As a seasoned market observer with roots tracing back to the 1970s, I have learned to approach predictions with a blend of caution and confidence. Peter Brandt’s latest analysis on Bitcoin (BTC) has certainly piqued my interest, given his extensive experience and the insightful observations he’s made about the post-halving behavior of this cryptocurrency.

Peter Brandt, an experienced financier with roots in the 1970s market, has shared fresh insights on Bitcoin (BTC)’s price trend, the most widely used cryptocurrency. In his recent assessment, Brandt emphasizes post-halving patterns of the digital coin as a crucial aspect.

He observes that significant increases usually occur during halving cycles, and it seems as though the period since March 2024 – when a new all-time high was reached – may be just a temporary halt in Bitcoin’s continuous uptrend. However, he predicts that BTC could reach $135,000 by August or September 2025.

According to the expert, Bitcoin is unlikely to soar to six figures instantly or experience a 35% rise beyond that within the next 365 days. Furthermore, Brandt has indicated that if Bitcoin reaches $48,000, both of these scenarios would become impossible.

Bitcoin (BTC): Price outlook

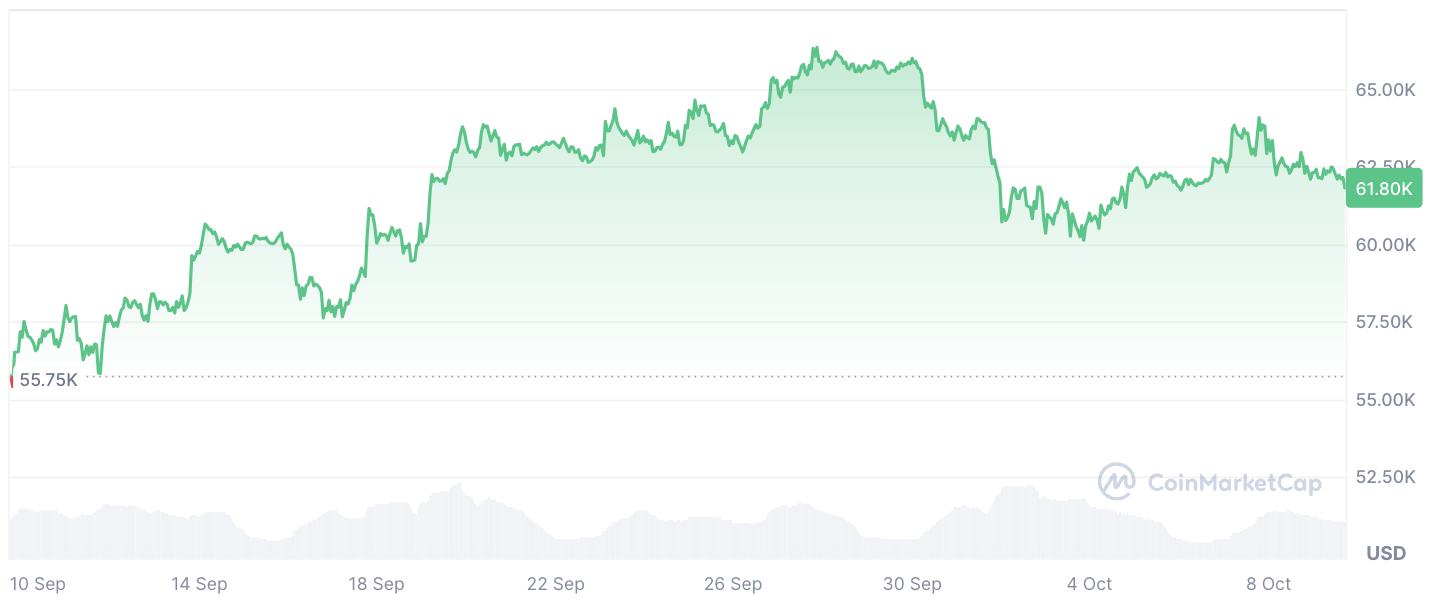

At present, one Bitcoin (BTC) is valued at approximately $61,800. After unsuccessfully attempting to surpass a significant price barrier near $65,000 towards the end of September, it subsequently stabilized around the $60,000 range.

Currently, as a researcher studying cryptocurrency markets, I find myself observing an intriguing state of Bitcoin‘s price movement. At present, it seems to be confined within a narrow range, with no clear direction for traders to follow. This phase in the market is often referred to as a “chop,” where prices fluctuate without any substantial trend.

As we move forward, the imminent disclosure of significant economic statistics about the U.S., specifically the Consumer Price Index (CPI) and the Federal Open Market Committee (FOMC) reports in the coming days, could potentially spark a resurgence in Bitcoin’s market trends. Traders are particularly eager for these releases.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD CLP PREDICTION

- SEILOR PREDICTION. SEILOR cryptocurrency

- CKB PREDICTION. CKB cryptocurrency

- USD PHP PREDICTION

- FJO PREDICTION. FJO cryptocurrency

2024-10-09 17:37