Oh, Bitcoin, you fickle beast! As of 9:55 a.m. Eastern time on Feb. 1, 2026, you’re trading at a cool $78,199 per coin. Meanwhile, derivatives traders are tapping the brakes like a grandma driving through a school zone. Futures and options markets are screaming, “Risk control, baby!” No more moonshot bets-just a bunch of nervous Nellies hedging their bets.

Bitcoin Futures and Options: The Party’s Over, Folks!

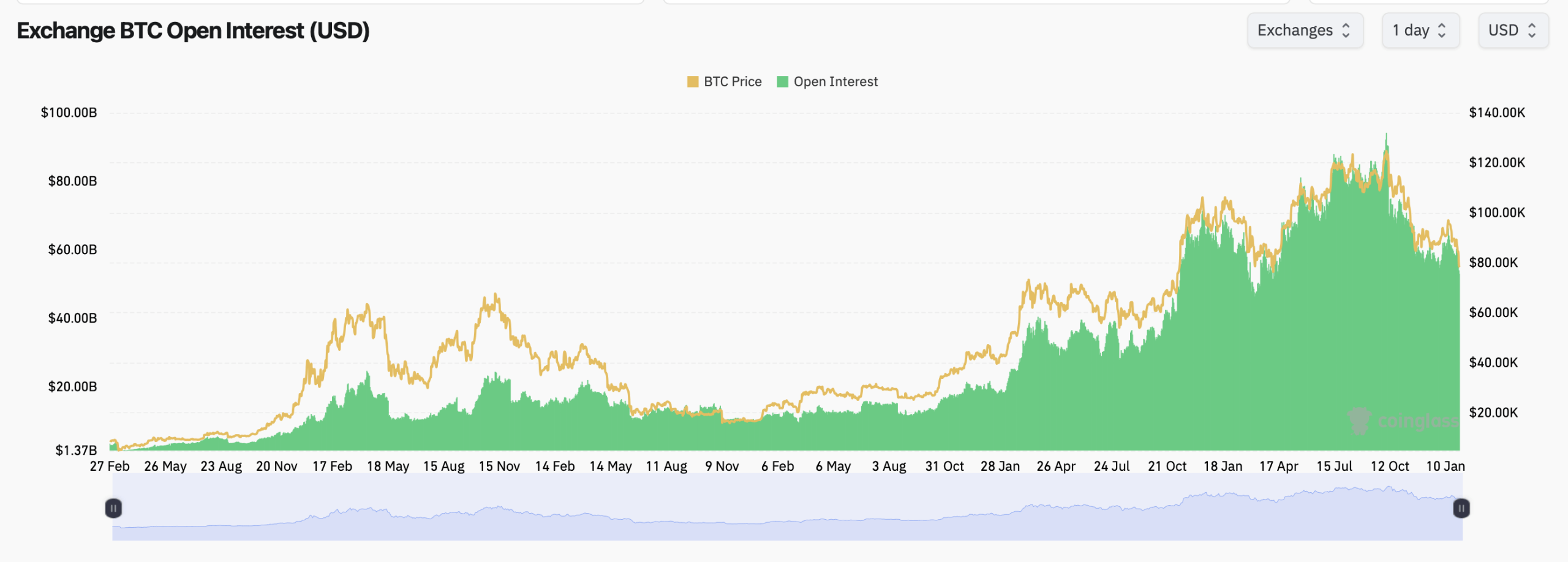

Across the wild west of derivatives exchanges, bitcoin futures open interest is sitting at 677,730 BTC, or a whopping $52.98 billion. But hold onto your hats-that’s a 6.83% drop in the last 24 hours! Looks like January’s volatility left everyone with a hangover.

Where’s the action? Binance and CME are hogging the spotlight, with 19.1% and 17.8% of the open interest, respectively. Binance leads with 129,580 BTC ($10.13 billion), while CME trails with 120,910 BTC ($9.45 billion). It’s like a crypto version of “Keeping Up with the Joneses.”

Short-term flows? More like short-term freezes. One-hour and four-hour open interest changes are in the red across Binance, Bybit, Gate, and CME. Only OKX and Bitget are showing modest increases-probably just a couple of daredevils left in the game.

Zoom out, and it’s a rollercoaster. Futures exposure ballooned in 2023 as Bitcoin flirted with six figures, then popped like a cheap balloon. Now, traders are trimming leverage faster than a dieter avoiding cake. But hey, they’re not quitting-just taking a breather.

