On this fateful Thursday, the prevailing air in the realm of cryptocurrencies was thick with trepidation. The Crypto Fear and Greed Index, that fickle barometer of market sentiment, languished in the low 20s, a reflection of weeks spent in a despondent stupor where confidence lay shattered like a fragile glass ornament. Bitcoin, that erstwhile darling of digital currency, found itself sliding perilously below the $84,000 mark, a casualty of the broader malaise afflicting equities and the relentless weight of macroeconomic stress.

Crypto Fear Gauge Highlights Caution During Broad Market Pullback

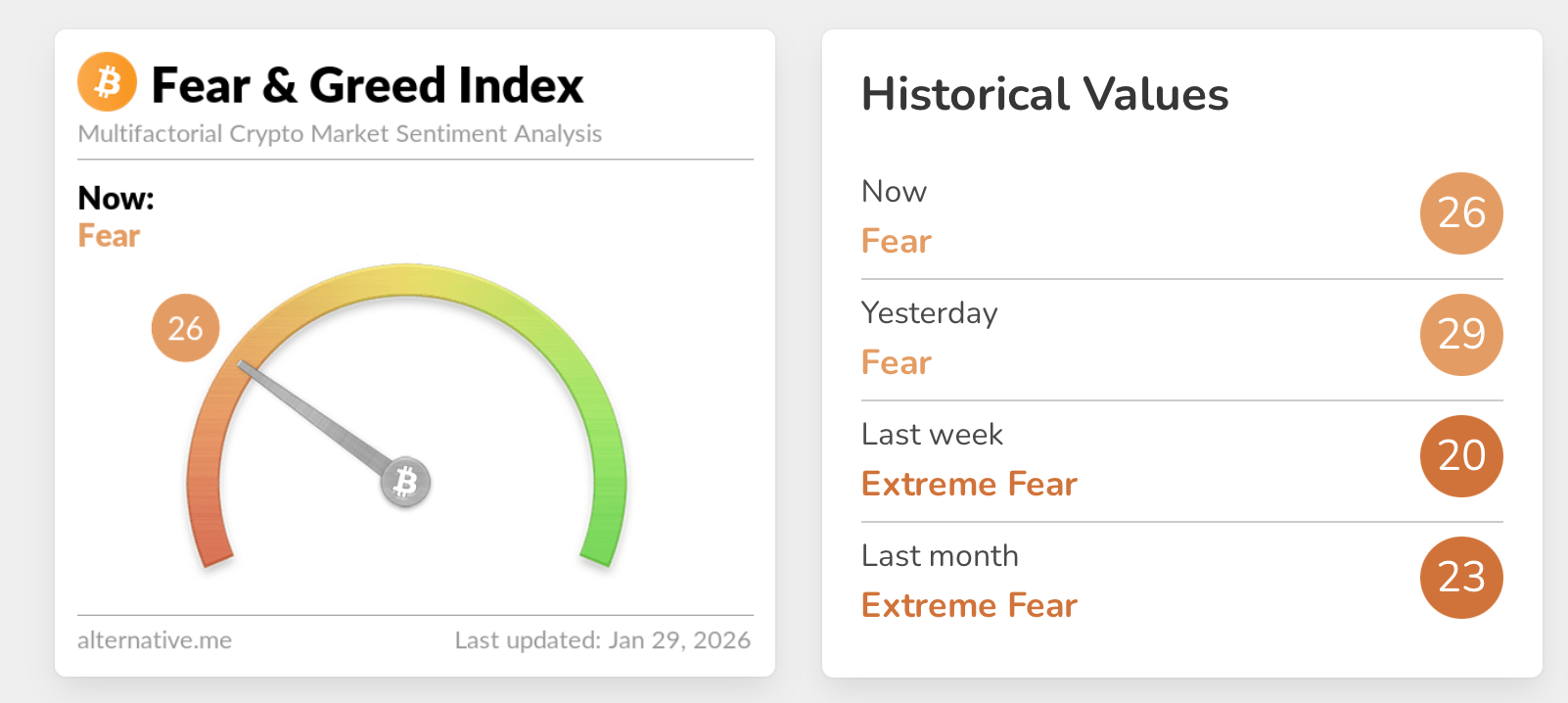

The Crypto Fear and Greed Index (CFGI), hosted on alternative.me, stubbornly printed a 26 (Fear) on this day, January 29, 2026, barely budging from its recent readings. This steadfastness underscored a market that, despite its best efforts, had failed to resurrect any semblance of confidence.

