As a seasoned analyst with years of market observation under my belt, I’ve seen enough market volatility to fill several volumes. The dance between fear and greed, particularly in the cryptocurrency realm, is a captivating spectacle that never ceases to amaze me.

As a researcher focusing on cryptocurrencies, I find myself consistently drawn to the ever-evolving price movements of Bitcoin (BTC). Today, the spotlight is once again on this digital currency as it surpasses the significant threshold of $60,000 per BTC. The reason behind this intrigue? A return to a level that has historically held importance in the Bitcoin market.

Yesterday, a significant drop in the cryptocurrency market, triggered by news events, caused a loss of approximately $180 million. As a result, the value of Bitcoin temporarily dipped to around $58,946, as shown on the Binance chart.

Nevertheless, buyers took control, and within the subsequent 12 hours, the perceived imbalance was corrected. At its peak, Bitcoin was being traded at around $61,200.

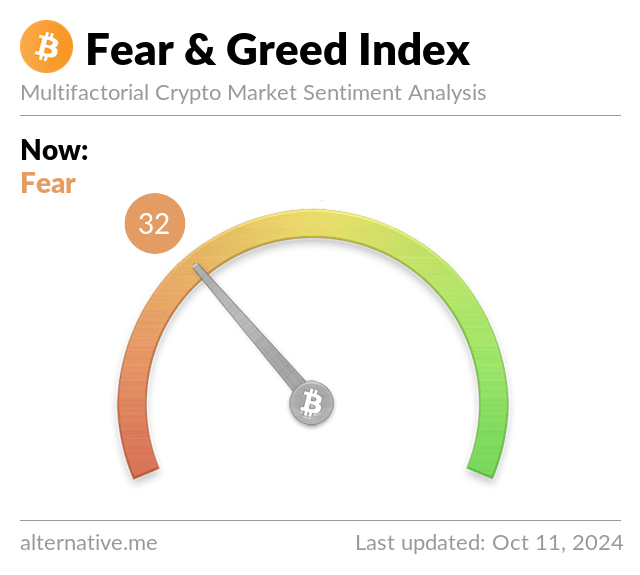

It is interesting to note the divergence between what is happening on the price chart of Bitcoin and the sentiment of market participants as, according to the Fear and Greed Index, we are now entering the period of the latter, with a figure of 32 on the radar of this popular indicator.

Fear or delayed greed?

Compared to the previous day and the week before, the cryptocurrency prices plummeted significantly yesterday. This suggests a significant decline in confidence or optimism among investors regarding the crypto market.

From another perspective, Bitcoin managed to reclaim significant price points and received backing from purchasers. Is this truly a contradiction, or is it that the boldest are capitalizing on fear? Which factor holds greater weight – market behavior or prevailing sentiment?

continuing its rise towards the current resistance level approximately at $65,000, falling below $60,000 for further decline, or experiencing a prolonged period of fluctuation which will eventually push it towards one of the first two directions.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD COP PREDICTION

- WIF PREDICTION. WIF cryptocurrency

- EUR CLP PREDICTION

- BRISE PREDICTION. BRISE cryptocurrency

2024-10-11 17:48