As a seasoned analyst with over two decades of market experience under my belt, I’ve seen my fair share of market fluctuations, and the current state of Bitcoin is no exception. The recent dip in price has been a common occurrence in the crypto world, but what sets this apart is the accumulation by whales, which could be a sign of things to come.

At the moment, Bitcoin is facing stress, as shown by recent developments over the last fortnight. Although there was a surge in September, the bulls have struggled to gain momentum since the beginning of October, falling from approximately $66,000.

Despite currently hovering above at the present moment, having briefly dipped below $60,000 following the decline on October 10, potential buyers must demonstrate their control by making further significant purchases.

Bitcoin Whales Accumulate 1.5 Million BTC In 6 Months

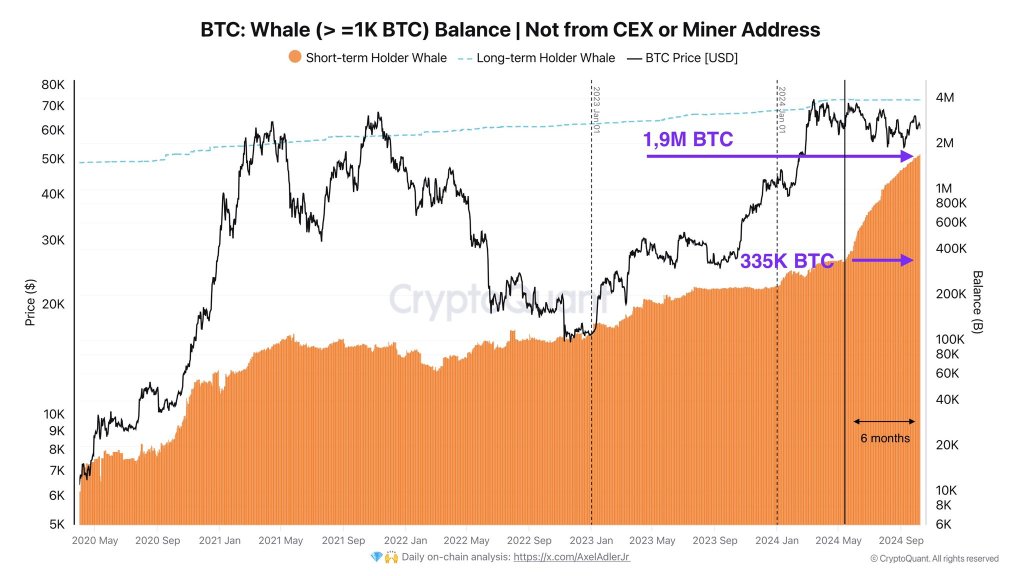

While fundamental factors are closely monitored, on-chain data can show where the market could be headed. In a post on x, one analyst notes that Bitcoin whales could be taking advantage of the low prices to accumulate.

Over just the past six months, whales who own at least 1,000 Bitcoin have jointly purchased a total of approximately 1.5 million Bitcoin. The increasing accumulation of these coins by the whales might indicate that they are confident about the future and continue to buy even as market conditions worsen.

Starting from March, when prices peaked at $73,800, Bitcoin has been experiencing a steady decline, marked by disappointing new lows and dampening any excitement among traders who fear they might be missing an opportunity. However, technically speaking, overcoming the all-time high is a significant hurdle that needs to be cleared for buyers, which would pave the way for a fresh direction in the journey of the world’s most precious cryptocurrency.

For the near to mid-future, purchasers need to surpass the amounts of $66,000, $70,000, and crucially, $72,000. If Bitcoin’s price increase is driven by increased trading volume, it could surge, mirroring the optimism of the whales and boosting the overall market.

Rising Inflation And Accommodative Monetary Policy Could Drive Demand

In the forthcoming weeks, a variety of elements might influence the coin’s direction. The United States has seen a surge in inflation as per recent market statistics. Surprisingly, this increase reached 2.4% according to Trading Economics data, which was higher than the predicted 2.3%. This rise contrasts economists’ expectations. In such an inflationary climate, risk-on assets like Bitcoin typically thrive.

Apart from increasing inflation, many central banks are considering lowering interest rates even more. Following the reduction in September, the U.S. Federal Reserve intends to decrease lending rates further in the upcoming months and early 2025.

Central banks located within the European Union, the United Kingdom, as well as those in countries such as China, have adopted similar strategies by lowering their interest rates.

As economies have an abundance of affordable funds, global liquidity increases, leading to a potential influx of capital into Bitcoin and other top-tier investments. This situation could potentially mirror the price trend observed in Q1 2024.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD ZAR PREDICTION

- WIF PREDICTION. WIF cryptocurrency

- USD COP PREDICTION

- LQTY PREDICTION. LQTY cryptocurrency

- BETA PREDICTION. BETA cryptocurrency

2024-10-12 06:44