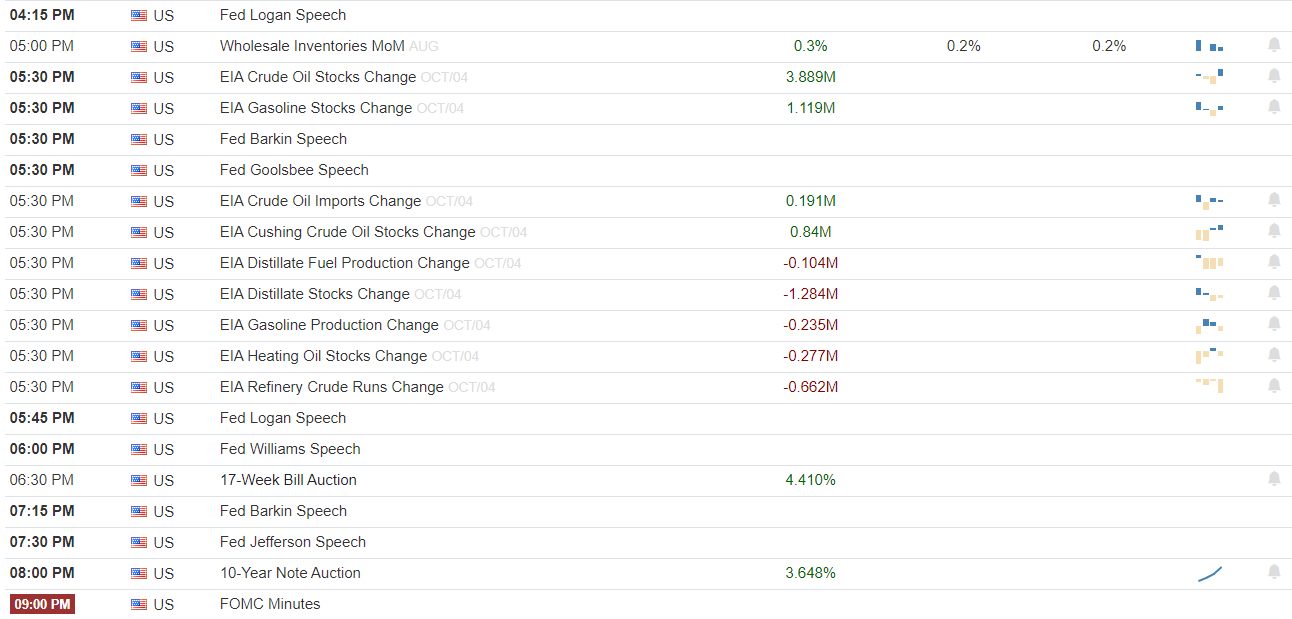

As a seasoned analyst with over two decades of market experience under my belt, I can confidently say that October 9th is shaping up to be a pivotal day for Bitcoin and the broader cryptocurrency market. The upcoming release of the Federal Reserve’s monetary policy minutes and key U.S. economic indicators such as the Producer Price Index (PPI), unadjusted Consumer Price Index (CPI) annual rate, and initial jobless claims will undoubtedly stir up volatility in the financial markets, including Bitcoin.

This coming week is expected to mark a pivotal moment, specifically October 9th, for Bitcoin and the broader cryptocurrency market. The Federal Reserve will be releasing the minutes from their latest monetary policy meeting, and key U.S. economic data such as the Producer Price Index (PPI), unadjusted Consumer Price Index (CPI) annual rate for September, and the number of initial jobless claims for the week ending October 5th will also be disclosed.

As these occurrences unfold, the financial markets, including Bitcoin, might experience increased volatility. One reason for this could be that Bitcoin and other cryptocurrencies are becoming increasingly sensitive to macroeconomic data. This heightened sensitivity is due to investors viewing them as a protective measure against inflation and currency depreciation.

As a crypto investor, I’m keeping a close eye on the upcoming release of the Fed’s meeting minutes. If these minutes indicate a more aggressive stance (hawkish) suggesting further interest rate hikes, it might lead investors to favor safer assets over Bitcoin. In such a scenario, Bitcoin could potentially take a hit. For a comprehensive understanding of inflation in the U.S., I’ll be closely monitoring the Consumer Price Index (CPI) and Producer Price Index (PPI) data.

If the Producer Price Index (PPI) or Consumer Price Index (CPI) show higher-than-anticipated increases, suggesting ongoing inflation, the Federal Reserve may implement stricter monetary policies, potentially increasing volatility in risky assets such as Bitcoin. Conversely, a stronger labor market, as suggested by initial unemployment claims, could prompt the Fed to slow down its rate hikes, which might be beneficial for Bitcoin.

Keep an eye on significant price points and possible market fluctuations. Bitcoin’s value might become increasingly volatile due to upcoming events. Investors are advised to focus particularly on these key thresholds: as Bitcoin approaches the potential resistance level of $63,000, it’s getting close. If it surpasses this threshold, there could be a move towards the next goal of $65,000.

A significant level of backing for Bitcoin lies around $60,000; it’s a crucial point when market trends are bearish. If this support at $58,000 were breached, it might trigger mass selling due to panic. Bitcoin could surge unexpectedly in response to any unanticipated information from the Fed minutes or inflation data as October 9 approaches.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- USD PHP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- XRP PREDICTION. XRP cryptocurrency

- USD ZAR PREDICTION

- SNS PREDICTION. SNS cryptocurrency

- W PREDICTION. W cryptocurrency

- AKRO PREDICTION. AKRO cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- STORJ PREDICTION. STORJ cryptocurrency

2024-10-07 11:47