Crypto ETFs throw a panic bash as investors sprint like they’re avoiding a loose leaflet ad in Regent’s Park.

U.S.-listed crypto exchange-traded funds (ETFs) faced a sudden pullback last week as investors cut exposure with the enthusiasm of a failed dating app swiping left in December. Bitcoin and Ethereum funds, meanwhile, bled money like a wine merchant’s wallet at a discount store. Onchain data now whispers of a mood shift after the sector’s earlier “I’ve got Wings & Things” inflows in January.

BlackRock’s IBIT Rips Redefinition of “Biggest Loser” in Midweek Meltdown

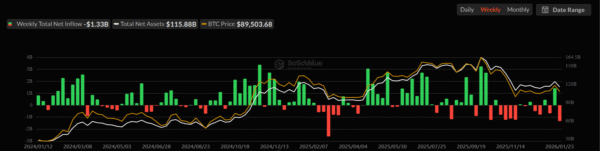

Bitcoin funds just scored the worst week in nearly a year, coughing up $1.33B to a stunned market during a holiday-shortened week (because nothing says excitement like trading over Martin Luther King Jr. Day). For context, this is like showing up to a dinner party with your main event and then getting ghosted twice. Speaking of ghosts, this week’s outflows are the first soured showing since February 2025’s “February Freeze” mini-drought.

Image Source: SoSoValue

The rudest interjection came midweek, with Bitcoin flee-fest topping $709M on Wednesday alone. Tuesday was also no pansy, raking in $483M in outflows. The week tried to tidy up its act eventually, with modest $32M and $104M losses on Thursday and Friday, respectively, which is gracious if you’re fleeing a trainwreck ballet.

BlackRock’s IBIT, the usual “King of the Hill” in Crypto Town, clearly had a bad hair day as it led the stampede. It’s got $69.75B in assets but couldn’t impress a single investor. The fund is now in a race with a limousine driver trying to avoid the speed limit before the next crypto Easter.

Bitcoin’s Weekly Losses: A New Chapter in “Love, Loss & ETFs”

This week’s drawdown harks back to the infamous “February Freeze” of 2025 when Bitcoin ETFs lost a ten-leaf clover’s worth of $2.61B. Back then, Bitcoin dropped from $109K to $80K like someone texted “Let’s go surfing!” while the sky was raining meteorites. February 2025 was basically the holiday of bad luck for crypto.

The stylist background here? Shortened markets, as if liquidity was a trapeze artist who’s practised for three minutes and then quit. Midweek saw red like a casino buffet. Also, large funds had the market’s attention all to themselves, like a diva in a single spotlight.

But hold your horses! Despite the heartbreak, these funds are still sitting pretty with a net $56.5B in inflows since late 2024. In terms of total assets alone, they’re chugging along at $115.9B. Not too shabby for a sector where last week’s vibe was “I need my space.”

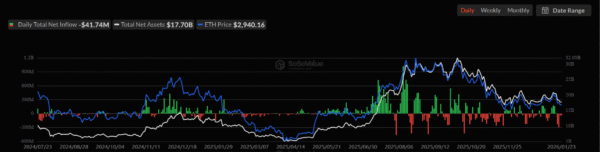

Ethereum ETFs: The Party Pooper Edition

Ether fans followed suit, exiting fund vehicles in a mood-specific sprint. Ethereum funds – cool, but unloved in this context – lost $611M, including a $298M pow wow on Wednesday. Grayscale’s ETHE took a $10.8M hit, but with a $9.16M addition from its own trust, it looks like they’re just playing a high-stakes game of hot potato.

Image Source: SoSoValue

All in all, it was one sad thursday for Ethereum, but the total net assets for the sector are holding up nicely at $17.7B. Cumulative inflows continue to grow like a borderline enthusiastic sapling. Still, yesterday’s outflows would make a serious mood ring shine much brighter than a neon sign at midnight.

If Ethereum isn’t your style, worry not – Solana ETFs danced to the beat of their own drum this week with $9.6M in inflows thanks to the ever-millennial-esque Bitwise. Meanwhile, XRP ETFs were a mixed bag (because life threw them a charm offensive). After $40.6M in total outflows, funds had a mini redemption day like part of a theme park ride – short, but altogether cringe-inducing.

Read More

- How to Unlock the Mines in Cookie Run: Kingdom

- Assassin’s Creed Black Flag Remake: What Happens in Mary Read’s Cut Content

- Jujutsu Kaisen: Divine General Mahoraga Vs Dabura, Explained

- The Winter Floating Festival Event Puzzles In DDV

- Upload Labs: Beginner Tips & Tricks

- Top 8 UFC 5 Perks Every Fighter Should Use

- Jujutsu: Zero Codes (December 2025)

- Where to Find Prescription in Where Winds Meet (Raw Leaf Porridge Quest)

- MIO: Memories In Orbit Interactive Map

- Xbox Game Pass Officially Adds Its 6th and 7th Titles of January 2026

2026-01-25 14:56