The grand waltz of traditional finance and the capricious tango of decentralized infrastructure has reached a fever pitch. ING, that venerable European titan of banking, now frolics deeper into the crypto thicket, clasping hands with Bitwise like two lovers in a fog of regulatory ambiguity.

This is no mere ledger shuffle. It heralds a seismic shift in how institutions, once paralyzed by red tape, now pirouette toward digital asset custody and yield generation with the grace of a drunkard on a trapeze.

For years, banks clung to their vaults like a child to a security blanket, shackled by the bureaucratic equivalent of quicksand. Now, Bitwise’s regulated tracks allow these leviathans to sidestep the technical chaos of direct ownership while sipping from the Bitcoin goldmine. A G-SIB’s nod to Bitcoin as collateral? Oh, how the mighty stoop to scrape.

Capital no longer flows like a trickle of retail speculation but as a roaring river of institutional ambition. Yet, even the most sophisticated actors find themselves parched. The market, ever insatiable, demands utility. Alas, Bitcoin’s Layer 1 remains a snail’s gallop compared to the lightning of innovation. The bottleneck? A tragicomedy of slow transactions and missing smart contracts.

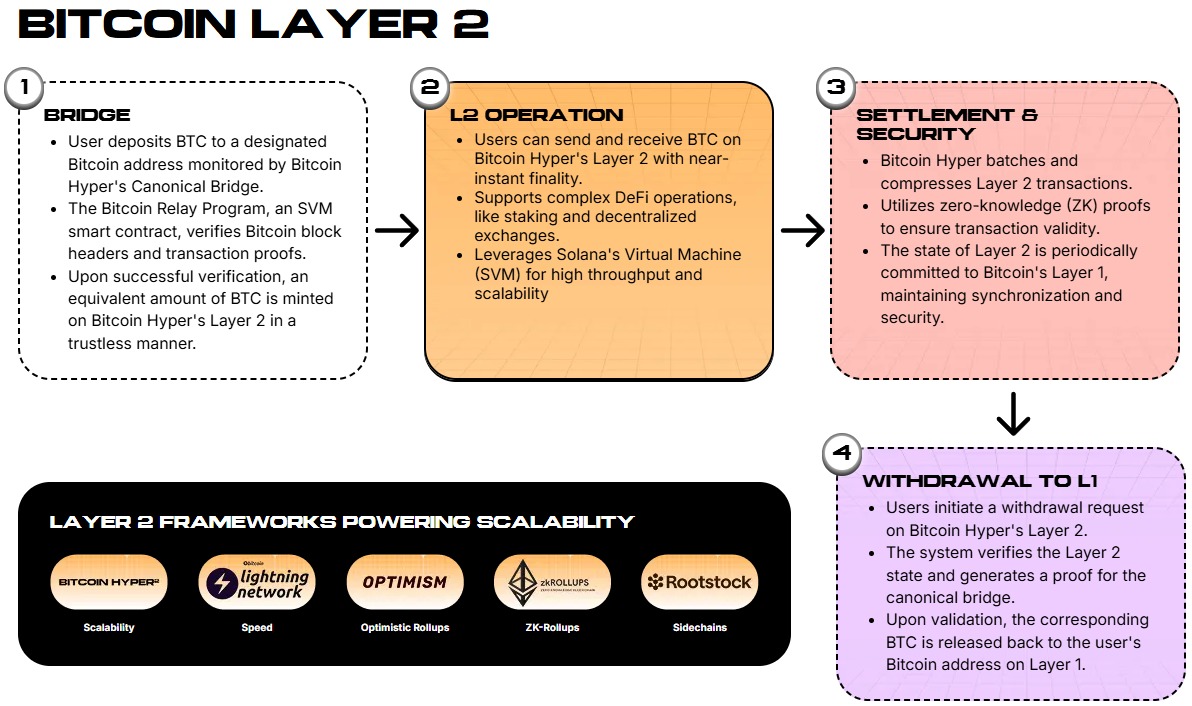

This chasm has birthed a new darling: Layer 2 solutions. Bitcoin Hyper ($HYPER), the belle of the ball, claims to slay the scalability trilemma just as the institutional floodgates creak open. One might call it digital alchemy-or a desperate gamble.

Buy your $HYPER here.

Bitcoin Hyper: Solana’s Speed, Bitcoin’s Liquidity, and a Side of Hubris

While the world fixates on ETFs, developers toil in the shadows, weaving code into a tapestry of execution. Bitcoin Hyper’s crown jewel? The Solana Virtual Machine, a savior for those who crave speed without sacrificing Bitcoin’s security. A bold claim, really. Who needs elegance when you can have velocity?

This Layer 2 marvel promises Solana-like speeds, sub-second finality, and fees so low they’d make a economist weep. Anchored to Bitcoin’s L1, it’s a marriage of opposites: the swiftness of a cheetah and the sluggishness of a glacier, all in one.

For developers, it’s a playground. High-frequency trading platforms, gaming dApps, and DeFi protocols-Rust, the language of the future, dances to their tune. Billions in BTC, once dormant, now stir like bees in a hive. Yet, trustless bridges? How quaint. Let us not forget the ghosts of failed bridging attempts.

Procure your $HYPER here.

Whales Feast on $HYPER: $31M Presale and a Lesson in FOMO

Smart money, that elusive specter, has already snatched up $HYPER’s presale, raking in $31.2M. A figure so staggering it makes one wonder if the whales are swimming in a pool of cryptocurrency or merely dreaming of it.

Priced at $0.013675, the token offers an entry point so humble it could fit in a beggar’s pocket. Staking incentives, with their 7-day vesting, promise loyalty. Or perhaps they’re a trap for the gullible. The roadmap, of course, whispers of a mainnet launch-another “soon” in the land of crypto promises.

View the presale. Or don’t. The choice is yours, though history suggests the latter is wiser.

The musings herein are but a mosaic of musings. No financial advice is offered, only the gentle nudge to consult a professional-or a psychic, if you prefer.

Read More

- Gold Rate Forecast

- How to Unlock the Mines in Cookie Run: Kingdom

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- Gears of War: E-Day Returning Weapon Wish List

- The Saddest Deaths In Demon Slayer

- FromSoftware’s Duskbloods: The Bloodborne Sequel We Never Knew We Needed

- All Pistols in Battlefield 6

- Jujutsu: Zero Codes (December 2025)

- Epic Pokemon Creations in Spore That Will Blow Your Mind!

2026-02-03 12:42