a teenager trying to sneak past their curfew.

According to our wise sage Ali, ETH needs to reclaim the heroic figure of $3,085 to have any shot at bouncing back. Spoiler alert: it’s currently miles away, probably taking a nap in the crypto corner.

$3,085.

That’s the level Ethereum $ETH needs to hold to have a chance of a bullish breakout.

– Ali Charts (@alicharts) January 19, 2026

Merlijn The Trader, a gentleman with a predilection for charts and doom, points out that every time ETH tries to break free from the shackles of the 200-day moving average (which currently sits at a lofty $3,300), it gets refused faster than a bad Tinder date. These rejections tend to lead to double-digit declines, with some estimates suggesting ETH could slide another 20%-which, in trader-speak, is basically a birthday party for a bear market.

ETHEREUM IS STILL STRUGGLING BELOW THE 200D MA.

Every rejection at the MA200 has triggered a sharp selloff:

Dump 1: -27%

Dump 2: -21%

Dump 3: -14% (so far)Now $ETH is rejecting the MA200 again…

If history rhymes, another ~20% reset isn’t off the table.

Watch this level…

– Merlijn The Trader (@MerlijnTrader) January 23, 2026

Read More

- How to Unlock the Mines in Cookie Run: Kingdom

- Assassin’s Creed Black Flag Remake: What Happens in Mary Read’s Cut Content

- Jujutsu Kaisen: Divine General Mahoraga Vs Dabura, Explained

- Upload Labs: Beginner Tips & Tricks

- The Winter Floating Festival Event Puzzles In DDV

- Top 8 UFC 5 Perks Every Fighter Should Use

- Jujutsu: Zero Codes (December 2025)

- Where to Find Prescription in Where Winds Meet (Raw Leaf Porridge Quest)

- Xbox Game Pass Officially Adds Its 6th and 7th Titles of January 2026

- Jujutsu Kaisen Modulo Chapter 18 Preview: Rika And Tsurugi’s Full Power

2026-01-24 18:01