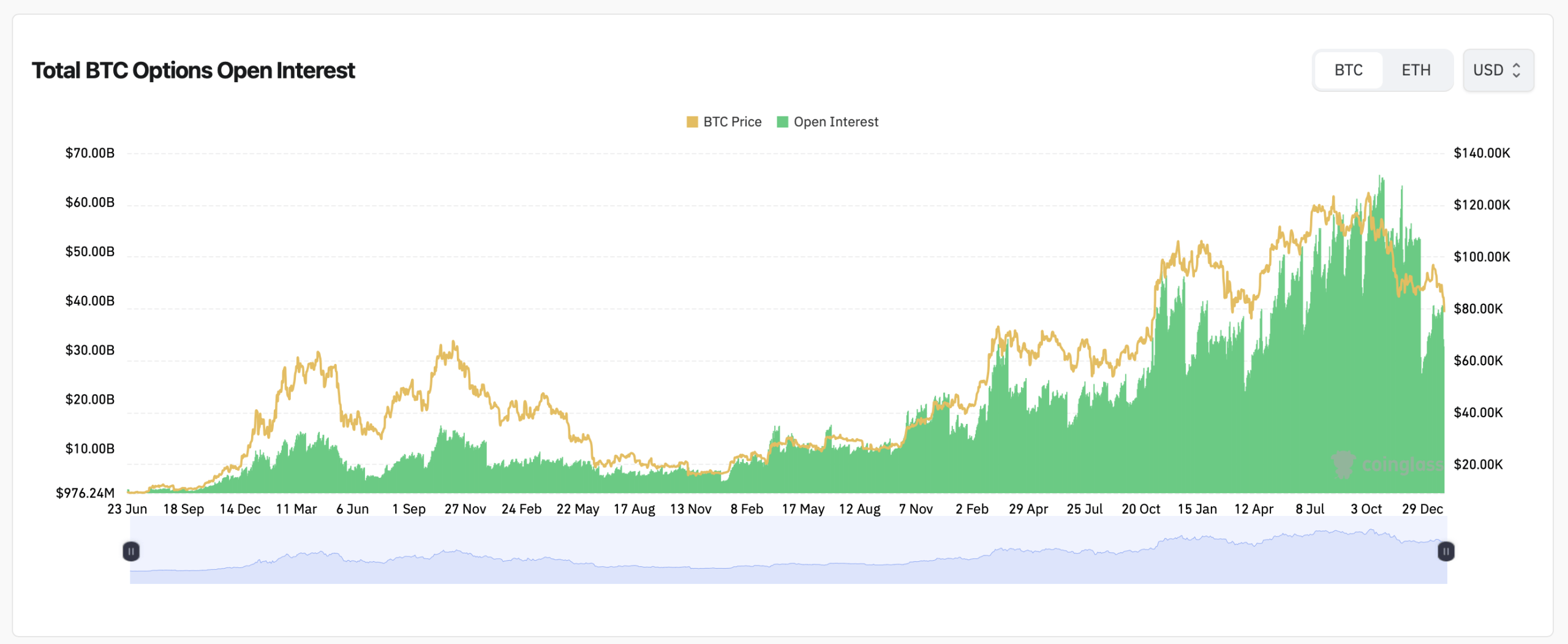

Options market data from coinglass.com is like a soap opera. Call contracts hold 55.99% of open interest, while puts have 44.01%. Traders are still dreaming of upside, but they’re hedging like their lives depend on it.

Volume tells a different tale. Puts are edging out calls, with 51% of traded options volume. Traders are buying downside protection like it’s going out of style. Better safe than sorry, right?

Strike concentration on Deribit is a real nail-biter. Open interest is piled at $100,000 and $105,000 calls, with heavy positioning in $75,000 and $85,000 puts. It’s like everyone’s bracing for a wild ride but can’t decide which way the rollercoaster’s going.

Max pain levels? On Deribit, it’s around $90,000, while OKX is chilling in the mid-$80,000 range. Binance’s max pain is pushing toward the low $90,000s. Option writers are crossing their fingers for prices to stay put-not too high, not too low, just right.

CME options are the institutional party crashers. Near- and mid-term maturities are all the rage, with calls still outpacing puts. But recent growth favors downside hedges-no one’s ready to go full bear just yet.

So, what’s the verdict? Bitcoin’s derivatives markets are neither euphoric nor terrified. Futures traders are cutting leverage, options traders are huddling around key strikes, and max pain levels are tightening like a noose. For now, everyone’s letting the spot price do the heavy lifting while they sip their coffee and wait for the next act.

FAQ ⏱️

- What is bitcoin futures open interest?

It’s the total value of open futures contracts that haven’t been settled or closed. Think of it as the crypto world’s “I owe you” pile. - Why is falling open interest important?

Declining open interest means traders are either deleveraging, losing interest, or running for the hills. Take your pick. - What does max pain mean in options markets?

Max pain is the price where most options expire worthless, making option sellers the only ones smiling. - Are traders bullish or bearish right now?

Options data says mildly bullish, but short-term trading screams “caution.” It’s like they’re bullish with a side of anxiety.

Read More

- Gold Rate Forecast

- How to Unlock the Mines in Cookie Run: Kingdom

- Jujutsu: Zero Codes (December 2025)

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Gears of War: E-Day Returning Weapon Wish List

- The Saddest Deaths In Demon Slayer

- Top 8 UFC 5 Perks Every Fighter Should Use

- XRP Whales Are Splashing Around – Is Q3’s Altcoin Party Starting? 🌊💰

- Epic Pokemon Creations in Spore That Will Blow Your Mind!

2026-02-01 18:37