As a seasoned financial analyst with over two decades of experience in navigating turbulent markets and analyzing emerging trends, I find myself intrigued by Michael Saylor’s latest proclamation of bullishness towards Bitcoin. His unorthodox yet effective use of social media to express his opinions on the cryptocurrency market is a testament to its transformative power and the growing acceptance of digital assets in mainstream finance.

In simpler terms, Michael Saylor, a well-known American businessman and the head of MicroStrategy, has finally spoken up during the turbulent times in the cryptocurrency world. Predictably, his statement reaffirmed his backing for Bitcoin (BTC).

Michael Saylor, who is well-known for his strong advocacy for significant cryptocurrencies, recently made comments that further highlight his conviction in Bitcoin’s long-term growth prospects.

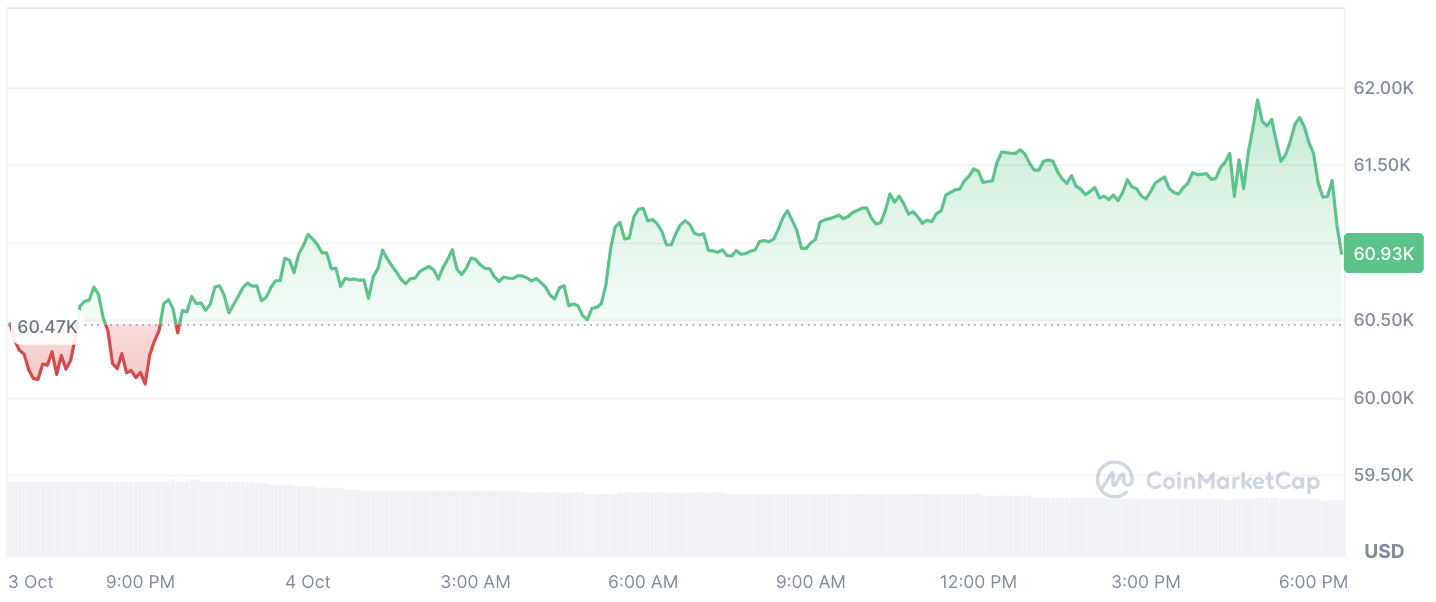

With BTC‘s price surging past $62,000 after breaking key support levels, Michael Saylor, CEO of MicroStrategy, expressed his optimism in a single word: “bullish”. But his post didn’t stop there; he also shared an AI-generated image depicting him riding a bull adorned with the Bitcoin symbol on its forehead.

₿ullish

— Michael Saylor⚡️ (@saylor) October 4, 2024

This was characteristic for the businessman, and while such a social media presence may seem unconventional, the cryptocurrency itself is also unconventional, so it is the perfect match.

Roller coaster ride of Bitcoin

In essence, the strong U.S. job market reports, which surpassed expectations, likely fueled the rise in the cryptocurrency market. This optimistic outlook on the economy might have contributed to an increase in asset prices, particularly in the cryptocurrency sector.

Yet, it’s not just smooth sailing ahead, as heightened labor market activity raises concerns about a potential lack of cooling. Given these trends, drastic measures to reduce rates by 50 basis points become unlikely. Instead, the debate centers around whether a rate reduction is even necessary in November.

If an interest rate reduction doesn’t materialize, it means that the ‘money printing machine’ that some market players anticipate won’t be activated any time in the near future.

Read More

- USD ZAR PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- CKB PREDICTION. CKB cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- EUR ILS PREDICTION

- HUDI PREDICTION. HUDI cryptocurrency

- Best JRPGs That Focus On Monster Hunting

- ANKR PREDICTION. ANKR cryptocurrency

- LOVELY PREDICTION. LOVELY cryptocurrency

2024-10-04 18:37