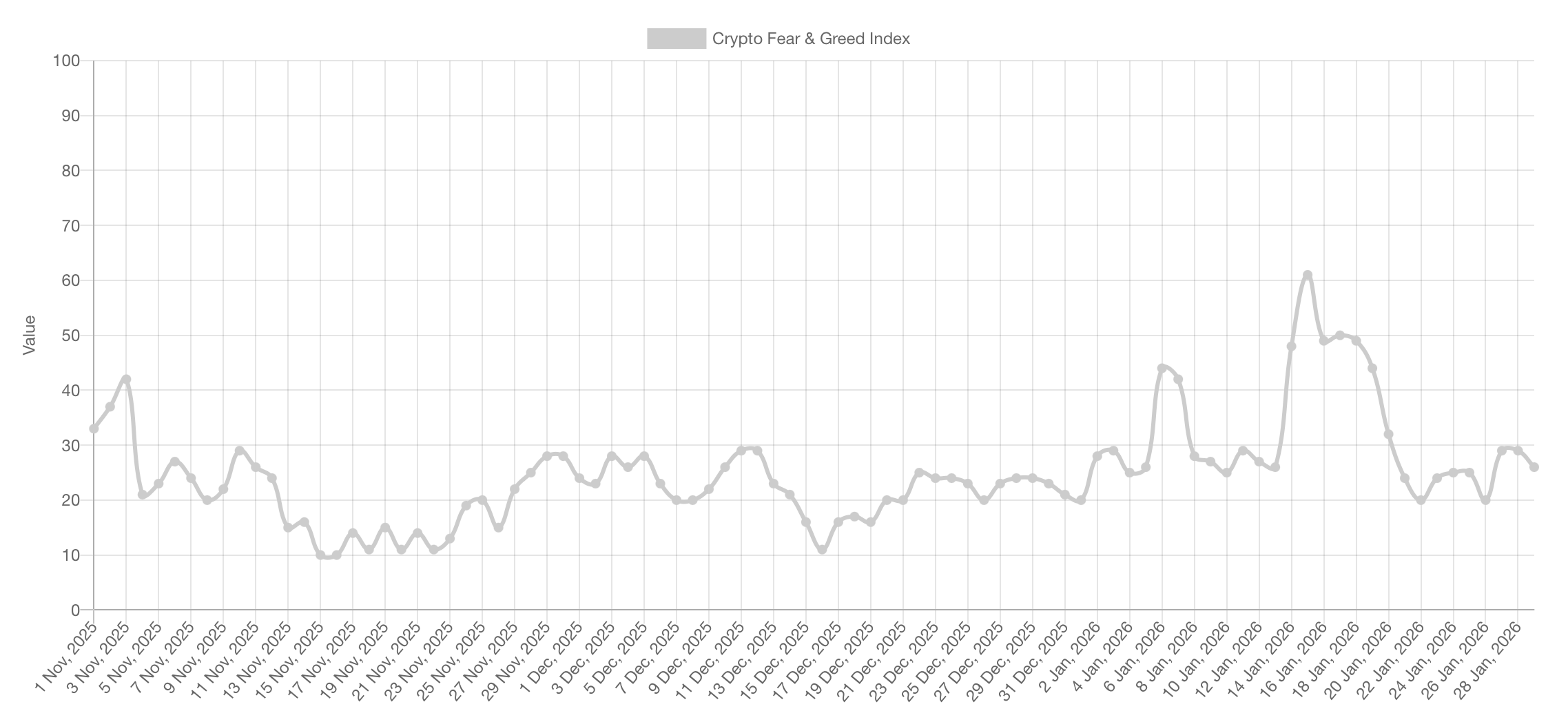

Indeed, just yesterday, the index was a tad higher at 29 (Fear), yet last week it dipped into 20 (Extreme Fear), and a month ago to 23 (Extreme Fear), illustrating a sentiment that has remained sadly compressed for weeks, as if trapped in a dark cellar without hope of escape. A longer glance at the CFGI chart reveals this stagnation, reminiscent of the endless Russian winter. In early November, the index had hovered in the low-to-mid 30s, already hinting at the caution that would soon envelop the markets.

