As a seasoned researcher who has witnessed the cryptocurrency market’s rollercoaster ride for years now, I can confidently say that Bitcoin’s recent price action is a testament to its intrinsic volatility and unpredictability. However, instead of viewing the pullback as a negative development, I believe it could potentially set the stage for a more resilient long-term price outlook for Bitcoin.

Over the past fortnight, Bitcoin‘s price fluctuations have underscored its inherent volatility, even with a consistent influx of institutional funds. The cryptocurrency experienced a significant rise from approximately $53,500 to a peak of $66,000 towards the end of September, but swiftly retreated to around $61,000 in the early days of October, highlighting its unforeseeable tendencies.

It’s intriguing to note that as Bitcoin reached $66,000, it altered the investment patterns among its owners. This alteration in patterns implies that the subsequent dip and retest following the rally might not be entirely negative for Bitcoin’s value. Instead, this transition indicates that the decline could be preparing the ground for a stronger long-term price trajectory for Bitcoin.

Bitcoin’s Rejection At $66,000

Bitcoin’s recent break above $66,000 last week led to the creation of the first higher high since June. This notable Bitcoin development was noted by on-chain analytics platform Glassnode in a recent report. Bitcoin, which had initially created a higher low of $53,000 in September, eventually went on to break above the August high of $64,500. According to the report, the creation of this higher high led to a change in the profitability of short-term and long-term holder cohorts, with many more bitcoins moving into the long-term threshold.

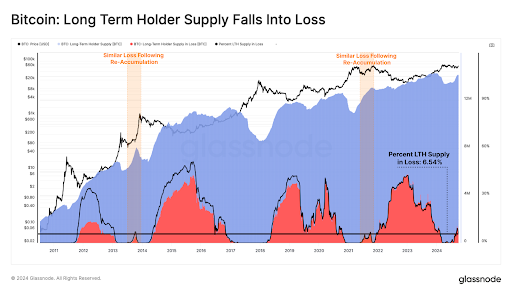

After reaching an all-time high at $73,780 approximately 155 days ago, many coins that were bought around this time are now being held by long-term investors. Interestingly, although only a small percentage (6.54%) of these long-term holders are currently in losses, they represent nearly half (47.4%) of all the coins experiencing losses. This might not seem promising for these long-term holders right now, but data from Glassnode suggests that this is typical during periods of coin re-accumulation, as observed in 2013, 2019, and 2021. Historically, such phases have often led to further price increases.

Conversely, it’s worth noting that the profitability of those who hold Bitcoin for a shorter period has experienced a substantial boost. According to data from Glassnode, a considerable portion of these short-term investors initially bought their coins at prices ranging from $53,000 to $66,000. It’s interesting to note that the recent rally has driven the profitability of this group to exceed 62%. Moreover, the volume of profits being realized is now a staggering 14.17 times greater than the volume of losses being incurred. This means that the financial strain on short-term holders has significantly decreased, and many are now finding it more advantageous to continue holding onto their investments.

What Next For Bitcoin?

Regardless of Bitcoin’s recent drop from its $66,000 high, investors across the board find it in a stronger and more lucrative position compared to its state a month prior. Moreover, the rejection at $66,000 provides an opportunity for investors, particularly long-term holders, to accumulate more Bitcoin.

At the time of writing, Bitcoin is trading at $61,200.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- WELSH PREDICTION. WELSH cryptocurrency

- IQ PREDICTION. IQ cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

2024-10-05 09:11