As a seasoned researcher with years of experience delving into the intricacies of corporate law and finance, I find this development between Nvidia Corp. and the US government particularly intriguing. The allegations against Nvidia, if proven true, could potentially set a significant precedent in the tech industry, emphasizing the importance of transparency in financial reporting.

In simpler terms, the United States government is supporting a lawsuit against tech company Nvidia Corporation, which manufactures graphics processing units (GPUs). The Department of Justice and Securities and Exchange Commission are asking the Supreme Court to reinstate a case that alleges Nvidia Corporation deceived investors about its cryptocurrency mining revenue. This legal battle has had ups and downs since it started in 2018, but it’s being discussed again now.

Government Support For Investors

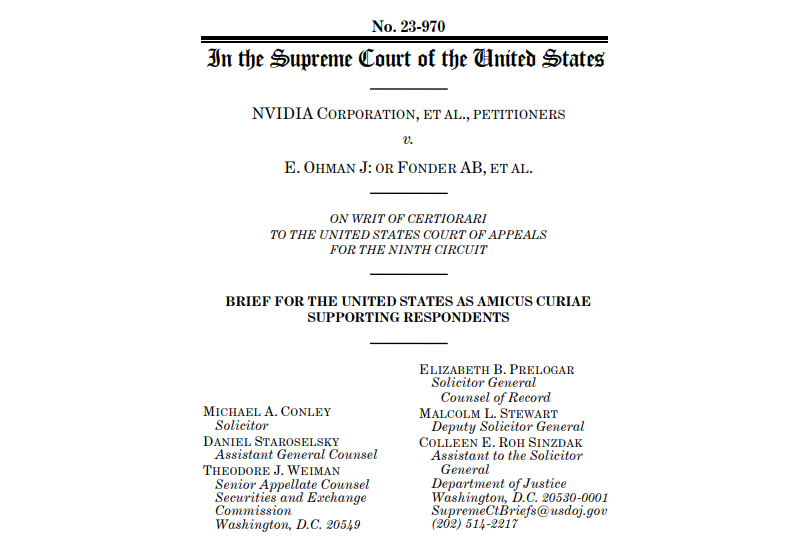

In an amicus brief submitted on October 2nd, Solicitor General Elizabeth Prelogar and SEC senior lawyer Theodore Weiman contended that the case presents enough evidence to reopen the proceedings. They asserted that Nvidia’s top executives, particularly CEO Jensen Huang, had underreported the company’s reliance on cryptocurrency mining revenue during a time when such sales were at an all-time high.

The brief underlines how private actions are an essential piece of the securities enforcement puzzle, making the government have a concrete interest in this case. Oral arguments before the Supreme Court are scheduled for November.

In my role as a researcher, I’ve been tracking the case involving Nvidia that was initially dismissed by the Ninth Circuit Court of Appeals in 2021 due to lack of evidence. However, last August, in a divided panel decision, the court chose to reexamine it. The investor plaintiffs allege that prior to the 2018 market crash, Nvidia had deceptively understated its reliance on cryptocurrency mining revenue. They claim that Huang’s statements were misleading, which led to accusations of securities fraud.

Allegations Against Nvidia

Fundamentally, it alleges that the corporation deceived investors about its financial status by not disclosing the extent of revenue generated from cryptocurrency sales on public markets.

As suggested by the investors, it appears that Huang was fully aware of his company’s dependence on cryptocurrency sales, yet he deliberately understated this fact in public after the cryptocurrency market crash in 2018 led to a decline in the company’s revenue, which made the lack of transparency more noticeable.

In response to the accusations by investors, Nvidia argued that their claims were built on misleading information regarding the company’s revenue sources. However, the investors have presented evidence from ex-employees who claim that Huang was involved in discussions about how cryptocurrency mining impacted sales. The Third Circuit acknowledged this testimony, implying that Huang had a conscious awareness of involvement in fraud against investors related to false financial practices.

Legal Implications And Future Steps

The involvement of the DOJ and SEC lends greater credibility to the investors’ claims. They argue that relying solely on an expert’s opinion as proof of dishonesty or intent would undermine the investor protections established by the Private Securities Litigation Reform Act (PSLRA). To demonstrate their commitment to enforcing securities regulations, these agencies have requested 10 minutes for oral arguments when the case is presented.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD PHP PREDICTION

- USD ZAR PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- USD CLP PREDICTION

- CVC PREDICTION. CVC cryptocurrency

- NXRA PREDICTION. NXRA cryptocurrency

2024-10-05 15:11