As mid-November approached, however, sentiment took a nosedive, plummeting into the low teens as selling pressure became akin to the relentless Russian winter, chilling all hope. December, rather miserably, afforded only a smidgen of relief, as the index flitted between the high teens and the upper 20s-a dance of traders who dared to poke at risk yet recoiled at the slightest hint of commitment.

Each attempted rebound, like a poorly executed ballet, stalled at the same sorrowful level, creating a pattern of diminishing conviction and reinforcing the notion that fear had sunk its roots deeply into the soil of market psychology. January followed suit with a script predictable enough to elicit a weary smile. Early-month optimism briefly lifted the CFGI toward the upper 20s, but alas, the fleeting joy was short-lived, fading faster than a summer romance.

By mid-to-late January 2026, the index once again slumped back toward the dreaded territory of extreme fear, a grim alignment with renewed volatility and ever-tightening correlations between crypto and U.S. equities. This sentiment backdrop weighed heavily on Thursday-as Bitcoin fell an abysmal 6%, hovering resignedly between $84,000 and $85,000, and touching an intraday low of $83,242 per coin, as if it were a sad poet lamenting lost fortunes.

The CFGI’s inability to rise meaningfully above the mid-30s this year suggests traders have treated each rally as an opportunity to reduce their exposure, rather than as a clarion call indicating a robust turnaround. The equity markets provided the immediate catalyst for this dismay.

In a rather dramatic turn of events, Microsoft shares fell more than 12% following earnings reports, as heavy spending on artificial intelligence (AI) rekindled fears of delayed returns, dragging the Nasdaq down roughly 1.5%. This weakness among software and megacap stocks reverberated through the markets, reinforcing a pervasive aversion to risk.

In a display of mirroring that would make even the most skilled mimics envious, Crypto echoed this retreat. Bitcoin dutifully tracked stocks lower, liquidations surged, and the CFGI reflected this shift-a somber testament to the weight of volatility and negative momentum pressing down upon its calculations.

Moreover, geopolitical tensions added to the already heavy burden. President Trump’s warnings of potential strikes on Iran, coupled with a visible military buildup, sent investors scurrying toward safe havens like gold and silver, abandoning risk assets with the fervor of a man fleeing from an angry bear.

When viewed collectively, the CFGI tells a story as clear as a sunny day: fear has entrenched itself like an unwelcome guest who refuses to leave. Until sentiment can muster the strength to sustain a move out of the low 20s and 30s, the crypto markets will remain vulnerable to the shocks of the macro world and the selloffs driven by equities.

FAQ ❓

- What is the Crypto Fear and Greed Index?

It measures crypto sentiment using volatility, momentum, volume, and the erratic behavior of the market.

- What does a reading near 26 indicate?

It signals a state of fear, suggesting that traders are cautious and their appetite for risk is as limited as a beggar’s coin purse.

- Why has sentiment stayed weak for months?

Repeated selloffs driven by equities and the looming uncertainty of the macroeconomic landscape have effectively capped any hope for confidence.

- Does prolonged fear matter for prices?

Extended periods of fear often coincide with heightened volatility and a structure of the market that resembles a house of cards-fragile and precarious.

Read More

- How to Unlock the Mines in Cookie Run: Kingdom

- Gold Rate Forecast

- How To Upgrade Control Nexus & Unlock Growth Chamber In Arknights Endfield

- Top 8 UFC 5 Perks Every Fighter Should Use

- Byler Confirmed? Mike and Will’s Relationship in Stranger Things Season 5

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- USD RUB PREDICTION

- MIO: Memories In Orbit Interactive Map

- Where to Find Prescription in Where Winds Meet (Raw Leaf Porridge Quest)

- Solo Leveling: From Human to Shadow: The Untold Tale of Igris

2026-01-30 02:08