Ah, the great Bitcoin, that digital chimera, has once again decided to take a leisurely stroll below the precipice of $83,000 in the fateful days of late January 2026. What a spectacle! The on-chain holders, those poor souls, are now bathed in the crimson glow of losses, their wallets weeping like a Gogol protagonist in a rain-soaked St. Petersburg square.

The Gaussian Channel: A Volatility Vaudeville

From the technical abyss, we observe the Bitcoin price closing below the lower boundary of the Gaussian Channel-a statistical contraption of medians and deviations. Oh, the irony! This indicator, which once strutted like a peacock during bull cycles, now lies in the dust, its feathers plucked by the merciless hands of the market. As Ted (@TedPillows) so eloquently quoth: $BTC has dropped below its weekly Gaussian Channel. To be honest, this looks really bad.

Indeed, Ted, indeed. It looks as bad as a nose disappearing in a Gogol tale, never to be seen again.

$BTC has dropped below its weekly Gaussian Channel.

To be honest, this looks really bad.

– Ted (@TedPillows) January 31, 2026

Historically, such a plunge has been the harbinger of corrective phases, not the harbinger of doom. Yet, the current breakdown near $83,000 whispers of weakening momentum, not immediate capitulation. Ah, the market-a fickle mistress, is she not?

Meanwhile, the broader market conditions remain as fragile as a glass nose on a frosty morning. January’s volatility failed to reclaim key resistance levels, leaving Bitcoin to consolidate under pressure, like a bureaucrat trapped in a Kafkaesque nightmare.

Sentiment Sours: A Comedy of Errors

Sentiment indicators, those fickle barometers of human emotion, have turned as defensive as a cornered cat. The community, once brimming with optimism, now murmurs of deeper retracements, their voices echoing through the digital ether. Yet, sentiment alone is as reliable as a Gogol character’s sense of direction-rarely leading to the bottom.

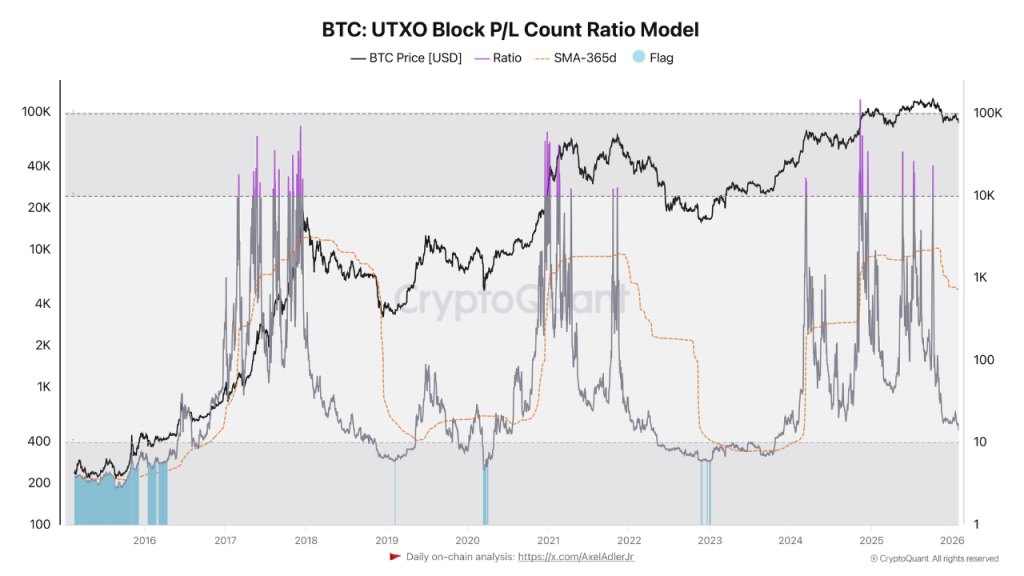

On-chain data, however, paints a clearer, though no less absurd, picture. The ratio of UTXOs in loss versus those in profit has plummeted to levels akin to late correction phases or bear market environments. Behold, the market in its full grotesque splendor!

When profits reign, sell-offs follow like a faithful dog. But when losses spread, selling pressure wanes-not from renewed confidence, but from the sheer exhaustion of participants. Ah, the human condition, even in the digital realm!

UTXO Loss Ratios: A Tragicomedy of Stress

The current environment is a theater of investor strain. UTXOs slipping into unrealized loss create a negative feedback loop, where fear replaces momentum like a bad actor taking center stage. Historically, when this ratio reaches such extremes, downside risk begins to compress. Yet, this does not herald immediate recovery, but rather a slowing of forced selling, even as volatility remains as erratic as a Gogol plot twist.

Short-term conditions remain bearish, but structurally, the market approaches a region where pressure becomes asymmetrical. The BTC price is now driven not by optimism, but by exhaustion dynamics-sellers gradually losing dominance as losses spread like a yawn in a crowded room.

Bitcoin’s Compression Phase: A Farce in Progress

In this absurd setup, Bitcoin’s price analysis reflects a convergence of technical weakness and on-chain stress, rather than a single catalyst-driven move. The breakdown below volatility bands aligns with an environment where most participants are underwater, amplifying fear while reducing the incentive to sell aggressively. It is a compression phase, a pause in the farce, where the market decides whether to descend further or stabilize.

Will this phase resolve through further downside or stabilization? Only time will tell, as the market, like a Gogol character, meanders through its own absurd logic, leaving us all to wonder: is this comedy or tragedy? Perhaps, it is both.

Read More

- Gold Rate Forecast

- How to Unlock the Mines in Cookie Run: Kingdom

- Jujutsu: Zero Codes (December 2025)

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- How To Upgrade Control Nexus & Unlock Growth Chamber In Arknights Endfield

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- Top 8 UFC 5 Perks Every Fighter Should Use

- All Pistols in Battlefield 6

- Top Anime Like I’m the Evil Lord of an Intergalactic Empire You Can’t Miss

- Gears of War: E-Day Returning Weapon Wish List

2026-01-31 17:16