As a seasoned crypto investor with a decade of experience under my belt, I can’t help but feel a sense of optimism when I see such positive on-chain indicators for Bitcoin. The latest surge in demand for BTC is indeed reminiscent of the bullish sentiments we witnessed back in April 2013, when the price skyrocketed from $50 to over $260 within a matter of weeks.

Based on recent blockchain analysis, there’s a noticeable increase in the demand for Bitcoin, the leading digital currency, during the past few days. The intriguing point is whether this mounting tension could trigger a new Bitcoin market rally.

Can The Latest Demand Spike Restart The Bull Run?

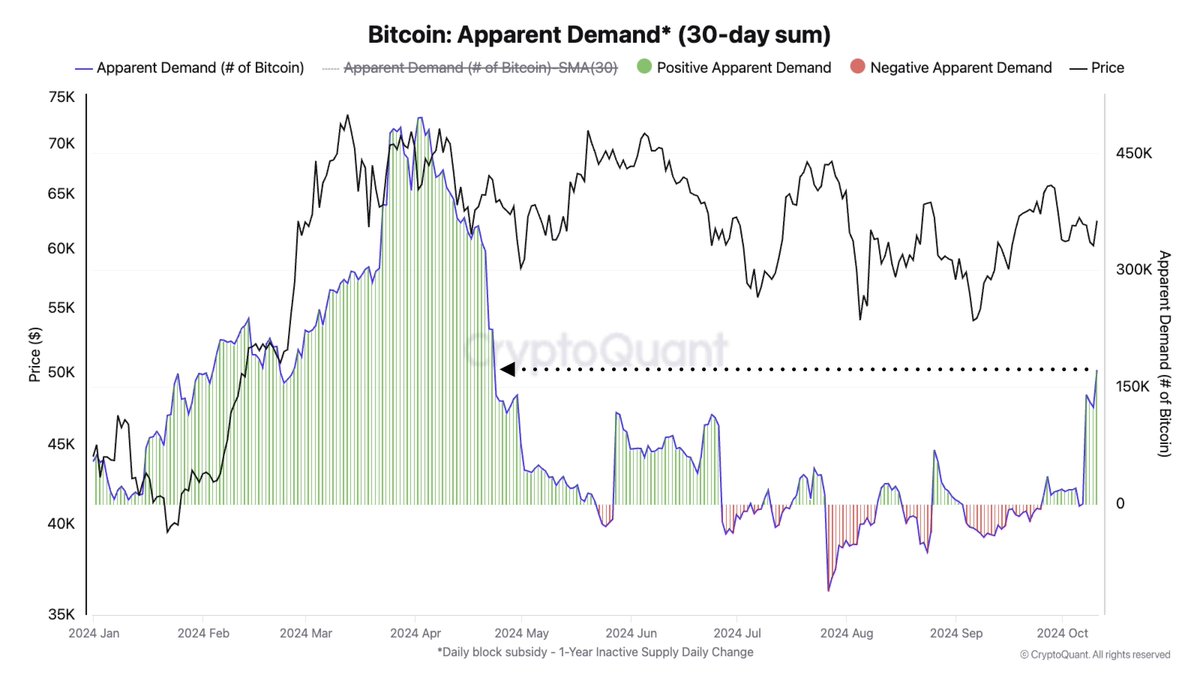

CryptoQuant’s head of research Julio Moreno took to the X platform to share an interesting on-chain observation about Bitcoin and investors’ appetite over the last few weeks. According to the on-chain expert, apparent demand for BTC is growing at its fastest monthly pace since April 22.

This disclosure about Bitcoin is derived from an observable indicator called the apparent demand measure, which calculates the gap between the daily Bitcoin block reward and the daily change in Bitcoins held for more than a year. This metric signifies the level of Bitcoin activity and market demand for it.

Over the last six months, there’s been a gradual decrease in the perceived need for Bitcoin, which peaked at approximately $70,000 per coin back in April. At times, this dwindling demand has even turned into a slight disinterest, contributing to a relatively tranquil market environment.

According to a report published on October 2nd, CryptoQuant suggests that Bitcoin might be about to experience a period of strong seasonal growth, particularly during the fourth quarter of all years following a halving event. Nevertheless, it’s important to note that for Bitcoin’s price to continue its upward trend, there needs to be a substantial increase in demand.

It seems that with demand growing at rates similar to those seen in April, Bitcoin’s price could be preparing for an upward trend. This increase in demand makes it more probable that the leading cryptocurrency will reach its previous record high and possibly set a new one by the end of Q4 2024.

Nevertheless, as per Moreno’s recent post, the current trend shows a negative demand momentum. CryptoQuant’s head of research pointed out that while there’s currently more selling than buying, the extent of this disparity seems to be lessening.

Bitcoin Price At A Glance

Currently, Bitcoin’s price hovers slightly over $63,000, showing a minimal increase of 1.1% in the last day. However, looking at data from CoinGecko, it has experienced a significant jump of more than 2% in the last seven days.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD PHP PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- USD ZAR PREDICTION

- USD CLP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- WQT PREDICTION. WQT cryptocurrency

- VANRY PREDICTION. VANRY cryptocurrency

2024-10-13 16:11