Ah, Avalanche-once merely a snowball careening down the mountain of crypto despair, now a veritable fountain of on-chain activity that refuses to be muted by the icy grip of market decline. In a dance of paradoxes, its price tumbles like a clumsy guest at a garden party, while its on-chain numbers soar as if inspired by Oscar Wilde’s own wit.

Metrics Ascend as AVAX Wears the Fainting Couch

Once the belle of the blockchain ball, AVAX’s value took a nosedive-59.0% QoQ and 65.5% YoY-leaving wallets emptier than a poet’s pocket. From a princely $30 to a humble $12.30-the descent was swift enough to make even the most stoic blush. Yet, amidst this financial fumble, the network’s usage kept climbing like a well-bred dandy, unphased by the tragic comedy of token price.

Market cap shrank by a staggering 58.3% QoQ, a decline so dramatic it could inspire a Victorian melodrama. Yet, internet usage expanded-quietly, splendidly-breaking the age-old link between token’s glamour and its utility. Network fees, though diminished in dollars, grew in AVAX native terms-a reminder that even amidst decline, there is growth-albeit in a language only blockchain enthusiasts can decipher.

Transaction numbers soared-63% daily on the C-Chain-making it busier than a London coffeehouse during a scandal. The grand market crash of October 2025 merely added a splash of excitement, generating fees high enough to make a banker feel poor. Evidently, Avalanche basks in its chaos, undeterred and perhaps even delighted by the spectacle.

Uncanny Activity and Record-Breaking Outbursts

What’s this? Avalanche’s ecosystem reached heights as lofty as Wilde’s own salons. Activity soared: daily transactions increased 4.5% QoQ, and a staggering 1,162.1% YoY-highlighting that where prices falter, activity often flourishes in satire and paradox. Addresses-those digital guests-expanded by 25.1% QoQ and an almost absurd 16,360.3% YoY, reaching 24.7 million, proving that even in decline, the network’s social calendar remains fuller than a Victorian ball.

And on the C-Chain alone? Record-breaking transactions-like a Wildean wit-dancing through the chaos. Activity surged 69% QoQ, 799.3% YoY, making it the busiest period in its storied history. Yet, the staking metrics told a more somber tale-dip, decline, retreat-an echo of the token’s own fall, echoing Wilde’s own wit that “Youth is wasted on the young.”

DeFi’s Resilient Charm and Real-World Assets’ Raucous Rise

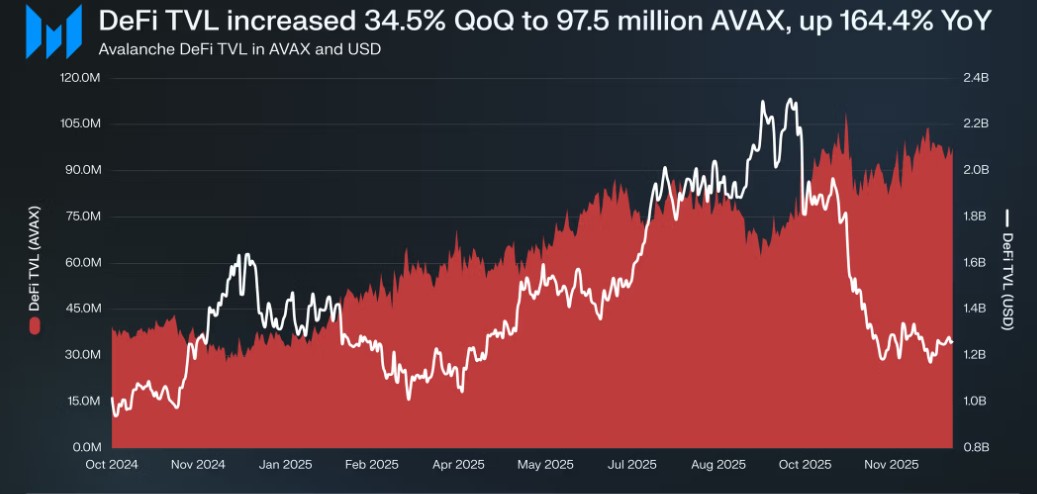

Meanwhile, the DeFi scene-quite loyal in its resilience-witnessed an increase in the Diversity Score, a subtle reminder that diversity remains the best shield against market folly, rising 5.9% QoQ. Total value locked? A modest fall from $2.2 billion to $1.3 billion-less a decay, more a slow, melancholic waltz. The stablecoin universe? Growing steadily-like Wilde’s reputation among the skeptical-by 1.7% QoQ and 24.3% YoY to $1.8 billion.

Native DeFi TVL skyrocketed 34.5% in AVAX terms, proving that even when measured in the currency of decline, the underlying value may thrive in areas Wilde himself might have called “a period of splendid decadence.” RWA-real-world assets-took a giant leap, surging 68.6% QoQ, nearly tenfold YoY, from $789.8 million to an opulent $1.33 billion. Truly, a phoenix rising from a flame of market despair, clothed in the attire of blockchain audacity.

So, dear reader, let us toast to Avalanche-a lesson in paradox and resilience, that even when the world seems to be crashing into Wildean chaos, beauty and brilliance can still be found rising from the wreckage with a mischievous grin.

Read More

- Gold Rate Forecast

- How to Unlock the Mines in Cookie Run: Kingdom

- How To Upgrade Control Nexus & Unlock Growth Chamber In Arknights Endfield

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- Jujutsu: Zero Codes (December 2025)

- Byler Confirmed? Mike and Will’s Relationship in Stranger Things Season 5

- Gears of War: E-Day Returning Weapon Wish List

- USD RUB PREDICTION

- Top 8 UFC 5 Perks Every Fighter Should Use

2026-01-31 09:05